The narrative surrounding Salesforce stock (CRM) is shifting from fear to execution. While critics previously labeled the company an “AI loser,” the Agentforce platform is proving them wrong. In the fiscal third quarter, Agentforce revenue reached a $540 million run rate, with more than 50% of new bookings coming from existing customers. As businesses move from “proof of concept” to full production with AI agents, Salesforce is positioned to lead the trend of enterprises using AI to drive actual, measurable earnings.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Saleforce Is Re-Accelerating Toward a $46 Billion Revenue Goal

The stomach bug that hit software stocks in 2025 appears to be fading for Salesforce. Calendar year 2026 sales are forecasted to reach nearly $46 billion, an 11% increase over 2025 levels. This represents a crucial re-acceleration from the 10% growth seen in 2025 and the pandemic-era low of 9%. Management points to its Current Remaining Performance Obligation (CRPO), the revenue already booked for the next 12 months, as a primary indicator that growth has officially bottomed.

Salesforce Meets the Industry’s ‘Rule of 40’

Salesforce is finally meeting the industry’s “Rule of 40,” where the sum of revenue growth and profit margins equals at least 40. With margins now at 33% and growth accelerating toward 11%, the company is delivering the “profitable growth” that CEO Marc Benioff has prioritized.

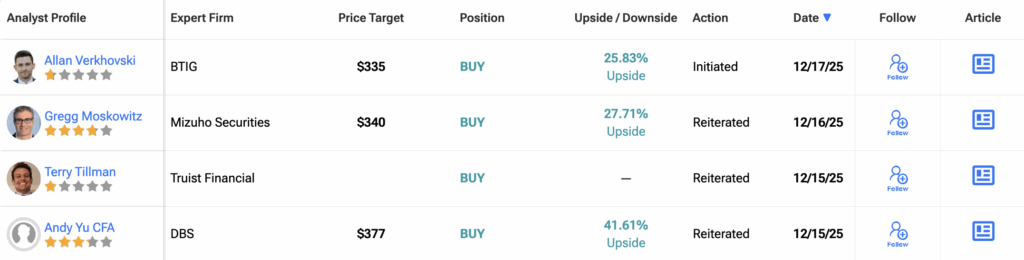

BTIG analyst Allan Verkhovski maintains a Buy rating with a $335 price target, noting that the current market valuation is essentially “pricing in CRM’s demise”—an outlook he considers far too bearish. If the stock returns to a valuation of eight times its 2026 sales estimates, shares could reach $390, offering a significant reward for investors who bet on the turnaround.

Is Salesforce a Good Stock to Buy?

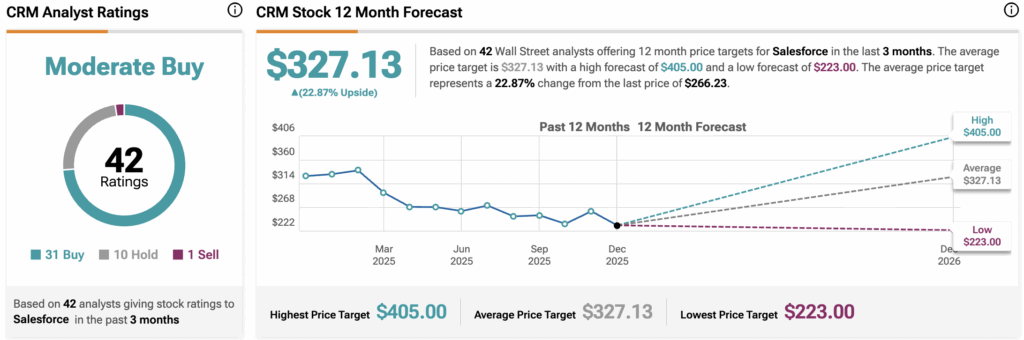

Analyst sentiment toward Salesforce (CRM) is leaning positive, rated as a Moderate Buy based on the consensus of 42 analysts tracked in the last three months. Of these ratings, 31 analysts call it a Buy, 10 recommend a Hold, and only one recommends a Sell.

The average 12-month CRM price target sits at $327.13. This target implies a strong upside potential of 22.9% from the last price.