The quantum computing sector has taken a back seat in early 2026, overshadowed by the artificial intelligence (AI) hype. Nonetheless, the sector remains full of developments and investors are betting on the technology as the next big thing. Pure plays like Rigetti Computing (RGTI), D-Wave Quantum (QBTS), and IonQ (IONQ) lead, joined by tech giants such as Alphabet (GOOGL), Microsoft (MSFT), and IBM (IBM).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

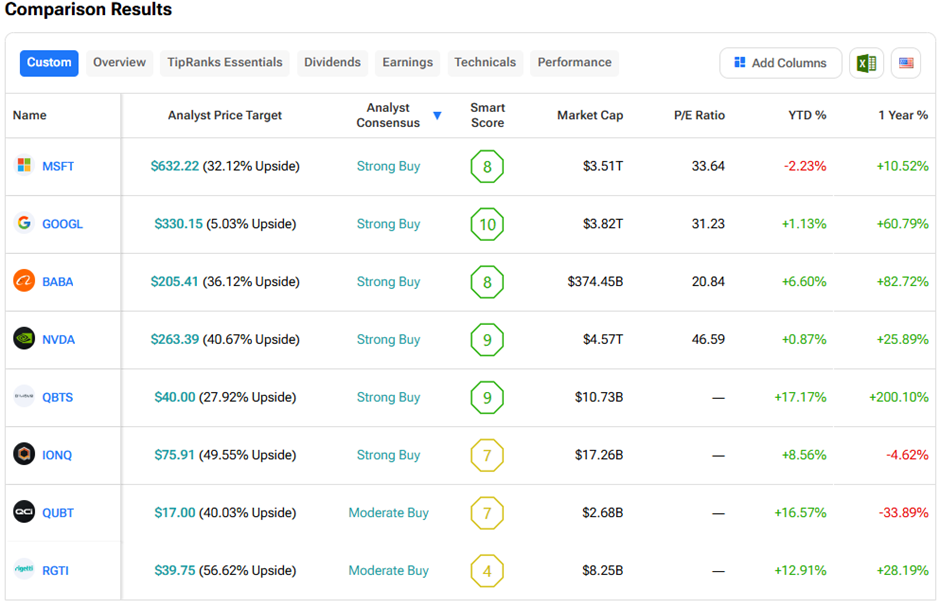

The TipRanks Stock Comparison Tool for Quantum Computing Stocks compares companies based on different parameters. Wall Street rates both Rigetti Computing and Quantum Computing Inc. (QUBT) as Moderate Buy overall, but with notable risks.

Rigetti Stock: Hype Outpaces Fundamentals

Rigetti shares have gained nearly 85% over the past six months, more from market hype than solid fundamentals. Analysts flag unclear tech roadmap, inconsistent growth, heavy reliance on government contracts, and limited operating leverage. RGTI also lags rivals in system fidelity and missed the U.S. DARPA Quantum Benchmarking Initiative’s Stage B milestone.

On the contrary, Rigetti stands to gain from early quantum computing growth, strong scalability in its chiplet design, solid technical advances, debt-free balance sheet, and $600 million liquidity to support QCaaS expansion and pilot conversions.

Analysts have awarded RGTI a Moderate Buy consensus rating based on seven Buys and three Hold ratings. The average Rigetti Computing price target of $39.75 implies 56.6% upside potential from current levels.

QUBT Stock: Persistent Losses and Execution Risks

Quantum Computing is a relatively early-stage firm, facing persistent losses, minimal revenues, and high execution risks. The company focuses resources on building advanced manufacturing facilities (fabs) for the future, rather than chasing quick sales now, which has delayed commercialization. Moreover, it competes with larger, well-established firms that use a similar photonics-based approach.

On the brighter side, QUBT showcased live demos of its technology at CES 2026, which have already sparked a roughly 8% stock jump, with the event highlighting photonics-based products in networking and sensing. Additionally, its proposed $110 million acquisition of Luminar Semiconductor aims to boost manufacturing capabilities, supporting long-term scalability and drawing investor interest.

QUBT stock has a Moderate Buy consensus rating with two Buys and two Hold ratings each on TipRanks. The average Quantum Computing price target of $17 implies 40% upside potential from current levels.