Quantum computing has been on fire, and Rigetti Computing (RGTI) is one of the sector’s standout movers—its stock has surged more than 80% in the past month and 160% over the last three months. The quantum computing pioneer has amped up its uptrend in recent weeks, posting nine consecutive days of gains in mid-September.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Yet, the fundamentals tell a different story: Rigetti recently missed quarterly expectations, posting minimal revenue and a net loss of nearly $40 million. Clearly, investors are betting more on the promise of tomorrow’s technology than today’s results.

While I remain optimistic about Rigetti’s long-term potential, I view the stock less as a stable investment and more as a lottery ticket on the commercial breakthrough of quantum computing—a play defined by high risk, but potentially yielding enormous rewards.

What’s Got Investors Excited?

Rigetti develops full-stack quantum computers, integrating quantum and classical computing to solve problems that conventional machines can’t handle efficiently. Its business model spans hardware sales, Quantum Cloud Services, on-premises installations, research collaborations, and government contracts.

Recently, the company unveiled the CPS-136Q, touted as the world’s largest multi-chip quantum computer—a significant technical milestone, though not yet a commercial breakthrough. Progress on the revenue front came in September, when Rigetti secured a $5.8 million, three-year contract with the U.S. Air Force Research Laboratory to advance quantum networking and long-distance quantum connections. News of the award sent Rigetti’s stock up 9% in a single session.

RGTI’s Current Financial Reality

Despite recent buzz, Rigetti reported its Q2 2025 results just last month, and the substance was underwhelming. Revenue hit $1.8 million, down 41.9% from the same period last year. Operating expenses totaled $20.4 million, while gross margins declined to 31% from 64% the previous year, leading to a loss of $39.7 million for the quarter.

The company is still in its early stages, burning cash while racing to commercialize its technology. It reported holding $571.6 million in cash and equivalents at quarter’s end, which should give the company runway to continue research and development without immediate financial pressure.

Still, revenue trends are a concern. The company missed consensus estimates and provided no guidance on future growth. Management’s silence suggests caution is warranted.

Valuation and Momentum

Rigetti trades on future potential rather than current fundamentals. The company has no P/E ratio because it has not generated any profits. The price-to-sales (981x) and price-to-book (18.25) ratios sit well above peers in the sector, where the average P/S is 3.56x and P/B is 3.72x.

The valuation is based on tremendous growth assumptions, betting that the company will capture a meaningful market share as quantum computing shifts from research to commercial applications. That shift hasn’t happened yet.

Meanwhile, the stock shows strong positive price momentum, trading above all major moving averages. Objects in motion tend to stay in motion, so this could continue to provide lift for the stock.

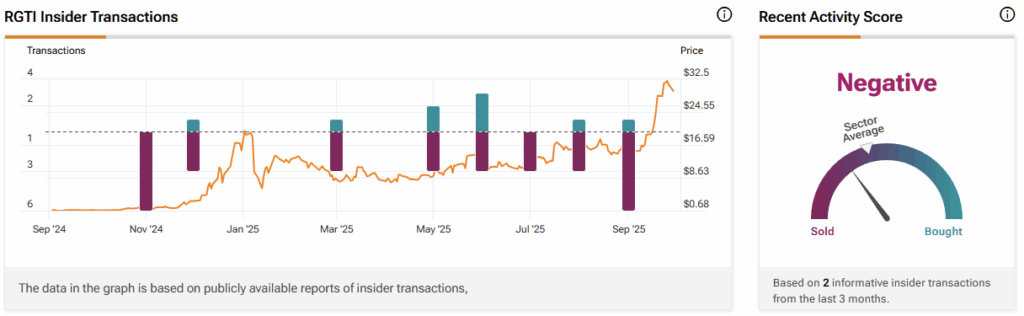

Rigetti Insiders Cash Out Amid Quantum Stock Rally

RGTI’s insider activity could be one factor that provides some insight. The stock has leaned decisively negative in recent months, raising eyebrows among investors chasing the quantum stock’s explosive rally. Directors Thomas Iannotti and Ray O. Johnson have executed significant sales, including multi-million-dollar auto-sell transactions tied to option exercises.

In total, insiders have unloaded more than $3 million worth of stock since July, according to TipRanks data. While such sales don’t always signal a lack of confidence—tax filings and portfolio diversification are typically the go-to for explaining hefty share sales—the timing stands out. Coming amid RGTI’s triple-digit percentage gains, the insider exits suggest company insiders may be taking profits while momentum is peaking.

Is RGTI a Good Stock to Buy?

Rigetti has garnered a Strong Buy rating overall, based on seven Buy and one Hold recommendation from analysts. While the recent trend has analysts increasing their price targets for the stock, the current 12-month average price stands at $21.42, indicating that Wall Street analysts expect RGTI to decline by approximately 27% over the next year.

Most recently, B. Riley analyst Craig Ellis raised his price target from $19 to $35 while maintaining a Buy rating, noting that breakthroughs in quantum technology are racing ahead of expectations.

This theme was reiterated by Needham’s Quinn Bolton, who assigned a Buy rating with an $18 price target. He recently highlighted Rigetti’s progress in developing a 4-chiplet, 36-qubit quantum processing unit (QPU) with a high median two-qubit gate fidelity of 99.5%. Bolton noted management’s optimism about reaching 100 qubits and maintaining the same level of fidelity by the end of the year.

Rigetti’s Promise is Big—But So Are the Risks

Rigetti offers exposure to the potential of quantum technology to transform computing. When it does, Rigetti’s full-stack approach and superconducting qubit technology position it to compete. The company possesses strong technical capabilities and has sufficient cash to fund its operations for the foreseeable future.

Yet, current financials don’t support the stock’s lofty valuation. Future potential does. At some point, Rigetti will need to show commercial traction. News of customer wins should continue to have a positive impact on the stock, as commercial adoption signals matter more than technical milestones at this stage.

Investors will also want to track the progress of competitors such as IBM (IBM), Alphabet (GOOGL), and IonQ (IONQ). Any major breakthrough from one of these competitors could change the landscape overnight.

I remain Bullish on the upside potential of the space and Rigetti’s position in it. Still, it is a high-risk, high-reward lottery ticket — one that may take a longer time horizon to play out than many investors might realize.