Home furnishings retailer RH, Inc. (RH) recently delivered better-than-expected numbers for the third quarter. The company provides furnishing collections via retail galleries, books, and online shopping at RH.com, RHModern.com, RHBabyandChild.com, RHTEEN.com, and Waterworks.com.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

During the quarter, RH’s revenue increased 19.2% year-over-year to $1.01 billion, outperforming estimates by $24.6 million. Earnings per share at $7.03 exceeded analysts’ estimates by $0.44.

With these developments in mind, let us take a look at the changes in RH’s key risk factors that investors should know.

Risk Factors

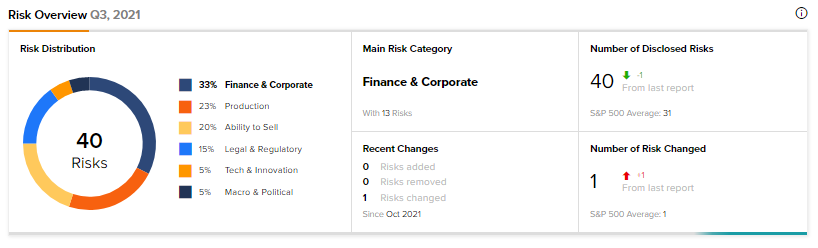

According to the TipRanks Risk Factors tool, RH’s top two risk categories are Finance & Corporate and Production, contributing 33% and 23% to the total 40 risks identified, respectively. Compared to a sector average of 17%, RH’s Production risk factor is at 22%.

In its recent quarterly report, the company has changed one key risk factor under the Finance & Corporate risk category.

RH highlighted that it has historically relied on debt financing to fund its operations. The company has also made use of debt to finance strategic initiatives such as stock buybacks and may continue to do so in the future. (See Insiders’ Hot Stocks on TipRanks)

Although RH estimates that it should be able to repay debt maturities as they become due, there is no guarantee that it will be able to do so. The company may have to take on additional debt or refinance existing debt to make debt repayments.

If RH is unable to arrange financing to meet debt obligations or is unable to extend the maturities of existing debt, then it may see a negative impact on its business and operations.

Wall Street’s Take

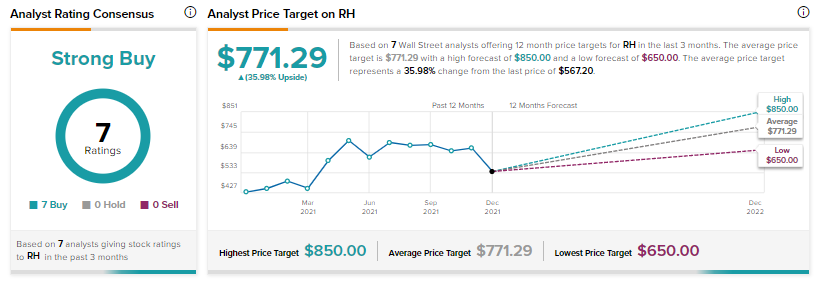

On December 9, Citigroup analyst Steven Zaccone reiterated a Buy rating on the stock but decreased the price target to $766 from $790 (35% upside potential).

The analyst highlighted that in spite of supply chain constraints, RH delivered robust Q3 numbers on the back of higher sales and better-than-expected gross margin.

Consensus on the Street is a Strong Buy based on 7 unanimous Buys. The average RH price target of $771.29 implies a potential upside of 35.98%. That’s after a near 33% gain in RH’s share price over the past year.

Related News:

Laurentian Bank Posts Loss in Q4, Dividend Raised

Ford Chairman Acquires 2M Shares of the Automaker — Report

FARFETCH Snaps Up LUXCLUSIF for Undisclosed Amount