Worldwide smartphone use has increased by 2.6% year-over-year, according to new research by IDC (International Data Corporation). As smartphones become more affordable and AI becomes interlaced into their systems, consumers have been upgrading their phones frequently. Samsung (SSNLF) and Apple (AAPL) showed the most year-over-year growth: Samsung increased its smartphone shipments by 6.3%, and Apple increased its shipments by 2.9%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SSNLF and AAPL saw robust upgrades in both their premium and more affordable smartphone segments. Apple, which claims 18.2% market share in the third quarter of 2025, had its strongest results ever in a July quarter. Significantly, pre-orders for the iPhone 17 surpassed pre-orders of its previous generation phones. Samsung, for its part, holds 19% of 3Q25 market share, having achieved its strongest growth ever in a July quarter. Furthermore, more of Samsung’s Galaxy Z Fold 7 and Galaxy Z Flip 7 phones were sold than any of its previous foldable smartphones.

Apple Springs Forward in China

In China, where smartphone sales have been sluggish, Apple’s shipments grew 0.6% year-over-year to 10.8 million units in the third quarter, according to IDC research. Of the top three smartphone producers in China, only Apple demonstrated growth in shipments during the quarter.

Apple has managed to succeed in China even while the total smartphone shipments fell 0.6% year-over-year in the third quarter. IDC researcher Will Wong attributed that success to “Apple’s value-for-money base model iPhone 17.”

Is Apple Stock Expected to Rise?

AAPL stock has already started to rise in today’s pre-market trading, as news of its Q3 shipments sparks trading action.

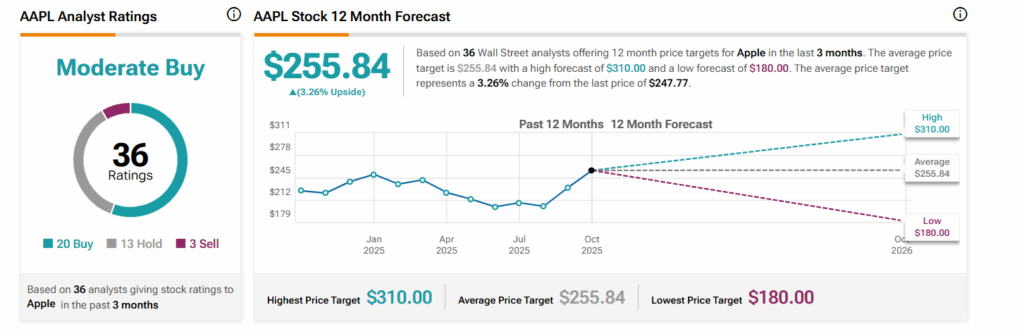

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 20 Buys, 13 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $255.84 per share implies 3.26% upside potential.