The one great thing about home entertainment stock Roku (ROKU) is that it handles both sides of the content ecosystem so well. It not only offers content, through its Roku Channel, but also, it offers a means to present that content with set-top boxes, outright televisions, and recently, a new smart projector. But some wonder if this is enough to keep Roku relevant in a growing field of competitors. And that is leaving Roku shareholders concerned. Roku shares dipped fractionally in the closing minutes of Tuesday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Certainly, Roku is keeping up with both sides of the coin reasonably well. It offers the content, and the means to view that content, making it a useful part of home theater operations all over the United States and beyond. But it is not hard to see where Roku might not be able to keep pace with its competitors. Roku is not much when compared to a Disney (DIS) or a Netflix (NFLX). In fact, Roku might be regarded as a more likely target for acquisition by its competitors than an actual competitor.

Current reports suggest Roku looks to bring in $6.1 billion in revenue and $372.1 million in earnings by 2028, which means an annual growth rate of 11.4%. If it can keep that pace up for any length of time, Roku could be a powerhouse. But it would also be a powerhouse in an environment packed with competitors. So for all of Roku’s advances, Roku might have a tough time convincing investors to get on board.

Lots More AI Ads to Come

Though, in what might be called a downside move, Roku recently warned its users to brace for a lot more advertising generated by artificial intelligence (AI). The good news there is that the plan means small businesses will be much more readily able to buy ads on Roku. But these ads will also be generated by artificial intelligence, because the alternative—spending money for ad content creators—is out of reach for many small businesses.

Thus, one report proclaimed, “expect many more ads from the Uncanny Valley.” While this does have the potential to be entertaining in and of itself—some of these ads are downright wild—this also may come back to haunt Roku. Sure, the ads will be entertaining, but they are unlikely to sell product. And that means all those small businesses are unlikely to come back.

Is Roku Stock a Good Buy?

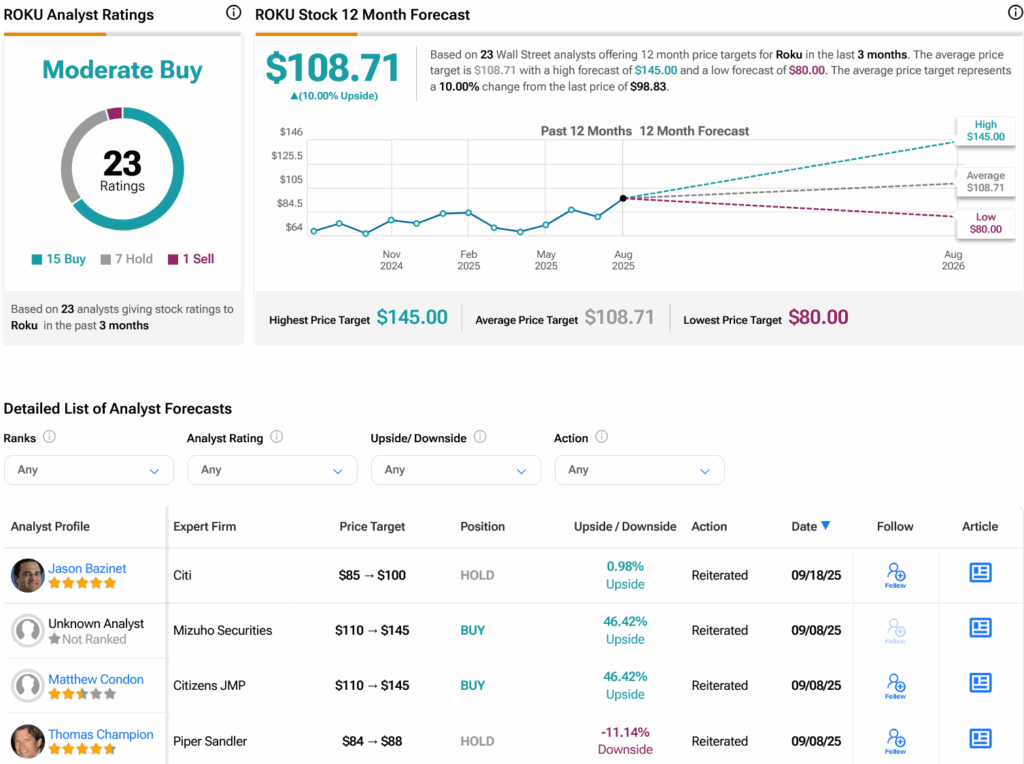

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ROKU stock based on 15 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 29.71% rally in its share price over the past year, the average ROKU price target of $108.71 per share implies 10% upside potential.