U.S.-based space company Rocket Lab (RKLB) reported its Q1 earnings last week, earning Buy ratings from several analysts.

Rocket Lab (RKLB): Analysts Stay Bullish on This Russell 2000 Space Stock After Q1 Earnings

Story Highlights

Rocket Lab USA (RKLB), a member of the Russell 2000 Index, recently reported its first-quarter 2025 results. Despite posting a wider-than-expected loss, analysts remain optimistic about the company’s long-term growth prospects. With a robust launch backlog, expanding space systems business, and consistent progress on its Neutron rocket development, many analysts continue to rate RKLB stock a Buy.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

For context, the Russell 2000 Index (IWM) tracks 2,000 U.S. small-cap stocks, serving as a key benchmark for these companies.

Cantor Fitzgerald Lifts Price Target on RKLB Stock

Following the Q1 release, Cantor Fitzgerald analyst Andres Sheppard raised his price target on RKLB stock to $29.00 from $24.00 while maintaining a Buy rating. According to Sheppard, Rocket Lab is steadily progressing on the development of its new reusable medium-lift rocket, Neutron. The company has confirmed it remains on track for Neutron’s first launch in the second half of 2025, likely in the fourth quarter.

Additionally, Sheppard highlighted that Rocket Lab’s Neutron rocket has been selected for onboarding to the U.S. Space Force’s National Security Space Launch (NSSL) program. This is part of a $5.6 billion firm-fixed-price IDIQ contract running through 2029. Notably, Rocket Lab is one of just five companies chosen for these top-priority Department of Defense missions. This endorsement could enhance investor confidence, drive long-term revenue opportunities, and solidify Rocket Lab’s standing in the national security launch market.

Stifel Applauds Rocket Lab’s Q1 Results

Stifel Nicolaus’ five-star-rated analyst Erik Rasmussen applauded Rocket Lab’s strong quarter, with revenue near the high end of its forecast and a smaller loss than expected. He added that the company expects growth to return in Q2 and pick up even more in the second half of the year.

Moreover, Rasmussen believes that launch services are set to benefit from higher prices and more frequent missions, while its space systems segment will gain from new phases of a government defense program. Plus, with its upcoming acquisition of Mynaric, Rasmussen stated that the company will soon be able to offer full-service space solutions, launching rockets, building satellites and components, and potentially running its satellite network.

Is Rocket Lab a Good Stock to Buy?

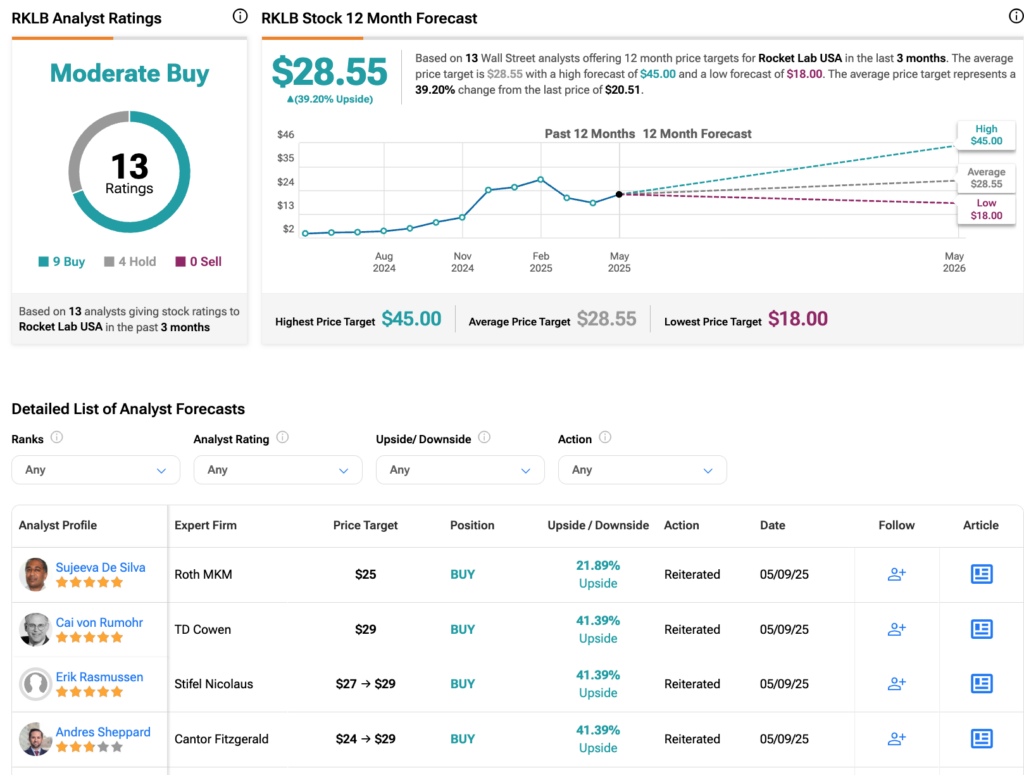

According to TipRanks, RKLB stock has received a Moderate Buy consensus rating, with nine Buys and four Holds assigned in the last three months. The average Rocket Lab stock price target is $28.55, suggesting a potential upside of 39.2% from the current level.