Things were not looking good for pharmacy chain Rite Aid (NYSE:RAD). The chain carried over $3 billion in debt. Opioid lawsuits were breathing down its neck. There was no shortage of competition, either, and an increasingly fussy local government piled on as well. Thus, Rite Aid revealed plans to file for Chapter 11 bankruptcy, and its shares plunged over 52% in Friday afternoon’s trading as a result.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

There was no shortage of reasons for Rite Aid to circle its wagons. Not only does it have exposure to the massive chain of opioid-related lawsuits, somehow, but it also has over 1,000 separate federal lawsuits that were combined into a “multi-district litigation” being served out in Ohio. Currently, Rite Aid is handling opioid lawsuits as “general unsecured claims,” which means that it hasn’t worked much with governments at any level or individual plaintiffs to get the matter addressed.

Rite Aid is also closing stores rapidly, likely as a cost-saving measure to help it in post-bankruptcy operations. It’s closed at least two stores in as many days in Oakland, California, and Pottsville, Pennsylvania, leaving residents of both areas scrambling to find replacements and potentially tainting that entire pool against the Rite Aid brand for months, if not years. Further, Rite Aid locations in New York and New Jersey are under the gun from no less than OSHA itself, who demanded a plan to address “…blood and other infectious materials…” in Rite Aid stores.

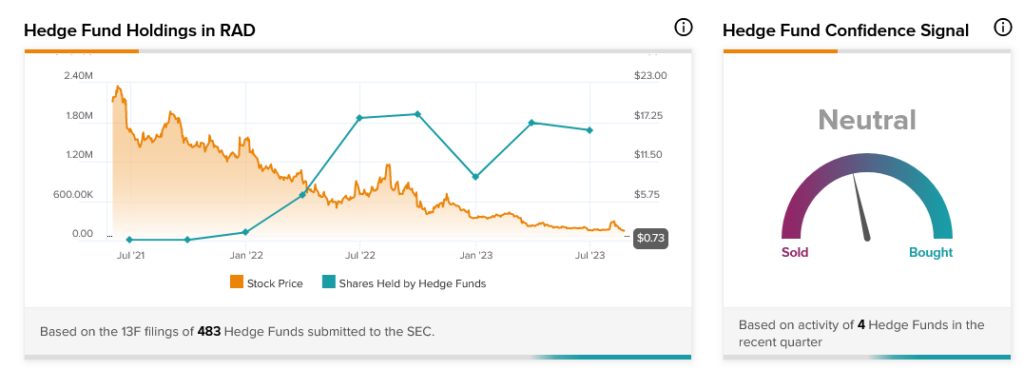

Hedge funds are also increasingly taking a dim view of Rite-Aid stock. In the last quarter, hedge funds reduced their holdings of Rite-Aid stock by 112,300 shares, which was enough to tip the needle on hedge fund confidence to the low side of Neutral.