Salesforce (CRM) is set to announce its second-quarter results on August 28, with Wall Street eagerly awaiting insights into the company’s margin improvements and progress with its AI initiatives. All eyes are on the cloud-based software giant to see if it can meet expectations and leverage its recent advancements effectively.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Key Factors Likely to Contribute to CRM’s Q2 Results

Several factors are expected to impact Salesforce’s Q2 performance. Salesforce Einstein, the company’s generative AI tool, is designed to create customizable and predictive experiences for businesses. Alongside this, recent acquisitions, growth in data management and cloud services, and ongoing cost restructuring initiatives are anticipated to contribute positively. Analysts expect these factors to help Salesforce align with Wall Street’s forecasts.

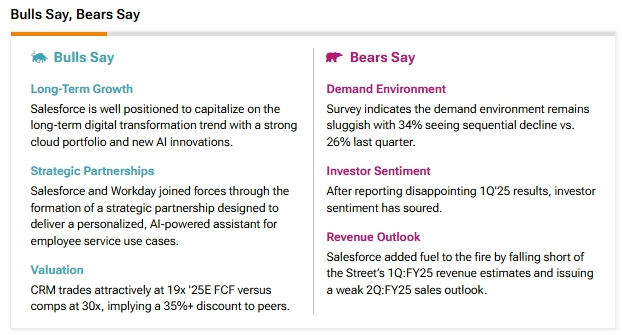

Analysts are generally bullish on CRM stock, as reflected in TipRanks’ “Bulls Say, Bears Say.” They believe that Salesforce’s long-term fundamentals are solid, and the company is well-positioned to benefit from the ongoing digital transformation trend. With a strong cloud portfolio and new AI innovations, Salesforce is seen as a key player in future growth.

CRM Downgrades Q2 Outlook

Looking forward, Salesforce expects its Q2 revenues to range between $9.2 billion and $9.25 billion, representing a year-over-year growth rate of 7% to 8%. This projection aligns with analysts’ estimates. However, analysts anticipate a potential decline in Q2 earnings to $2.35 per share, a drop of 3.7% from the previous quarter. This follows a first quarter that fell short of expectations and resulted in a weaker forecast for Q2.

Despite this, CEO Mark Benioff maintained a positive outlook, keeping the company’s full-year revenue guidance at $38 billion. This optimism reflects progress in AI initiatives and transformative customer success stories.

CRM Options Traders Expect a Fairly Large Move

Turning to options traders, TipRanks’ Options tool reveals that a significant move is expected following the earnings report. The tool calculates this expected movement based on the at-the-money straddle of the options closest to expiration. Currently, options traders anticipate a sizeable 7.67% move in either direction, showing the high anticipation and potential volatility surrounding Salesforce’s upcoming earnings announcement.

Is CRM a Good Stock to Buy Now?

Analysts remain cautiously optimistic about CRM stock, with a Moderate Buy consensus rating based on 28 Buys, 10 Holds, and one Sell. Over the past year, CRM has increased by more than 20%, and the average CRM price target of $296.74 implies an upside potential of 11.8% from current levels.