Royal Caribbean Cruises (NYSE:RCL) is a global cruise company based in Miami, Florida. The company is seeing strong post-pandemic demand and reporting record sales. However, I believe the stock is now trading at a record level of risk. I’m bearish on RCL stock; its valuation looks far too high at over 7x book value and 30x potential 2024 free cash flow. The firm’s balance sheet is worrisome, and the cruise business can be quite capital-intensive and competitive.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Why Cruise Companies Have Poor Economics

The cruise line business is exceptionally difficult. Everyone knows that bulk shipping is a bad business because of its fluctuating demand and capital intensity, but I think cruise companies suffer from many of the same problems. Royal Caribean spent approximately $3.9 billion on capital expenditures in 2023, and it expects to spend $3.3 billion in 2024. This compares to $4.5 billion in 2023 cash from operations.

Investors who are bullish on RCL stock often point to its low Forward PE Ratio (13.7x). But in some industries, this can be a trap. Royal Caribbean and cruise companies, in general, are notorious for having capital expenditures that exceed depreciation & amortization. They do this in an attempt to grow their fleet and upgrade their ships. But why? Well, because their competitors are doing the same.

Over the past 10 years, Royal Caribbean’s average depreciation & amortization expense, which flows into net income, was $1.1 billion. But its average capital expenditure, which flows into free cash flow, was $2.4 billion (more than double D&A). This makes EPS and net income a poor metric for valuing a cruise company.

Cruise businesses often lack a durable competitive advantage because any customer experience or pricing strategy they provide can be easily copied by their competitors. Investors like growing revenues, so cruise companies continuously expand their fleets, as well as build new pools, waterslides, and casinos on board to please their customers and compete effectively.

To compound the issue, when any sort of unforeseen event comes around, say a recession, pandemic, or war, Royal Caribbean and its competitors may be forced to sell ships at a loss because demand has fallen off. If the company were to keep these excess ships, they would eat the fixed expenses related to storage, debt service, and maintenance.

RCL’s Balance Sheet Is Troublesome

The reason Royal Caribbean took on so much debt during the pandemic was that it had a poor current ratio (current assets to current liabilities). This meant it couldn’t afford to have negative free cash flow and needed to raise cash via long-term debt issuance.

Fast forward to today, and Royal Caribbean still has a bad current ratio. At the end of 2023, the company had $1.8 billion in current assets compared to $9.4 billion in current liabilities. Even if we subtract the $5.3 billion in customer deposits from its current liabilities, there’s a huge hole in the balance sheet.

Royal Caribbean is a highly levered company. Its long-term debt and operating lease liability (more than $20 billion) is approximately 35 times the size of its 2023 free cash flow. This is bad news. To make things worse, the company’s equity is tiny compared to its assets. For these reasons, lenders may think twice about giving Royal Caribbean new loans in the event of a downturn.

The Valuation Is Too High

In the midst of record sales, RCL stock now trades at a near-record-high price-to-book ratio of 7x. When I hear record sales, I tend not to get too excited. There’s always a chance that “record sales” could mean a “cyclical peak.” This is all the more reason to invest with a margin of safety.

Royal Caribbean’s 10-year average free cash flow has been negative, and so have its earnings. If the company could maintain its record cash from operations it reported in 2023 ($4.5 billion) and maintain its CapEx guidance of $3.3 billion, it’d have $1.2 billion in free cash flow in 2024. With a market cap of $36 billion, the company trades at 30x this amount. The company is likely to use all of this free cash flow to pay off its enormous debt, resulting in $0 remaining for buybacks and dividends.

Is RCL Stock a Buy, According to Analysts?

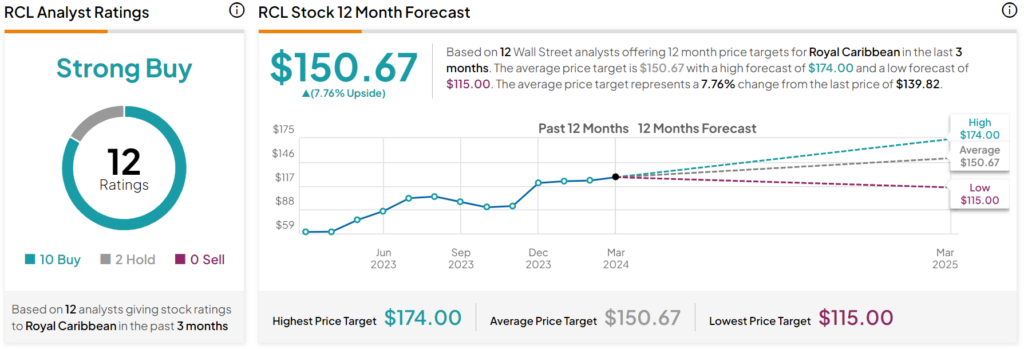

Currently, 10 out of 12 analysts covering RCL give it a Buy rating; two rate it a Hold, and zero analysts rate it a Sell, resulting in a Strong Buy consensus rating. The average Royal Caribbean Cruises stock price target is $150.67, implying upside potential of 7.76%. Analyst price targets range from a low of $115 per share to a high of $174 per share.

The Bottom Line: Unprofitable Revenue Growth

Royal Caribbean has a tendency to grow revenues without maintaining positive free cash flow. This is because it operates in a capital-intensive industry where it’s nearly impossible to have a durable competitive advantage.

The company trades at a very high multiple to its prospective free cash flow and book value. I think the balance sheet carries a lot of risk, with a deeply negative current ratio and excessive debt load. The company may exist only to serve its customers and repay debt for many years to come, that is, if another recession, pandemic, or war doesn’t disrupt its business in the meantime. For these reasons, I think the risk has never been higher for RCL.