Saudi Arabia is shifting its focus from its $500 billion Neom project, the futuristic city announced in 2017, to AI-related technology. The change marks a shift away from massive construction projects toward faster-growing industries that offer quicker returns.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A New Focus on AI

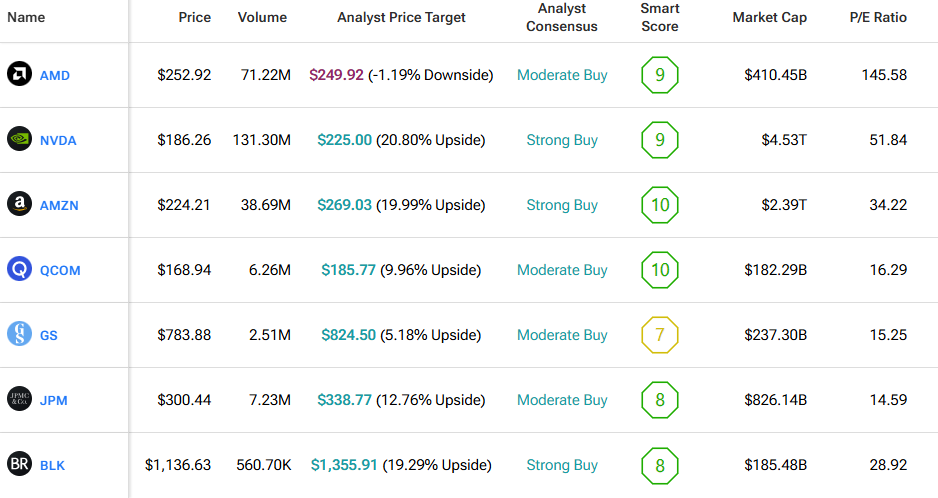

The Public Investment Fund, known as PIF, is backing a new company called HUMAIN. It launched in May 2025 and is now leading Saudi Arabia’s push into AI. HUMAIN plans to set up a $10 billion fund to invest in startups across the U.S., Europe, and Asia. The company has also signed $23 billion in deals with major U.S. technology firms, including Nvidia (NVDA), Advanced Micro Devices (AMD), Amazon (AMZN), and Qualcomm (QCOM). These agreements will help build new data centers with a capacity of about 6.6 gigawatts by 2034.

This new spending comes as oil prices have fallen more than 10% this year, cutting into government revenue. Petroleum still makes up about half of Saudi Arabia’s economy, so the shift toward AI and high-tech production shows the kingdom’s effort to prepare for lower oil income in the future.

A Slowdown for Neom

Meanwhile, Neom, the futuristic city announced in 2017, is losing momentum. The project received no mention in the 2026 pre-budget report after appearing for three years in a row. Construction has slowed, and work on its main feature, The Line, has been reduced. Some contractors and workers have been moved to other projects, while parts of Neom remain under review.

Finance Minister Mohammed Al-Jadaan recently said that if a project no longer makes sense, the government will not hesitate to change or stop it. That signals a clear priority to direct capital to projects with faster payback and global reach.

Global Investors Take Note

The change comes just as top global investors arrive in Riyadh for the Future Investment Initiative conference. Executives from JPMorgan Chase (JPM), Goldman Sachs (GS), and BlackRock (BLK) are expected to attend as Saudi Arabia outlines its next phase of investment.

For companies like Nvidia, AMD, and Amazon, Saudi Arabia’s AI drive could open new markets and supply opportunities. For investors, the pivot signals a broader realignment within the Public Investment Fund, which is reviewing large projects and channeling more funds into technology, digital infrastructure, and advanced manufacturing.

The move reflects a shift in how Saudi Arabia plans to diversify its economy. After years of big-ticket construction spending, the kingdom now appears to favor high-tech ventures that can deliver faster growth and global relevance.

Using TipRanks’ Comparison Tool, we’ve compiled a list of all publicly traded companies mentioned in the piece that stand to benefit from the expected shift by the Saudis.