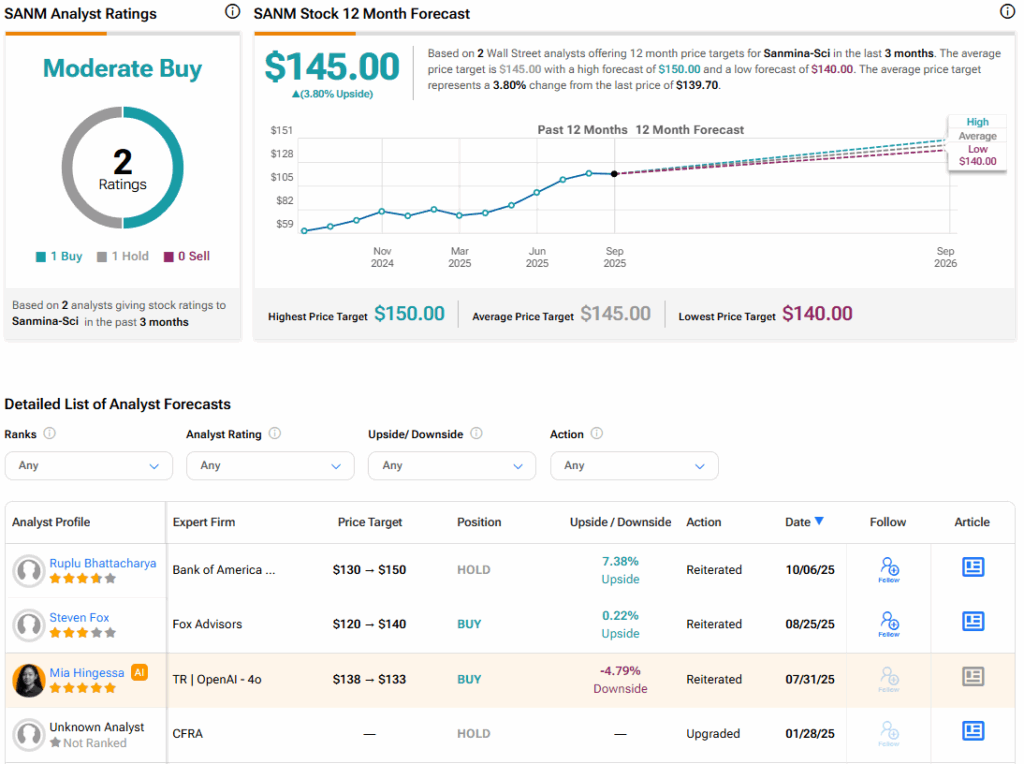

Sanmina (SANM) stock was on the rise Tuesday after the company’s shares received updated analyst coverage. Bank of America analyst Ruplu Bhattacharya reiterated a Hold rating for the company’s shares but increased his price target to $150 from $130, suggesting a possible 7.14% upside.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Bhattacharya’s higher price target for Sanmina comes after a deal was announced between Advanced Micro Devices (AMD) and ChatGPT creator OpenAI (PC:OPAIQ). This deal is worth billions for AMD and will have it supplying OpenAI with chips for its AI cloud computing servers.

Sanmina plays into this deal as it’s a partner of AMD. The company signed an agreement with AMD earlier this year to acquire the infrastructure manufacturing business of ZT Systems for $2.55 billion. AMD also named the company its preferred NPI manufacturing partner for the deployment of AMD AI rack and cluster-scale systems for cloud customers in this agreement. According to Bhattacharya, Sanmina expects ZT Systems to contribute between $5 billion and $6 billion in annual revenue once integrated.

Sanmina Stock Movement Today

Sanmina stock was up slightly on Tuesday, following a nearly 23% rally yesterday. The shares have increased 87.43% year-to-date and 109.3% over the past 12 months. While the company hasn’t closed its deal for ZT Systems just yet, it expects to do so by the end of 2025. When that confirmation comes, it could act as a further catalyst for SANM stock.

Is Sanmina Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Sanmina is Moderate Buy, based on one Buy rating and a single Hold rating over the past three months. With that comes an average SANM stock price target of $145, representing a potential 3.8% upside for the shares.