Shares of electric vehicle maker Rivian Automotive (NASDAQ:RIVN) gained over 2% in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at -$1.19, which beat analysts’ consensus estimate of -$1.34 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sales increased by 150% year-over-year, with revenue hitting $1.34 billion. This beat analysts’ expectations by $30 million.

For its full-year guidance, management raised its production forecast to 54,000 vehicles, higher than the previous guidance of 52,000. Furthermore, full-year adjusted EBITDA is expected to be -$4 billion, compared to a consensus estimate of -$4.2 billion.

In addition, the company disclosed that it may begin selling commercial vehicles to third parties aside from Amazon (NASDAQ:AMZN) as its exclusivity agreement with the e-commerce giant ended.

What is the Target Price for RIVN?

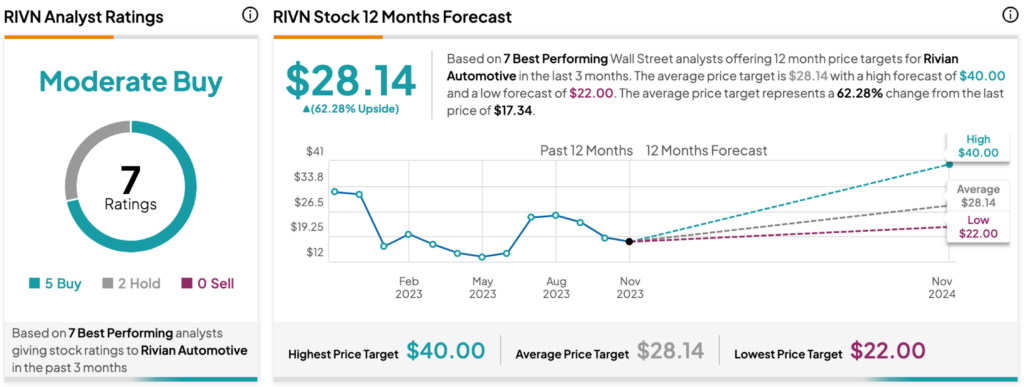

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RIVN stock based on five Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average RIVN price target of $28.14 per share implies a 62.28% upside potential.