Sometimes, the macro picture doesn’t tell the full story. When it comes to furnishing stocks, the very high-end names like RH (RH) don’t seem to be doing nearly as well as the slightly upscale Williams-Sonoma (WSM). The latter retailer has clearly been making major strides towards the higher-end market in recent quarters. Though it’s still not close to capturing the incredibly affluent home and furnishing market (that’s RH’s turf), it doesn’t need to in order to keep propelling its share price higher.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Indeed, Williams-Sonoma shows us all that you can “share-take” your way to solid results, even as macro headwinds weigh heavily on the industry. In the past year, WSM stock has surged more than 103%, while RH stock sank around 35%. That’s a stark difference in performance that may have investors in the former name jumping ship to the latter.

With recession risks moving back on investors’ radars following the last two jobs reports (the first sparked a sell-off, while the second induced a rebound), the battle for consumers’ dollars could get more intense. Thus, let’s check in with TipRanks’ Comparison Tool to gauge the two top furnishing plays and see where analysts stand.

RH (RH)

It’s been tough sledding in the luxury furnishing market in recent years, with RH down 10% in the past two years. Currently, RH stock is down around 67% from its 2021 all-time high as it looks to navigate an environment that management recently referred to as “the most challenging housing market in three decades.” In any case, RH has a plan to orchestrate a comeback amid headwinds, and with CEO Gary Friedman recently buying shares on weakness, I’m also inclined to be bullish on the stock.

Undoubtedly, the weak state of the housing market bears part of the blame for RH’s sales woes. But it doesn’t explain why Williams-Sonoma is fresh off one of its best past-year rallies to date. Perhaps being at the priciest end of an already pricy big-ticket discretionary goods category is not the place right now, not while consumers are still in value-maximization mode after the last few years of inflation on virtually everything.

The company has now missed on earnings for three straight quarters. The perfect storm of housing headwinds and its aggressive investments to expand are a reason why. Such long-term bets on growth could make near-term results look that much worse. However, with the next economic expansion, such short-term pain could be worth the longer-term gain.

In a way, RH’s cyclicality takes things to another level. While the RH brand screams luxury and incredibly high quality, consumers had better be incredibly confident about their economic circumstances to pull the trigger on a trendy, new RH Cloud sectional set, which can easily rack up a six-figure bill.

There’s no easy way around an unwell economy when you’re a high-end discretionary retailer. Although it’s tough to time when a cyclical upswing in demand will lift RH stock again, long-term investors have plenty of reasons to stick around as shares tread water.

Wells Fargo (WFC) analyst Zachary Fadem views RH as still in the “early innings” of a “long-term growth story” that’s “among the most intriguing in our hardlines coverage universe.” I couldn’t agree more. It’s also impressive how much brand power the firm has despite it being a $4.7 billion mid-cap stock.

If you’re looking to capitalize on a real return in consumer spending and perhaps the resumption of the roaring 20s, RH stock looks like a good option. However, at 28.7 times forward price-to-earnings (P/E), shares of the premium furnishing retailer go for a hefty premium to WSM.

