Riot Platforms (RIOT) has secured its first-ever Bitcoin (BTC-USD)-backed loan, a $100 million credit facility, from Coinbase Global’s (COIN) subsidiary, Coinbase Credit. The funds can be accessed through multiple withdrawals over the next two months and will be used to support Riot’s expansion plans and general corporate purposes. Importantly, RIOT’s strategic move comes ahead of its Q1 results, due for release on May 1.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

It is worth noting that Riot holds one of the largest corporate Bitcoin treasuries, with over 19,000 BTC valued at nearly $1.8 billion. A portion of these holdings will serve as collateral for the loan, which carries an annual interest rate tied to the federal funds rate plus 4.5%. The facility is set to mature in one year, with an option for extension.

Following the news, RIOT stock gained 5.3% in yesterday’s trading session.

Riot Taps Growing Crypto Loan Trend

Riot’s move reflects a growing trend in the crypto market, as Bitcoin-backed loans are becoming more common due to digital asset values. Both banks and crypto lenders are increasingly offering credit solutions secured by cryptocurrencies.

For instance, Cantor Fitzgerald started its Bitcoin financing unit in March, while Blockstream boosted its investment in crypto-lending funds. Earlier this month, another Bitcoin miner, CleanSpark (CLSK), expanded its credit facility with Coinbase Prime to $200 million.

At-the-market (ATM) stock offerings to raise capital worry shareholders about stock dilution, but Riot Platforms CEO Jason Les said this funding is a “non-dilutive” option that enhances shareholder value while allowing the company to diversify its funding sources.

Analysts Expect RIOT’s Q1 Earnings to Fall Y/Y

Currently, Wall Street analysts expect RIOT to report Q1 2025 loss per share (EPS) of $0.23, against earnings of $0.82 per share in the prior-year quarter. Meanwhile, Riot Platform’s revenue is expected to nearly double to $158.42 million in the first quarter.

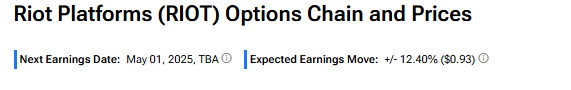

Importantly, TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. Currently, it indicates that options traders are predicting a 12.4% swing in either direction for RIOT stock.

Is RIOT Stock a Buy?

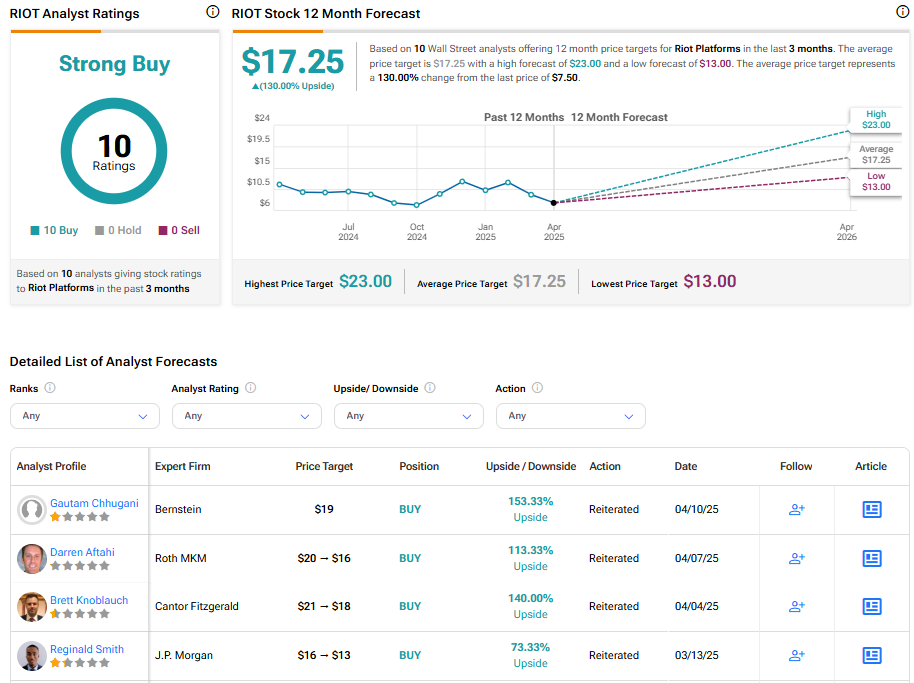

Turning to Wall Street, RIOT stock has a Strong Buy consensus rating based on 10 Buys assigned in the last three months. At $17.25, the average Riot Platforms price target implies a 130% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue