Rhythm Pharmaceuticals (RYTM) announced on November 27 that the FDA has approved IMCIVREE (setmelanotide) for chronic weight management in adult and pediatric patients age 6 years or older with obesity caused by proopiomelanocortin (POMC), proprotein convertase subtilisin/kexin type 1 (PCSK1) or leptin receptor (LEPR) deficiency, confirmed by genetic testing. In response, shares closed 21% higher on Friday.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This approval, which is supported by results from the largest studies conducted to-date in obesity due to POMC, PCSK1 or LEPR deficiency, makes IMCIVREE the first weight management therapy to be approved by the FDA for these rare genetic diseases.

“Our first new drug approval is a major milestone for Rhythm, and we look forward to delivering on the promise of IMCIVREE for patients suffering with obesity due to POMC, PCSK1 or LEPR deficiency,” Rhythm’s Chair, President and CEO David Meeker commented. “With IMCIVREE, we are advancing a first-in-class, precision medicine that is designed to directly address the underlying cause of obesities driven by genetic deficits in the melanocortin-4 (MC4) receptor pathway.”

In Phase 3 clinical trials, 80% of patients with obesity due to POMC or PCSK1 deficiency and 45.5% of patients with obesity due to LEPR deficiency witnessed more than a 10% weight loss after one year of treatment, and the therapy was generally well-tolerated.

Along with the approval, the FDA gave Rhythm a Rare Pediatric Disease Priority Review Voucher (PRV), which can be used to receive priority review for any subsequent marketing application or sold or transferred to other companies for their programs.

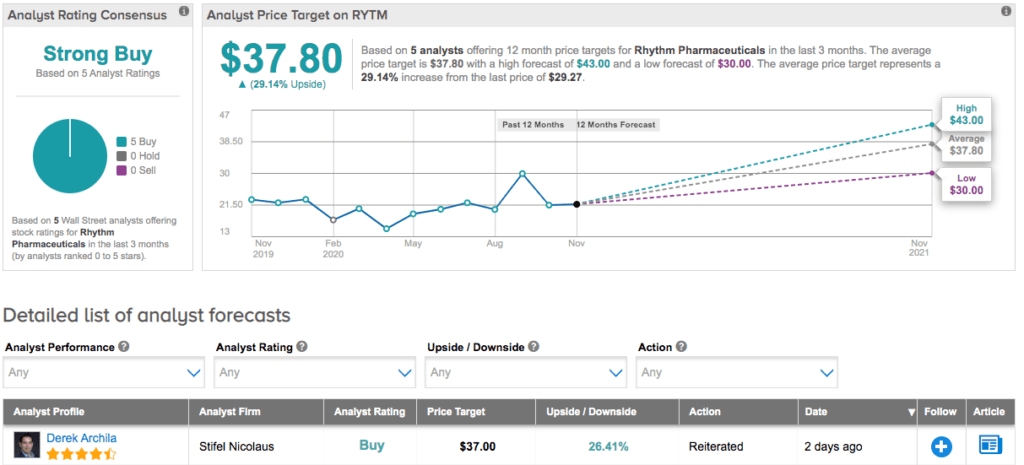

Covering the stock for Stifel, analyst Derek Archila bumped up the price target to $37 (26% upside potential) from $36 and reiterated a Buy rating after the news broke. He expects the product to be launched in Q1 2021, but acknowledges that “this won’t be a traditional launch or sales ramp given the small size of POMC/LEPR indications.”

However, Archila points out that the approved FDA label is a “bit broader in terms of patient population than Street’s base case but more importantly, certain label language suggests to us that RYTM and the FDA appear to be somewhat aligned on using a run-in period to identify IMCIVREE responders which we think could bode well for the allowance of a future Phase 3 basket trial.” He noted, “We believe the allowance of such a trial will meaningfully increase the TAM for IMCIVREE and represents an underappreciated catalyst for the stock in 2021.”

The rest of the Street is in agreement, as RYTM boasts a unanimous Strong Buy analyst consensus based on 5 Buy ratings. At $37.80, the average price target implies 29% upside potential. (See Rhythm stock analysis on TipRanks)

Related News:

Y-mAbs Wins FDA Approval For Neuroblastoma Antibody Therapy

AstraZeneca Mulls Global Trial With Lower Covid-19 Vaccine Dose – Report

Aurora Cannabis Inks Supply Deal with Israel’s Cantek