Shares of Rocket Lab USA (RKLB) have surged 175% in 2025, amid growing market interest in small‑satellite launches. However, TipRanks’ A.I. analysis urges caution on RKLB stock heading into 2026, pointing to profitability and valuation concerns.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks, giving investors a clear and concise snapshot of a stock’s potential. Moreover, TipRanks’ A.I.-driven rating combines insights from multiple models, including OpenAI’s GPT-4o and Perplexity’s SonarPro.

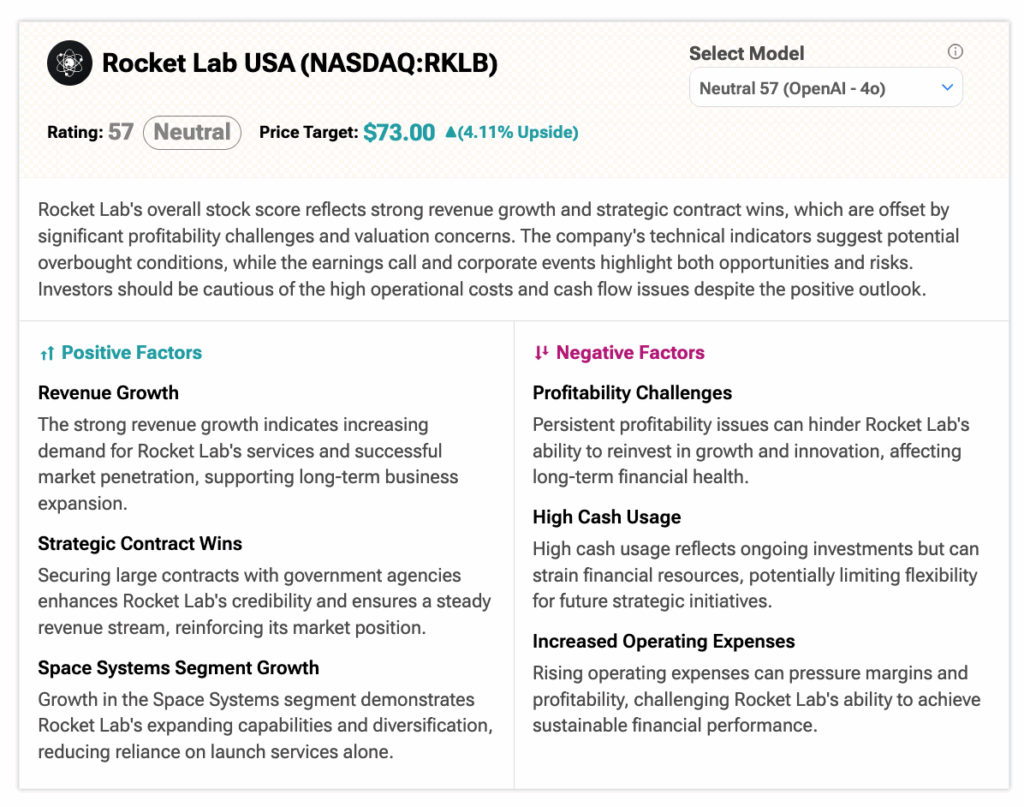

RKLB Earns Neutral Rating

Rocket Lab is a space launch company specializing in small orbital rockets and satellite solutions, best known for its Electron rocket and upcoming Neutron launch vehicle.

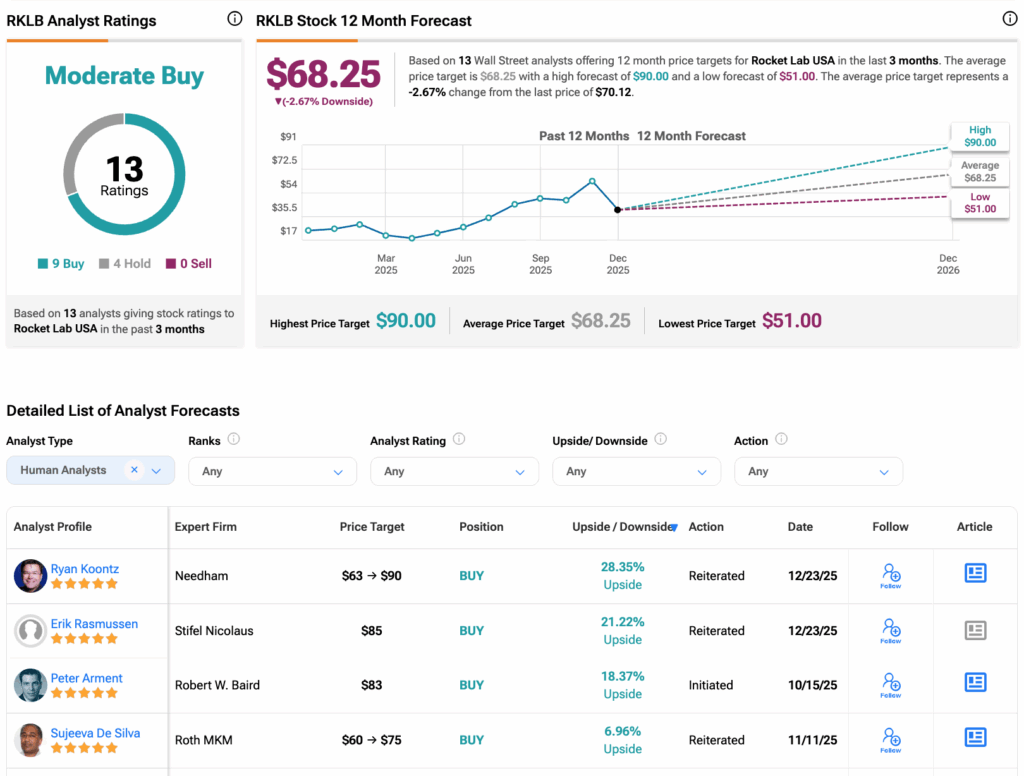

According to TipRanks A.I., RKLB stock currently scores 57 out of 100 based on the OpenAI model. It also assigns a price target of $73 to RKLB, suggesting a modest upside of 4.11%. On the other hand, Wall Street analysts rate the stock as a Moderate Buy, predicting over 2% downside.

