RTX (NYSE:RTX) shares have skyrocketed by nearly 8% in the pre-market session today after the aerospace and defense major delivered better-than-expected third-quarter numbers and announced an accelerated share repurchase program worth $10 billion.

RTX’s third-quarter EPS of $1.25 came in better than expectations by $0.03. Further, an 11.8% year-over-year jump helped its adjusted top line of $19 billion cruise past estimates by $800 million. The adjusted sales reflect the impact of the Pratt powder metal issue. The company’s order backlog at the end of the quarter stood at $190 billion, with $115 billion in commercial orders and $75 billion in defense orders.

Importantly, RTX is increasing its capital return commitment through 2025 to $36 billion to $37 billion and is immediately proceeding with a $10 billion stock buyback program. Additionally, RTX has entered into an agreement to sell its Cybersecurity, Intelligence, and Services business for about $1.3 billion.

For the full Fiscal year 2023, RTX now expects adjusted sales of $74 billion, compared to the prior outlook ranging from $73 billion to $74 billion. Adjusted EPS for the year is anticipated to be between $4.98 and $5.02, versus the prior outlook of $4.95 to $5.05.

What Is the Future of RTX Stock?

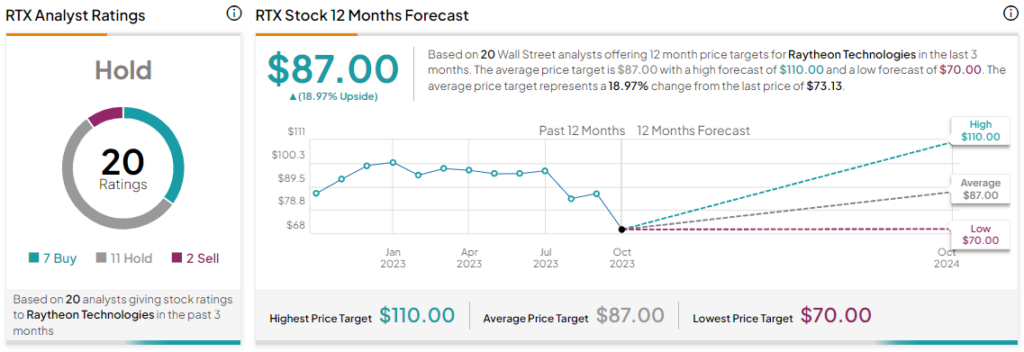

Overall, the Street has a Hold consensus rating on RTX. The average RTX price target of $87 implies a nearly 19% potential upside. That’s after a nearly 29% slide in the share price over the past six months.

Read full Disclosure