Samsung Electronics (GB:SMSN) is expecting an additional 80% decline in operating earnings in Q3 compared to the previous year, as per a Reuters report. This decrease follows a 95% drop in operating profit in the second quarter. The major appliance and consumer electronics maker is expected to announce its third-quarter preliminary earnings on Wednesday, October 11, 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Samsung’s third-quarter results are expected to be impacted by the weak performance of its memory chip business due to the global memory chip surplus and substantial price declines. The chip division is projected to report a quarterly loss between 3 trillion Korean won and 4 trillion Korean won.

Furthermore, Samsung’s move to cut down on chip production might also have hurt its bottom line as it resulted in higher production costs.

Regarding the smartphone business, prolonged high inflation and continued pressure on consumer spending continued to slow demand. However, Samsung launched its premium foldable smartphones during the quarter, which is expected to have bolstered sales, particularly in its Electronics Devices segment.

Is Samsung Stock a Buy Now?

The memory chip end market is showing signs of recovery. Smartphone and personal computer manufacturers have refrained from purchasing new chips and focused on depleting their inventories. As a result, demand is expected to rebound in the next year and benefit Samsung’s top-line figures.

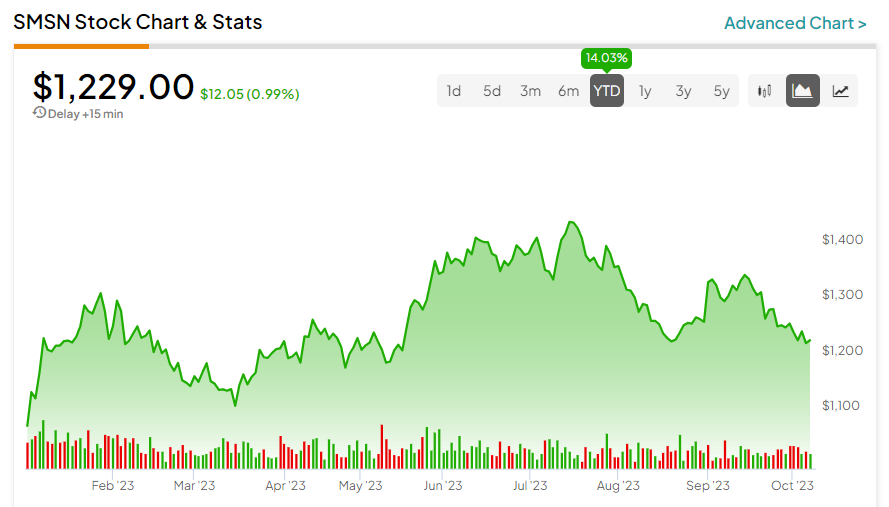

Meanwhile, strong demand for chips used in artificial intelligence (AI) might provide support to some extent. Also, its strong brand awareness and premium smartphone offerings provide a solid foundation for long-term growth. Year-to-date, Samsung stock has gained over 14%.