Rivian (NASDAQ:RIVN) shares rallied by nearly 5% today after the EV maker reported vehicle delivery numbers for the second quarter. In Q2, Rivian produced 9,612 vehicles and delivered 13,790 units. On a quarter-over-quarter basis, the company’s production volume dropped by nearly 4,368 units. However, its delivery numbers increased slightly from Q1. The company noted that its Q2 delivery volume was in line with its estimates. For the full year, Rivian aims to produce nearly 57,000 vehicles.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Additionally, the company plans to report its second-quarter results on August 6, after market close.

Upcoming Results

Analysts expect Rivian to incur a net loss per share of $1.23 on revenue of roughly $1.01 billion for the quarter. In the comparable year-ago period, Rivian’s net loss per share of $1.08 had come in narrower than expectations by nearly $0.35. It’s worth noting that the company has never reported a positive bottom-line figure.

Still, Rivian’s share price is up by nearly 30% over the past month thanks to its joint venture announcement with Volkswagen (OTC:VWAGY) (DE:VOW3). Under the $5 billion deal, Volkswagen will initially pour nearly $1 billion into Rivian and increase its total investment to $5 billion by 2026. The partnership could help both companies lower their cost per vehicle as economies of scale kick in.

Is RIVN a Buy, Sell, or Hold?

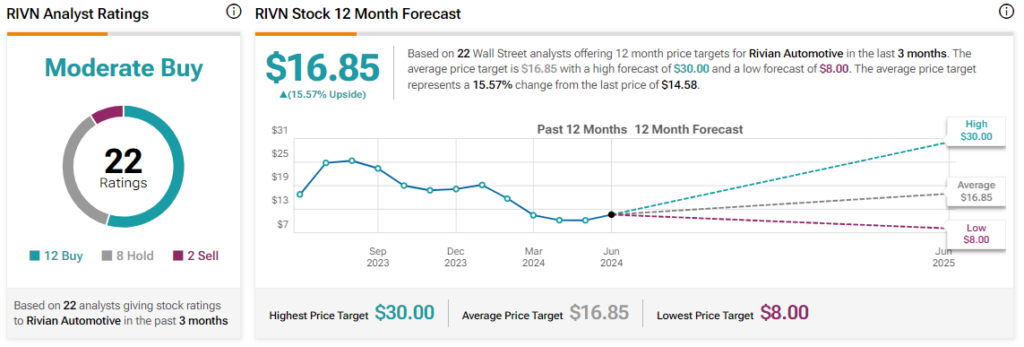

Despite this optimism, the Street remains cautiously optimistic about Rivian with a Moderate Buy consensus rating. The average RIVN price target of $16.85 points to a 15.6% potential upside in the stock.

Read full Disclosure