Shares of Rocket Lab USA (RKLB), a space launch and satellite systems firm, closed at a new all-time high on Tuesday, marking a second straight record finish. The stock ended the session at $86.03, up 10.1%, extending a rally that has drawn attention from both Wall Street and retail investors.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Over the past month, Rocket Lab shares have climbed more than 70%, rising from around $49 in early December. That move has made RKLB one of the standout performers in the market and a clear favorite among retail traders.

Momentum Builds as Traders Crowd In

Tuesday’s rally was not driven by price action alone. Options activity also jumped sharply, with volume running more than 3.5 times the stock’s 90-day average. That kind of activity often signals rising interest from short-term traders who are betting the move still has room to run.

The strength in Rocket Lab also lifted sentiment across the space sector. Stocks such as AST SpaceMobile (ASTS) and EchoStar (SATS) also rose on Tuesday, suggesting the rally extended beyond Rocket Lab alone.

Retail Support Remains a Key Driver

Despite the rally, Rocket Lab remains unprofitable. The company has never posted a full-year profit since going public. Even so, that has not slowed investor demand. Over the past two years, RKLB shares are up nearly 1,500%, reflecting steady buying interest from retail investors.

That enthusiasm was recently highlighted by Goldman Sachs (GS), which made Rocket Lab the largest holding in its latest GS Memes basket. The move places RKLB ahead of AST SpaceMobile and other popular retail names and shows how much attention space stocks are getting from individual investors.

Execution Becomes the Focus Now

Rocket Lab is often seen as a smaller public rival to SpaceX, with plans that extend beyond launches. The company is expanding into satellite parts, space systems, and defense work, which many investors view as important for long-term growth.

After such a fast rise, expectations are now high. With valuation stretched and profits still absent, future gains are likely to depend more on execution than enthusiasm.

Is RKLB a Good Stock to Buy?

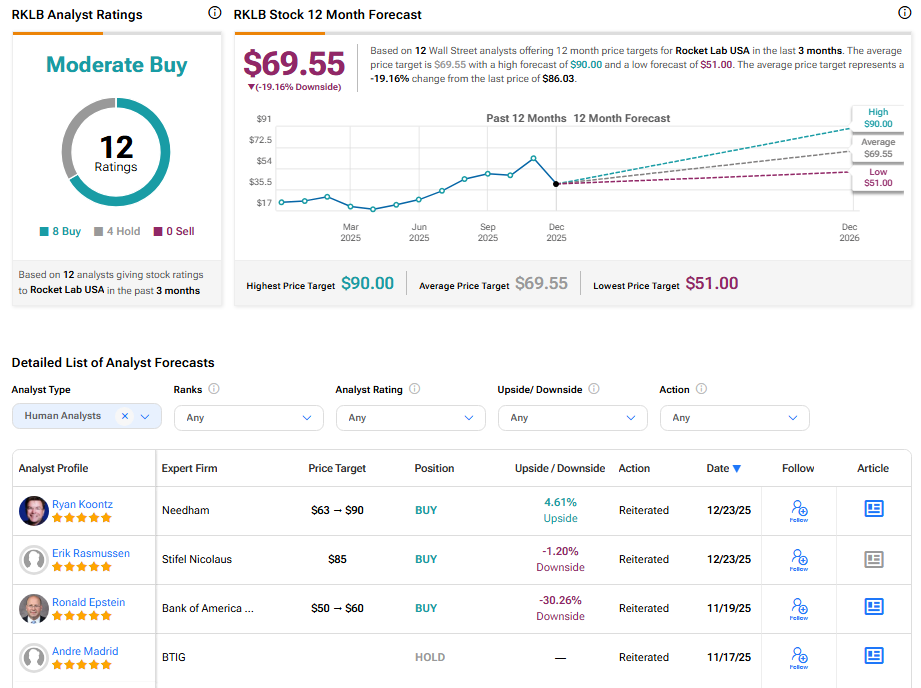

According to TipRanks, RKLB stock has received a Moderate Buy consensus rating, with eight Buys and four Holds assigned in the last three months. The average price target for Rocket Lab is $69.55, suggesting a potential downside of 19.16% from the current level.