Shares of RH (NYSE: RH), the holding company of Restoration Hardware, Inc. sank as much as 7.7% in the extended trading session yesterday after the company lowered its guidance for the second half of 2022. The shares are continuing the downward spiral, trading down 5.2% in the pre-market trading at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Restoration Hardware engages in the luxury home furnishings segment, selling furniture, lighting, textiles, bathware, decor, outdoor and garden, as well as baby and child products. RH stock has lost nearly 56% so far this year, dragged by the slowing demand for luxury items as rising inflation pressurized consumers to cut back on spending.

Clouded by the fears of further softening in demand for its offerings, the company lowered its outlook for the rest of the year, just four weeks after reporting better-than-expected first quarter fiscal 2022 results, and adding $2 billion to its existing share buyback program.

Commenting on the situation, Gary Friedman, Chairman and CEO of RH said, “With mortgage rates double last year’s levels, luxury home sales down 18% in the first quarter, and the Federal Reserve’s forecast for another 175 basis point increase to the Fed Funds Rate by year end, our expectation is that demand will continue to slow throughout the year.”

Revised Outlook

RH reiterated its previously reported Q2 guidance, as the company expects the backlog to offset the lower demand. And hence, as forecasted earlier, net revenue is expected to decline between 3% to 1%. This is in comparison to the same period last year, while the adjusted operating margin is projected between 23% to 23.5%.

Nonetheless, based on the current macroeconomic scenario, the company lowered its full year Fiscal 2022 guidance. FY22 net revenue is now expected to decline by 5% to 2% with the adjusted operating margin between 21% to 22%. While in its Q1 earnings call, RH had projected FY22 net revenue to grow between 0% to 2% with the adjusted operating margin between 23.0% to 23.5%.

The company had posted extraordinary gains during the pandemic, as people spent more on the comfort of their homes fueled by stay-at-home mandates. However, the upcoming quarters are expected to pose a “short-term challenge,” while the company is trying to improve quality and “shed less valuable market share.”

“While we navigate through the multiple macro headwinds, we continue to believe our long-term investments will enable us to drive industry-leading performance over a longer-term horizon,” Friedman concluded.

Analysts’ View

Responding to RH’s revised outlook, Wells Fargo analyst Zachary Fadem drastically slashed the price target on the stock to $300 (26.4% upside potential) from $400, while still maintaining a Buy rating.

Viewing the diminishing footfall in the company’s outlets, and the overall decline in the home furnishing category coupled with rising interest rates and falling consumer financial flexibility, the five-star analyst expects luxury home sales to continue experiencing pressure over the coming months/quarters.

“Needless to say, today’s update is disappointing, but not entirely surprising (and frankly could be worse) considering a host of rising macro concerns (rates, inflation, etc.). Adding it all up, we expect shares to trade lower tomorrow, but we believe balance sheet optionality, looming share repurchases, and attractive LT dynamics ultimately limit downside risk,” Fadem noted.

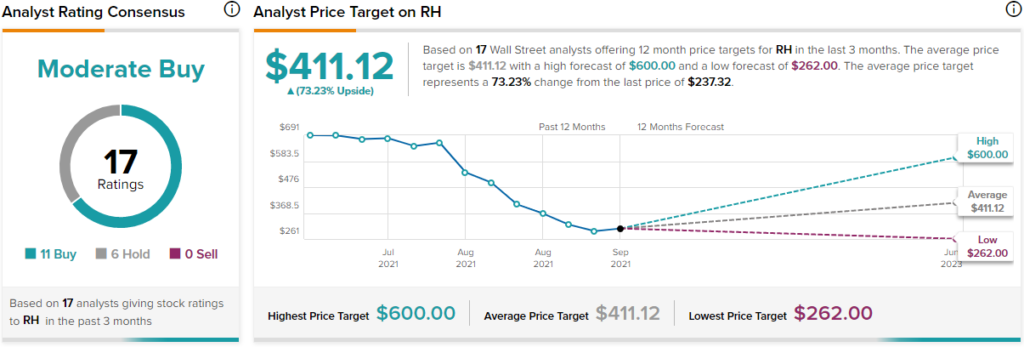

Notably, the Street is cautiously optimistic about RH stock, with a Moderate Buy consensus rating based on 11 Buys and six Holds. The average RH price target of $411.12 implies 73.2% upside potential to current levels.

Ending Thoughts

Although RH has lowered the forecast for the second half of 2022, it displays the company’s commitment to showing a clear picture to its stakeholders. As per TipRanks tools, retail investors have a neutral stance on RH stock and hedge funds have increased their holdings by 201,900 shares and are highly optimistic about the stock’s trajectory.