Root Inc. (NASDAQ:ROOT), an auto insurtech, has seen its shares skyrocket by over 900% in the past year. This impressive growth can be attributed to the company successfully doubling its gross written premiums and policies in force year-over-year, thanks in part to its ongoing partnership with Carvana. The shares trade at a discount, making the stock attractive for value-oriented investors interested in disruptive tech businesses.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Root’s Novel Approach

Root is a company focused on transforming the car insurance industry with its novel use of mobile technology and data science. It is based on the principle that driving behaviors rather than demographics should determine car insurance rates.

Furthermore, Root’s edge lies in its robust use of data science, technology, and modern quantitative methods. As Root adds clients, it grows its data set, retrains its models to constantly deliver better prices to customers, and promotes efficient growth in a virtuous cycle.

In addition, Root’s strategy is to diversify its distribution and integrate its technology-driven products into car-buying platforms like Carvana. Root aims to boost its Gross Written Premium growth by effectively integrating insurance buying into the typical car purchasing process.

Root’s Q1 Results & Forward Guidance

The company recently announced its Q1 results. Revenue for the period reached $254.9 million, reflecting a year-over-year growth of 263.6% and outperforming the forecast by $55.56 million. The company marked a significant milestone as it reported a positive operating income of $5 million and an EBITDA of $15 million for the first time, marking year-over-year improvements of $35 million and $26 million, respectively. The GAAP EPS was -$0.42, surpassing expectations by $2.04.

At the end of the quarter, cash and cash equivalents stood at $483 million, reflecting a quarterly cash consumption of $25 million for marketing and customer acquisition and short-term annual incentive payouts.

Management has given guidance for the second quarter, with cash expenses of approximately $10.6 million expected to cover the tax liability of vesting equity awards. Further, a decline in gross written premium levels is anticipated in the second quarter due to seasonality and shifts in the competitive landscape.

What Is the Price Target for ROOT Stock?

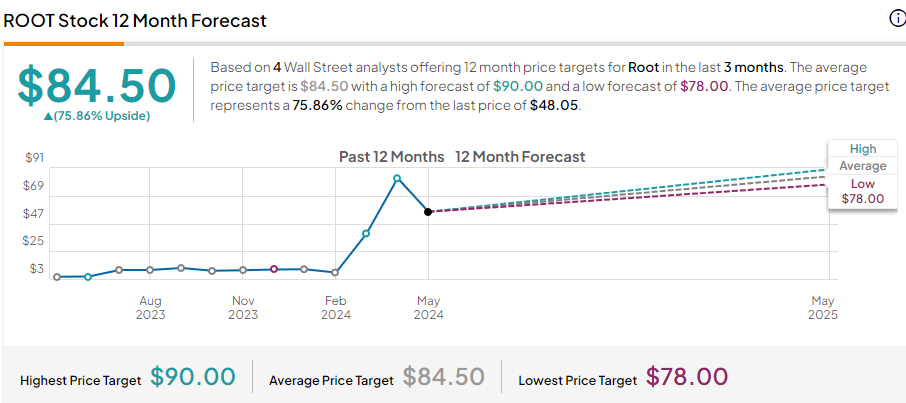

Analysts following the company have been mostly bullish on the stock. For example, JMP Securities analyst Matthew Carletti recently raised the price target from $15 to $90, whilst maintaining an Outperform rating on the shares. He noted that the price target increase reflects two consecutive quarters of solid results and the potential for the company to grow profitably.

Root is rated a Strong Buy based on the combined ratings and price targets issued by four analysts over the past three months. The average price target for ROOT stock is $84.50, representing an upside of 75.86% from current levels.

The shares have continued upward trajectory, climbing over 350% year-to-date. The stock trades in the middle of its 52-week range of $4.72-$86.57 and appears relatively slightly undervalued, with a P/S ratio of 1.08x, comparing favorably to the Property & Casualty Insurance industry average of 1.2x.

Final Analysis on ROOT

Root’s remarkable 900% share price surge over the past year and its outstanding Q1 report, which exceeded forecasts and delivered the first-ever positive operating income, highlight its potential for profitable growth. Trading at a current discount, the stock offers an attractive opportunity for investors interested in disruptive tech firms.