Wall Street analysts have mixed opinions about metaverse stock Roblox (RBLX) for 2026. However, the sentiment has leaned toward more caution recently due to concerns about slowing user engagement and pressure on profit margins. For instance, JPMorgan (JPM) downgraded the stock in December from Buy to Hold and lowered its price target from $145 to $100.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Analyst Cory Carpenter said that Roblox’s long-term position remains solid, but warned that the stock could “take a breather” in 2026 as bookings growth slows down and developer costs increase. The downgrade comes despite a strong 2025, when viral games like Grow a Garden and Steal a Brainrot drove bookings growth well above the company’s 20% annual target.

However, engagement has begun to cool off as those viral hits fade, and new risks are arriving, including the impact of a Russia ban that could affect up to 10 million daily active users. Still, Carpenter expects roughly 20% bookings growth in 2026, even though management has not reaffirmed that goal. But with engagement moderating and margins likely to face pressure, he believes the stock’s risk-reward looks more balanced than bullish.

Goldman Sachs Is Much More Optimistic

Nevertheless, not everyone on Wall Street is pulling back. Previously, Goldman Sachs (GS) took a much more optimistic stance by upgrading Roblox to a Buy rating and raising its price target to a Street-high $180 per share.

Four-star analyst Eric Sheridan pointed to strong momentum on the platform by noting that daily active users grew 41% year-over-year in the second quarter of 2025. He also highlighted that Roblox continues to invest heavily in artificial intelligence and infrastructure in order to support a larger and more engaged user base.

Is RBLX Stock a Good Buy?

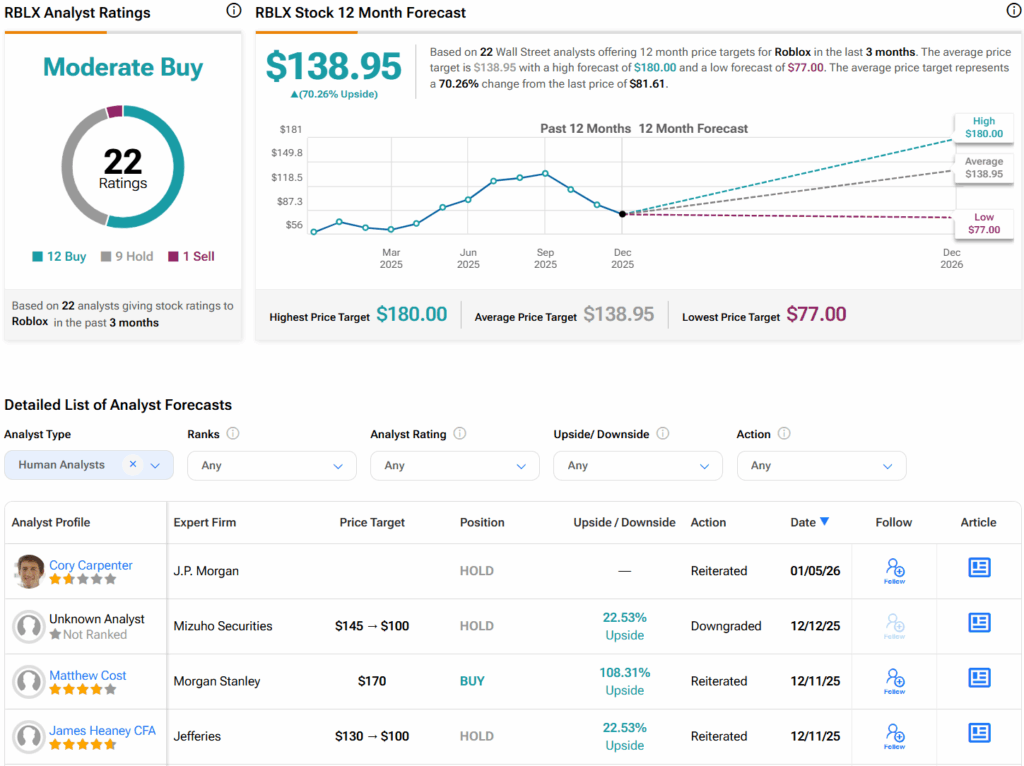

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RBLX stock based on 12 Buys, nine Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average RBLX price target of $138.95 per share implies 70.3% upside potential.