Electric car maker Rivian (NASDAQ:RIVN) recently offered a pessimistic Fiscal Year 2023 shareholder update, sparking fear among many investors that the company may be unable to achieve profitability in the near term. However, an upcoming and upgraded take on its electric adventure vehicle and a planned production shutdown to boost efficiencies and cut costs give buy-and-hold investors reason to consider jumping in on RIVN shares now.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Wall Street analysts remain broadly optimistic about Rivian, particularly over medium- and long-term timelines, and I join them in this bullish view. Below we’ll take a closer look at some of the factors at play.

FY2023 Earnings: Revenue, Earnings as Expected; Production Estimates Disappoint

Rivian’s full-year revenue of $4.4 billion and losses of $5.74 per share for 2023 were in line with many analyst estimates. This prompted some analysts across the Street to revise their Fiscal 2024 estimates downward. Alongside this, some analysts have lowered their average price targets for RIVN stock.

Nonetheless, perhaps the largest disappointment to come from Rivian’s earnings report was its 2024 vehicle production guidance. The company expects to produce 57,000 vehicles this year, a figure that is unchanged compared with 2023 estimates.

As a developing EV company, Rivian has focused on building its brand, establishing a customer base, and ramping up its capacity. All of this has contributed to substantial losses per share in recent quarters. Key to achieving profitability, many investors assume, will be Rivian’s ability to ramp up its production. Selling more vehicles—particularly those produced efficiently and at minimal cost—will be essential to turning a profit.

Add to Rivian’s earnings challenges the broader issues facing the EV industry, including high interest rates, costly materials, and saturation by an ever-growing number of vehicle manufacturers, and it may seem that Rivian’s prospects are dim.

Production Shutdown Provides a Unique Opportunity

On the contrary, though, when it comes to RIVN, investors may wish to keep in mind the advice of investment guru Warren Buffett, who famously encouraged investors to “be fearful when others are greedy, and be greedy when others are fearful.”

Rivian, in fact, does aim to become gross-profit positive in 2024, despite not increasing its production guidance for the year. The company could do this by achieving lower materials costs throughout the year.

Even more importantly, though, Rivian is likely to continue implementing measures to cut costs and increase efficiencies. The company recently announced sweeping layoffs of 10% of its workforce. And it could dramatically improve production efficiency in the second quarter when it plans a production shutdown.

Rivian’s production shutdown will lower the number of cars it produces in the short term, yes, but it will also allow the company to make some much-needed improvements to its production process, bring in new suppliers, and otherwise find ways to eliminate unnecessary costs from its operations. All told, this short-term setback may fuel stronger production—and better margins—in future quarters.

Consider Buying the Dip Before R2 Launch

Another important driver of momentum for Rivian in the coming quarters will be the launch and rollout of its R2 vehicle, the latest and most advanced of the company’s offerings. Rivian recently hired Jennifer Prenner as its top marketing executive ahead of the launch. Prenner was previously a marketing executive at Meta Platforms Inc. (NASDAQ:META) and Amazon (NASDAQ:AMZN).

It would appear that the company is seeking to strengthen its marketing surrounding the R2 launch in a bid to maintain its impressive growth rate from early 2023. These developments may help to explain why Wall Street analysts remain broadly optimistic about Rivian, at least over the longer term. Let’s take a look at what analysts are saying about RIVN.

Is RIVN Stock a Buy, According to Analysts?

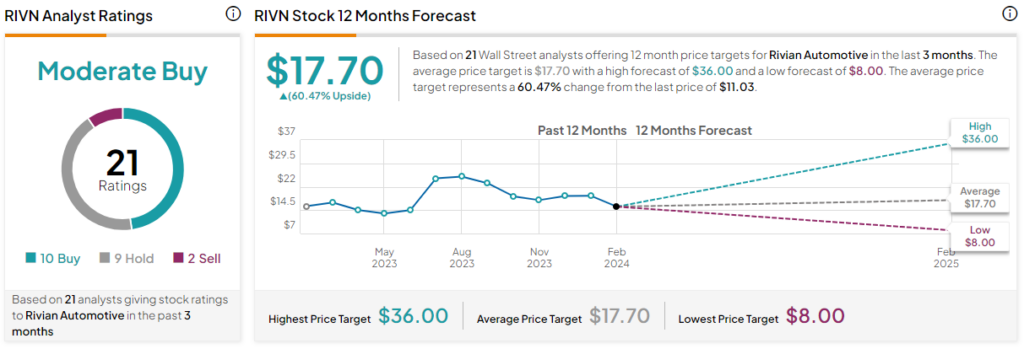

Based on 21 analyst ratings, RIVN stock currently enjoys a “Moderate Buy” rating, with 10 analysts suggesting that investors Buy, nine suggesting a Hold, and just two advocating to Sell. There is also significant upside potential of more than 60% based on RIVN stock’s average price target of $17.70. While RIVN stock has fallen by about 25% in the last year, this may present an opportunity for investors to buy the dip.

The Takeaway: Ride Out the Short-Term Bumpy Road

The fiercely competitive EV space has faced many challenges in recent quarters. Rivian, like many other EV firms, has a strong customer base and a popular line of vehicles but has yet to break into profitability. A lackluster Fiscal 2023 earnings report only further contributed to a decline in share price that has been ongoing for several months. On the other hand, Rivian has a new top-end vehicle launching soon and an ambitious plan to trim the fat in its production operations as it paves a road toward profitability.