American electric vehicle (EV) maker Rivian Automotive (RIVN) is scheduled to announce its results for the first quarter of 2025 after the market closes on Tuesday, May 6. Wall Street expects Rivian to report a narrower loss per share of $0.77 compared to $1.24 in the prior-year quarter, driven by the company’s cost reduction efforts.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

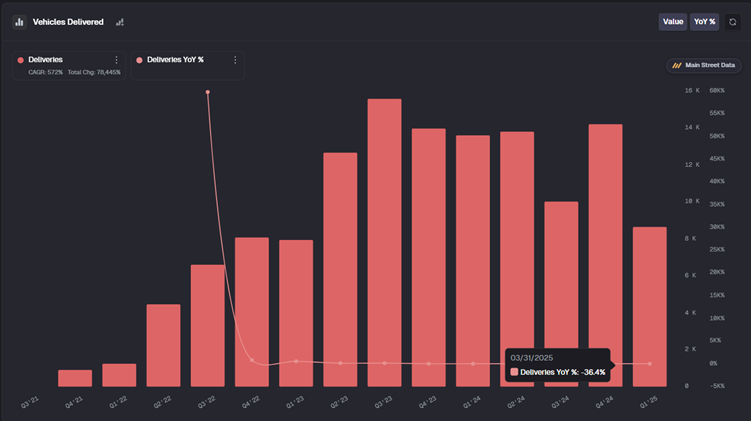

However, Rivian’s Q1 revenue is expected to decline 17% year over year to $997.27 million due to lower deliveries in the quarter, partially reflecting the impact of fires in Los Angeles. According to Main Street Data, the company’s Q1 deliveries fell 36% year-over-year to 8,640 vehicles. That said, Q1 deliveries exceeded the analysts’ consensus estimate of 8,200 units.

EV makers have been experiencing weak demand due to increasing competition and consumers’ preference for cheaper hybrid and gas-powered models amid macro uncertainty. Investors will pay attention to management’s commentary on the impact of higher costs from tariffs on Mexico and Canada. They will also focus on Rivian’s gross profit, given that Q4 2024 marked the first quarter in which the company reported a positive gross profit.

Analysts’ Views Ahead of Rivian’s Q1 Earnings

Last month, Bernstein analyst Daniel Roeska reiterated a Sell rating on Rivian stock with a price target of $6.10, warning that the EV maker’s stock could face nearly 50% downside risk from current levels due to rising tariff pressures and financial headwinds.

The 4-star analyst noted that while the EV startup manufactures all its vehicles in the U.S., it imports key components, specifically batteries, from South Korea and China. With tariffs on imported batteries set to increase in May, Roeska believes that the additional costs will weigh heavily on the company’s outlook.

In particular, the analyst expects Rivian to discontinue its Lithium Iron Phosphate (LFP) variants and reduce its volume and EBIT guidance. He expects the current scenario to force the company to consider raising fresh equity. Roeska cut his 2025 delivery forecast to 37,000 units, down 20% from the midpoint of the company’s guidance. He expects adjusted EBITDA to reach negative $2.2 billion, 17% below the company’s outlook. The analyst is also worried that RIVN’s weak financials might lead to a breach of covenants under the $6 billion Department of Energy loan related to the expansion of its Georgia plant and delay access to critical funding.

Meanwhile, Baird analyst Ben Kallo lowered his price target for RIVN stock to $14 from $16 and reiterated a Hold rating. As part of his Q1 preview, Kallo said that the outlook for the sustainable energy and mobility sector for Q2 and the second half of 2025 will likely be “muted,” given the global uncertainty.

Options Traders Anticipate a Major Move on RIVN’s Q1 Earnings

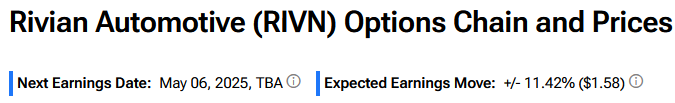

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about an 11.4% move in either direction in Rivian stock in reaction to Q1 results.

Is Rivian Stock a Buy, Sell, or Hold?

Overall, Wall Street is sidelined on Rivian stock, with a Hold consensus rating based on six Buys, 14 Holds, and four Sell recommendations. The average RIVN stock price target of $13.54 implies about 2.1% downside risk from current levels. RIVN stock has risen about 4% year-to-date.