Shares of Roku (ROKU) are up at the time of writing after Bank of America, led by four-star analyst Brent Navon, increased its price target on the TV streaming platform from $100 to $110 (25% upside from current levels) and kept its Buy rating on the stock. The firm said that the overall ad market is starting to improve, with less uncertainty in recent months and stronger sentiment by the end of the second quarter. One key reason for the optimism is Roku’s new partnership with Amazon (AMZN), which BofA sees as a smart move that supports Roku’s plan to make its platform more open and flexible.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The partnership with Amazon is expected to help Roku make more money from its ad inventory. In addition, Bank of America explained that this deal shows Roku’s willingness to work with more ad tech partners, or demand-side platforms (DSPs), to improve how ads are sold and placed on its platform. This change could help Roku build stronger relationships with advertisers and fill more ad space, which means more revenue from each available ad slot.

Looking ahead, Bank of America sees several trends that are expected to support Roku’s growth. These include the rise of connected TV (CTV) advertising, the global shift toward streaming video, and higher ad fill rates. As a result of these factors and Roku’s recent actions, the firm raised its 2025 revenue forecast slightly, from $4.55 billion to $4.59 billion, and increased its EBITDA estimate from $351 million to $360 million.

What Is the Fair Value of Roku Stock?

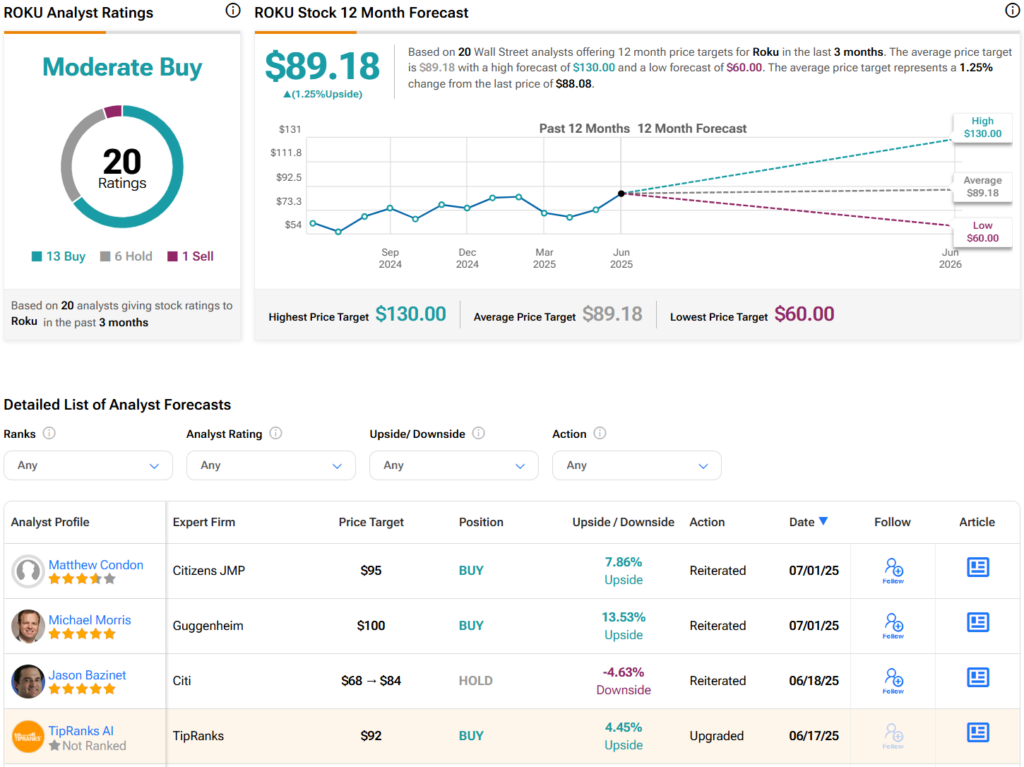

Overall, analysts have a Moderate Buy consensus rating on ROKU stock based on 13 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average ROKU price target of $89.18 per share implies that shares are near fair value.