A class action lawsuit was filed against Sana Biotechnology (SANA) by Levi & Korsinsky on March 21, 2025. The plaintiffs (shareholders) alleged that they bought SANA stock at artificially inflated prices between March 17, 2023 and November 4, 2024 (Class Period) and are now seeking compensation for their financial losses. Investors who bought Sana Biotechnology stock during that period can click here to learn about joining the lawsuit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sana Biotechnology is a biotechnology company focused on developing medicines through the use of modified (engineered) genes and cells. The company’s therapies target the treatment of oncology, diabetes, central nervous system (CNS) disorders, and B-cell-mediated autoimmune diseases.

Sana had three lead drug candidates: SC291 for the treatment of B-cell malignancies, SC379 for the treatment of CNS disorders, and SG299 for the treatment of hematologic malignancies.

The company’s claims about its financial condition, ability to maintain its current operations, and advance one or more of its product candidates are at the heart of the current complaint.

Sana Biotechnology’s Misleading Claims

According to the lawsuit, SANA and two of its senior officers (Individual Defendants) repeatedly made false and misleading public statements throughout the Class Period. Particularly, they are accused of omitting truthful information about its finances, and the viability of one of its product candidates from SEC filings and related material.

For instance, during the Class Period, the defendants repeatedly highlighted the company’s strong balance sheet to support its ongoing operations. In the annual report for Fiscal 2022, the company noted that its existing cash and cash equivalents were “sufficient” to meet its working capital and capex needs for at least the next twelve months.

Moreover, in a press release dated May 8, 2023, the CEO mentioned that the company had begun enrolling patients for its first-human trials of SC291, and was expected to release data from two clinical trials in 2023. Additionally, the CEO noted that the company was on track to file two additional Investigational New Drug (IND) applications in the latter half of 2023 and potentially three more in 2024. The CEO once again reiterated that Sana’s healthy capital position and experienced team enabled the continuation of its planned trials and data read-outs.

However, subsequent events (discussed below) revealed that Sana Biotechnology had misled investors about its financial position and ability to finance its ongoing operations.

Plaintiffs’ Arguments

The plaintiffs maintain that the defendants deceived investors by lying and withholding critical information about the business practices and prospects during the Class Period. Importantly, the defendants are accused of misleading investors about the company’s finances and viability of its product pipeline.

The information became clear in partial disclosures. First, on October 10, 2023, the company announced that it would cut down spending on its SG299 candidate and instead focus on its ex vivo cell therapy platform, which includes treatments for oncology, autoimmune diseases, and diabetes. Following this announcement, SANA’s stock declined nearly 9% the next day.

A year later, on November 4, 2024, Sana announced the suspension of its SC291 oncology program and the SC379 CNS disorder therapy. The company intended to find partnerships to continue funding these programs. Meanwhile, Sana would use the cash saved from these changes to increase investment in its type 1 diabetes program, and “extend the expected cash runway into 2026.” Following the news, SANA stock fell 9.8% on November 5.

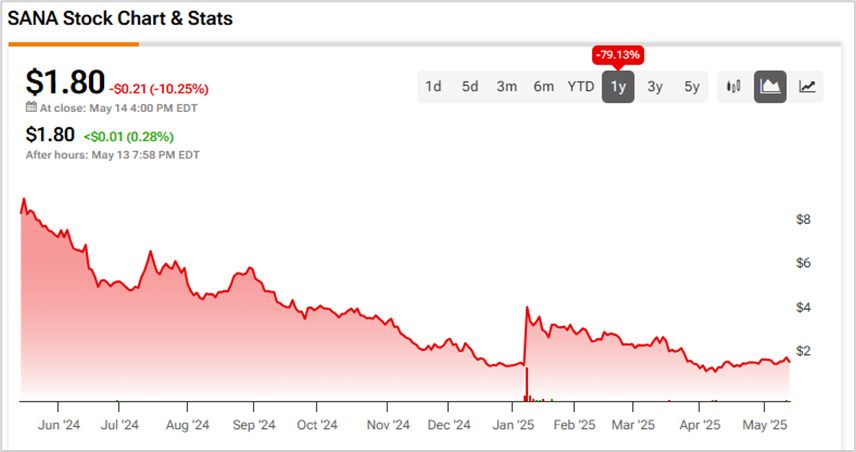

To conclude, the defendants allegedly misled investors regarding the company’s financial position and the potential to advance its product candidates. Owing to these issues, SANA stock lost 79.1% in the past year, causing massive damage to shareholder returns.