Samsung Electronics (SSNLF) is gearing up for its highest third-quarter profit in three years, thanks to a rebound in memory chip demand and steady gains across its core businesses. The South Korean tech giant expects operating profit to hit 12.1 trillion won ($8.48 billion), up 32% year-over-year and more than double the previous quarter’s figure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In its preliminary quarterly results, the company projects revenue of 86 trillion won, up 8.7%, beating analyst expectations.

The solid performance was driven by rising demand for DRAM and NAND chips used in AI servers and hyperscaler data centers.

The company is expected to release its full quarterly report later this month.

Is Samsung Stock a Good Buy?

Samsung’s promising outlook comes amid rising demand from hyperscalers and AI-driven server workloads, which are boosting chip prices and inventory restocking. While the company still trails rivals such as SK Hynix in supplying high-bandwidth memory (HBM) to key clients such as Nvidia (NVDA), it is investing heavily to close the gap.

Moreover, CEO Han Jong-hee has hinted at strategic deals to boost growth in AI and semiconductor technologies.

It must be noted that Samsung’s growth depends on its ability to scale AI-ready chip production, secure major HBM contracts, and execute on its M&A ambitions.

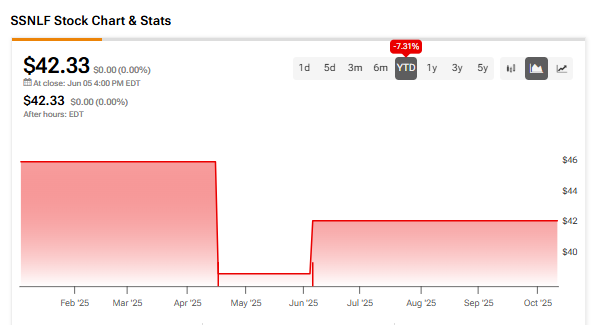

Samsung stock has declined 7.53% so far this year.