The tech industry continues to bear the brunt of job cuts. In the latest, Salesforce (CRM) has slashed its headcount by nearly 300 positions. This is the second headcount reduction by the customer relationship management software solutions provider this year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

More Layoffs at Salesforce

Salesforce’s actions come fresh on the heels of recent job reductions at UiPath (PATH) and Intuit (INTU). According to Bloomberg, Salesforce’s headcount trim is part of its aim to streamline operations.

At the same time, the move points to continued pain in the tech industry as companies look to rein in costs and employees grapple with job insecurity. This is the second round of layoffs at CRM this year alone. Last year, it had slashed its headcount by nearly 10%.

The question, though, is whether these actions are enough to generate positive returns for CRM shareholders. The company’s stock price is down by nearly 9% over the past three months and is up by an unimpressive 6% over the past three years.

What Is the Price Target for CRM Stock?

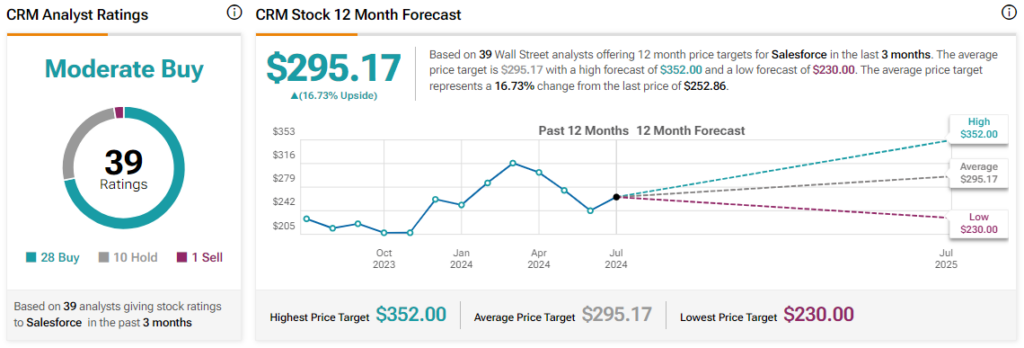

Yesterday, Stifel Nicolaus’ J. Parker Lane reiterated a Buy rating on Salesforce alongside a $300 price target. Overall, though, the Street is cautiously optimistic about Salesforce with a Moderate Buy consensus rating. The average CRM price target of $295.17 implies a 16.7% potential upside in the stock. A price-to-earnings multiple of 45.7, however, means investors could wait for a better entry point in the stock.

Read full Disclosure