EV maker Rivian Automotive (RIVN) saw its shares rise in after-hours trading after reporting its Q3 results. Earnings per share came in at -$0.99, which missed analysts’ consensus estimate of -$0.95 per share. In addition, revenue fell by 34.8% to hit $874 billion, also falling short of estimates calling for $991.51 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In Q3, Rivian made 13,157 vehicles and delivered 10,018. The firm also decreased its expenses to $777 million this quarter compared to the $963 million in the year-ago period, but its adjusted EBITDA was worse than anticipated at -$757 million. Rivian ended the quarter with $6.739 billion in cash and, when including all its available resources, has $8.105 billion in total liquidity.

Outlook for 2024

Looking ahead, Rivian reaffirmed its production guidance of 47,000 to 49,000 vehicles and delivery outlook of 50,500 to 52,000 vehicles, along with capital expenditures totaling $1.2 billion. In addition, it expects annual adjusted EBITDA to be between -$2.825 billion and -$2.875 billion.

Is RIVN Stock a Buy or Sell?

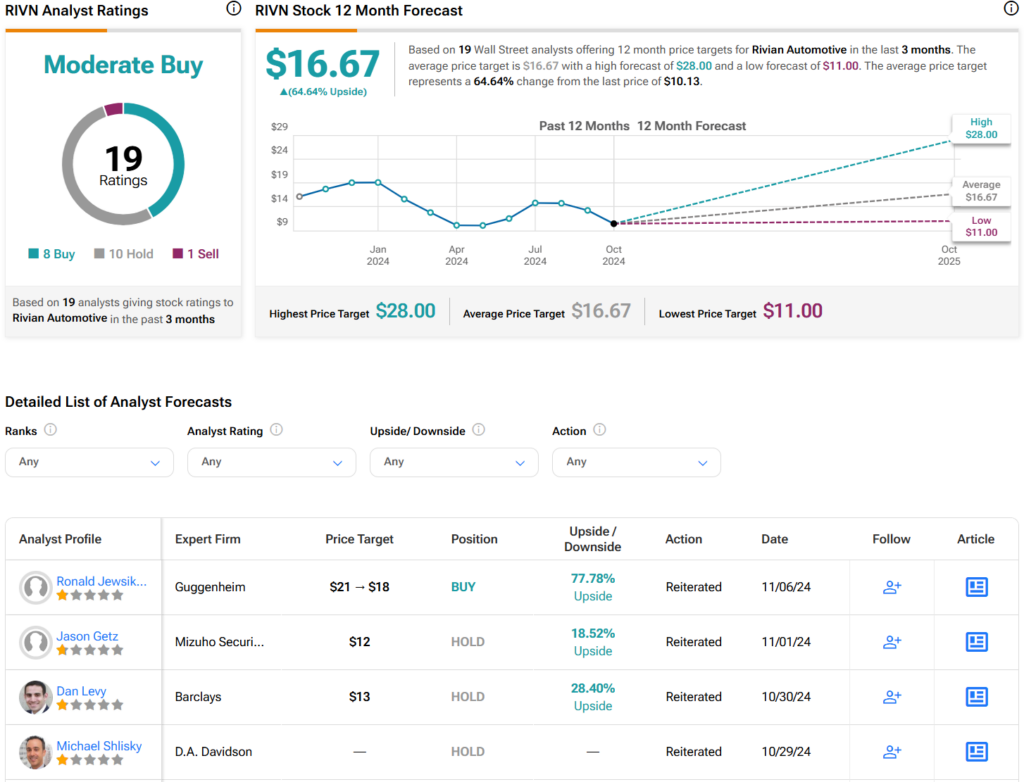

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RIVN stock based on eight Buys, 10 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 40% decrease in its share price over the past year, the average RIVN price target of $16.67 per share implies 64.64% upside potential.