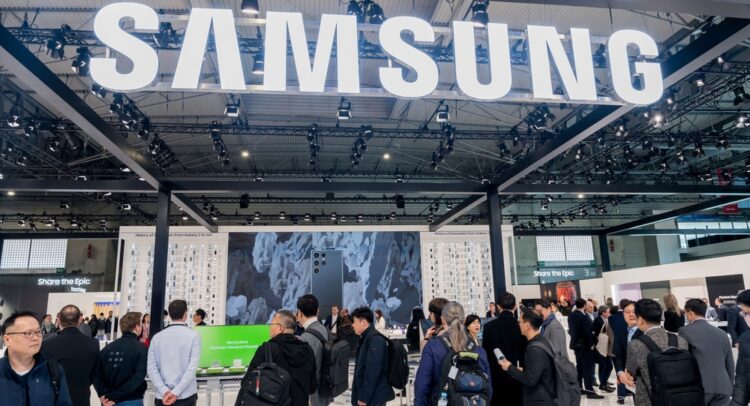

South Korea’s electronics giant Samsung Electronics (GB:SMSN) (OTC:SSNLF) (DE:SSU) expects a nearly tenfold increase in its first-quarter operating profits. The company also plans a significant boost to its chip investments in Texas.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Samsung’s Impressive Growth

Samsung expects its Q1 operating profits to surge nearly tenfold to 6.6 trillion Korean Won amidst an AI-fueled semiconductor boom and improving prices. The company anticipates sales for the quarter to reach nearly 71 trillion Korean Won, signaling an almost 11% year-over-year increase. Samsung is set to disclose its first-quarter results on April 30.

Samsung’s Future Growth Strategy

Amid buoyant demand for semiconductors, Samsung plans to boost its chip investments in Texas to a substantial $44 billion. Samsung is already establishing a semiconductor hub in Taylor, Texas. Its new plans consist of a chip-making facility and a site for advanced packaging and R&D.

Billion Dollar Investments

According to the Wall Street Journal, Samsung is expected to receive subsidies totaling billions of dollars to fund the expansion. Other top chipmakers, like Taiwan Semiconductor (NYSE:TSM) and Intel (NASDAQ:INTC), are also investing billions in setting up production hubs in the U.S. Intel intends to invest over $100 billion in the U.S. over the next five years.

Samsung Stock Performance

Samsung’s London-listed shares have rallied by nearly 28% over the past six months. Following this rise, SMSN stock is currently trading at a price-to-earnings multiple of 36.5.

Read full Disclosure