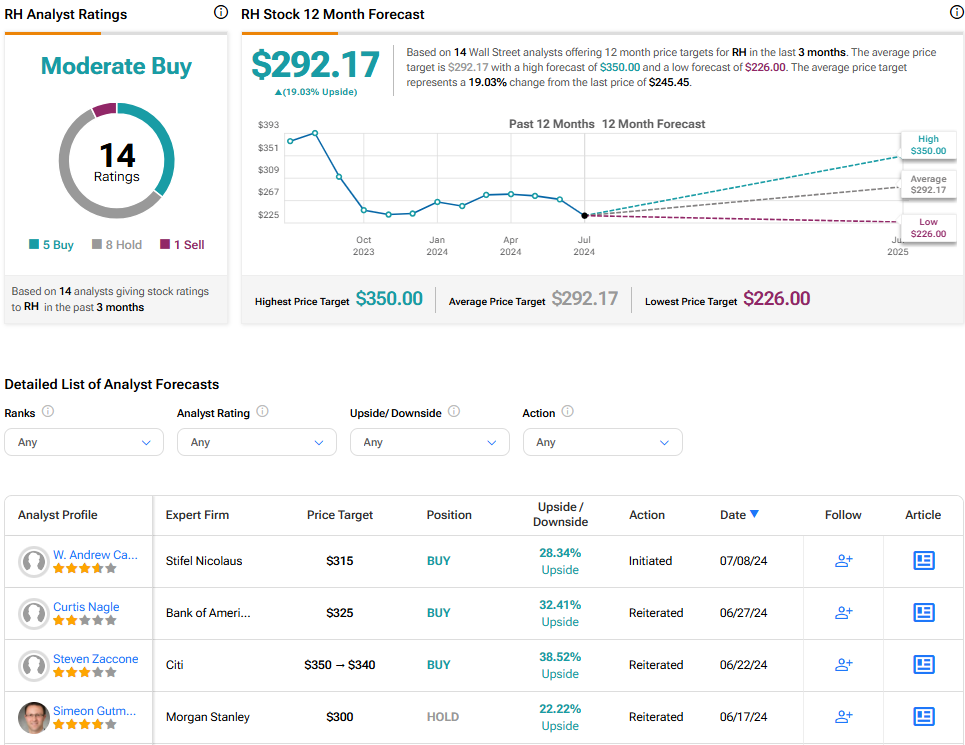

What Is the Price Target of RH Stock?

RH stock is a Moderate Buy, according to analysts, with five Buys, eight Holds, and one Sell assigned in the past three months. The average RH stock price target of $292.17 implies 19% upside potential.

Williams-Sonoma (WSM)

Williams-Sonoma, the firm behind such brands such as West Elm and Pottery Barn, has navigated this tough housing market like a true champ. CEO Laura Alber recently highlighted “easy updates” (home improvements that do not entail moving or big renovations) as part of the company’s secret sauce to faring well in today’s mixed consumer climate. With the stock more than doubling in the past year, the results really speak for themselves. All things considered, I’m staying bullish on the stock despite the potentially concerning “quadruple top” technical pattern that may be in the works.

The company has really capitalized on a value-conscious consumer who’s still willing to pay a bit more for quality. Still, Pottery Barn furniture, while not as pricy as some of RH’s newer offerings, does not come cheap. And unless one’s couch is sagging or falling apart, there’s really no reason to make such a big-ticket purchase in this environment. With the sluggish housing market weighed down by higher interest rates, there just aren’t as many people looking to “fill” their new, larger homes with home goods and furnishings.

With a diverse range of kitchen goods, home décor products, kid’s stuff, and classy seasonal items, Williams Sonoma stands out as more than just a furniture retailer, especially compared to RH. And as “easy updates” remain the hot sellers in this brutal housing climate, Williams-Sonoma will continue to have the upper hand over its top rival.

Further, when the tides do turn and low rates pave the way for a housing recovery, Williams-Sonoma also stands to do well as more people shift from “easy updates” to big-ticket furnishing purchases. At a mere 17.9 times forward P/E, WSM is a far cheaper stock than RH.

What Is the Price Target of WSM Stock?

WSM stock is a Hold, according to analysts, with four Buys, 11 Holds, and one Sell assigned in the past three months. The average WSM stock price target of $152.04 implies 9.5% upside potential.

The Bottom Line

Williams-Sonoma is better equipped to weather the rocky housing environment with its diverse line of “easy update” products, which don’t require breaking the bank to spruce up one’s existing place. Though RH has the better brand, its stock (and the goods it sells) is much pricier.

So, unless you’re looking to play an abrupt upward turn in housing, the consumer, and the economy, WSM looks like the far better bet. It’s been the better performer, its stock is still cheaper, and it may have less ground to lose if a recession does strike next year.