RTX Corp. (RTX), an aerospace and defense company, delivered impressive results for the third quarter of 2024 and raised its full-year guidance. The company posted adjusted EPS of $1.45, which easily surpassed the analyst consensus of $1.34 and increased 16% year-over-year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It should be noted that RTX’s Chief Operating Officer, Chris Calio, attributed this strong performance to robust demand, particularly within the defense business and the aftermarket for parts and services.

Segment Analysis of RTX’s Q3 Revenue

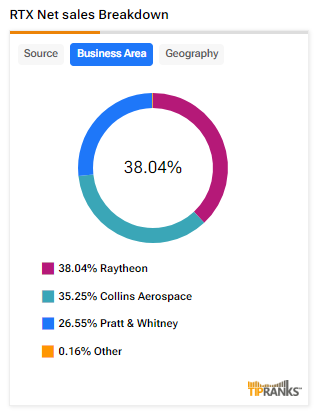

In the reported quarter, RTX’s revenue increased by 6% year-over-year to $20.1 billion. The reported figure exceeded analysts’ expectations of $19.8 billion, driven by a 14% year-over-year jump in adjusted sales for the Pratt & Whitney segment. This division benefited from higher commercial sales due to increased aftermarket demand and a favorable mix of larger commercial engines. Also, military sales rose due to higher maintenance and development activities for the F135 and F117 engine programs.

Coming to other segments, Collins Aerospace unit’s sales rose 7% to $7.08 billion. However, revenue for the Raytheon segment declined 1% to $6.39 billion.

RTX Upgraded Full-Year Guidance

RTX raised its full-year guidance, backed by a record order backlog of $221 billion, comprising $131 billion in commercial orders and $90 billion in defense orders.

Interestingly, the company now expects adjusted sales to reach between $79.25 billion and $79.75 billion, up from the previous range of $78.75 and $79.5 billion. Additionally, adjusted earnings are projected to be between $5.50 and $5.58 per share, surpassing prior guidance of $5.35 to $5.45 per share.

Is RTX a Good Stock to Buy Now?

Turning to Wall Street, RTX has a Moderate Buy consensus rating based on six Buys and eight Holds assigned in the last three months. At $125.93, the average RTX price target implies a limited 0.32% upside potential. Shares of the company have gained more than 52% year-to-date.