Investors looking for dividend-paying stocks can consider Rithm Capital (NYSE:RITM) and Ellington Financial (NYSE:EFC). Both of these companies offer a consistent income stream through dividends, with yields over 5%. Furthermore, Wall Street analysts have rated these stocks a “Strong Buy” and expect more than 10% upside potential from their current levels.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Let’s take a closer look at these stocks.

Is RITM a Good Stock to Buy?

Rithm Capital is an American investment management company. Importantly, the stock has a dividend yield of 9.05%, compared with the real estate sector yield of 3.91%.

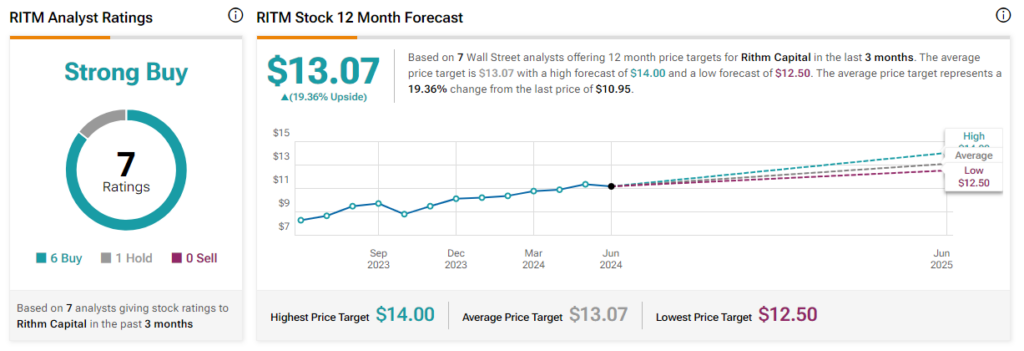

Last month, Argus Research analyst Kevin Heal raised the price target on Rithm stock to $13 (17.1% upside potential) from $12 and maintained a Buy rating. The analyst expects RITM to continue to benefit from the expansion of the home loan servicing business.

Overall, Rithm’s Strong Buy consensus rating is backed up by six Buy and one Hold ratings. The analysts’ average price target on RITM stock of $13.07 points to a 19.36% potential upside in the next 12 months. Shares of the company have gained 4.89% year-to-date.

Is EFC a Good Stock to Buy?

Ellington is a specialty finance company that acquires and manages mortgage-related and other financial assets. Notably, the stock has a dividend yield of 14.69%, compared with 3.91% for the real estate sector.

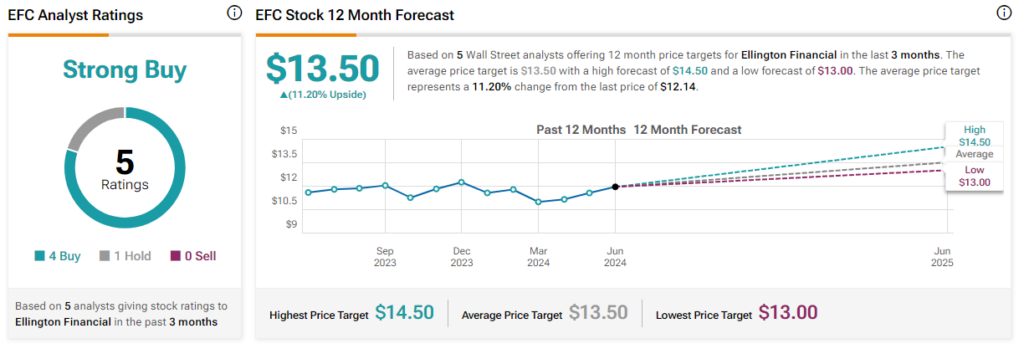

Last month, BTIG analyst Eric Hagen reiterated a Buy rating on the stock with a price target of $13.50 per share. The analyst expects the company to benefit from the potential reversal of unrealized losses in the non-qualified mortgage portfolio once interest rates decline.

Ellington has received four Buy and one Hold recommendation for a Strong Buy consensus rating. Further, analysts’ average price target on EFC stock of $13.50 implies an 11.2% upside potential. The stock has gained 1.25% so far in 2024.

Concluding Thoughts

Investors may consider looking at RITM and EFC stocks, as they offer high dividend yields and boast healthy cash flow. Importantly, analysts love these stocks and believe their prices could climb even higher.