AI Analyst Signals Risks Ahead for RKLB

Rocket Lab’s stock scores well due to strong revenue growth and recent contract wins, but those positives are balanced by ongoing profitability issues and valuation concerns.

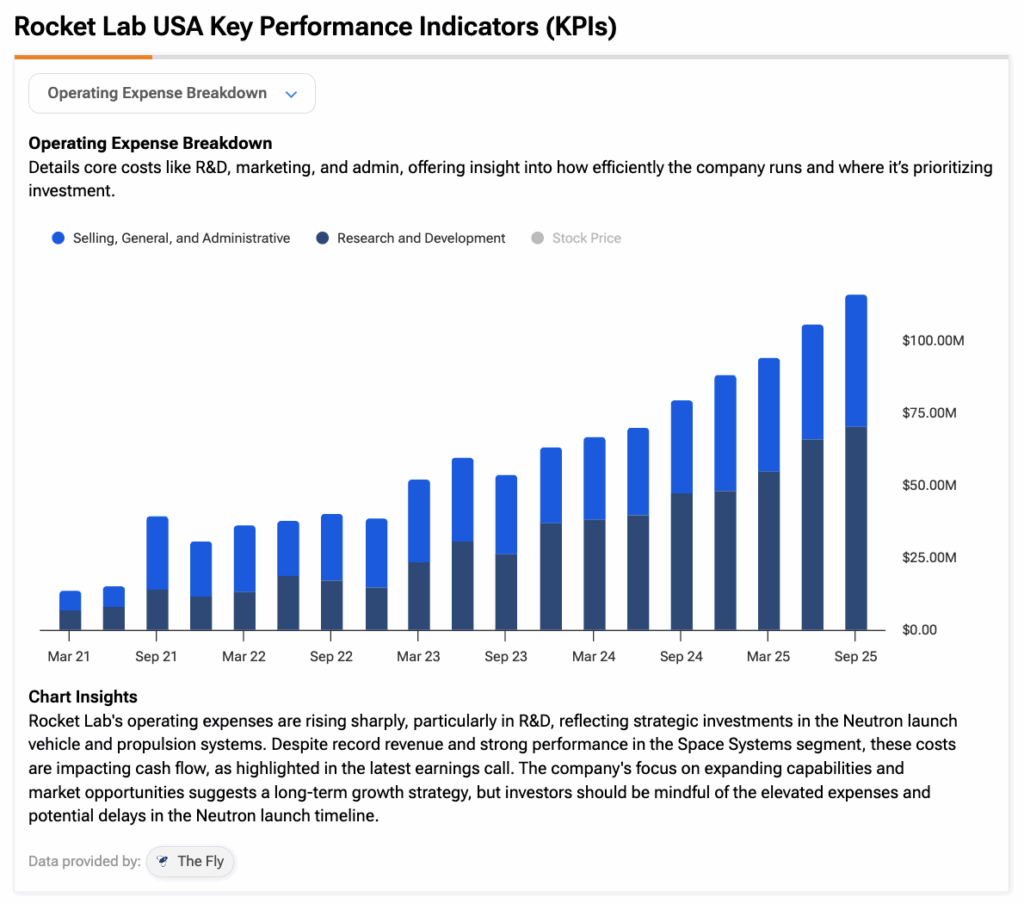

However, the company’s ongoing profitability challenges raise concerns about its long-term financial sustainability. High cash usage and rising operating expenses continue to pressure margins, limiting the company’s ability to self-fund growth and reducing financial flexibility. If these trends persist, Rocket Lab may face increased reliance on external funding, adding risk for investors.

Below is a screenshot showing the company’s growing operating expenses over the last few quarters.

Wall Street Is Bullish on Upcoming Neutron Launch

Rocket Lab’s upcoming Neutron rocket is a partially reusable launch vehicle designed for medium-lift missions in the commercial space market. Scheduled for its first launch in 2026, Neutron is expected to offer a lower-cost alternative to SpaceX’s Falcon 9 while retaining reusability features.

Analysts remain moderately optimistic on RKLB stock. Notably, five-star-rated analyst Ryan Koontz at Needham has a Street-high $90 price target on RKLB, citing recent defense contracts and growth outlook. Koontz sees multiple near- and mid-term drivers for revenue growth, including the first Neutron launch approaching. He added that these developments also improve visibility into Rocket Lab’s future defense-related cash flows.

Is RKLB a Good Stock to Buy?

According to TipRanks, RKLB stock has received a Moderate Buy consensus rating, with nine Buys and four Holds assigned in the last three months. The average price target for Rocket Lab is $68.25, suggesting a potential downside of 3% from the current level.