Few of Wall Street’s hedge fund billionaires can match the accomplishments of Israel Englander. Back in 1989, he used $35 million in seed money to found Millennium Management; today, his firm has more than $77 billion in assets under management, and Englander himself has a personal fortune of nearly $19 billion.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With that kind of track record, his moves are always worth watching – and his latest buys indicate he’s zeroing in on what many see as the next stage of the tech boom, namely quantum computing.

According to Fortune Business Insights, the quantum computing market had a total global value of $1.16 billion last year – and it’s estimated to reach $1.53 billion by the end of this year. Looking further ahead, quantum computing is expected to bring in $12.62 billion by 2032, a 7-year forecast period with a 34.8% CAGR.

There’s plenty of room for investors to find gains in a market like that. Englander’s choices, Rigetti Computing (NASDAQ:RGTI) and IonQ (NASDAQ:IONQ), represent two of the quantum field’s cutting-edge companies, and he recently loaded up on shares of both.

According to the TipRanks database, both stocks carry ‘Buy’ ratings from the Street – and analysts see meaningful upside ahead. With Englander placing his bets and Wall Street lining up behind these names, it’s a good moment to dig into what makes each company stand out.

Rigetti Computing

The first Englander pick we’ll look at is Rigetti Computing, one of the leaders in the quantum computing field. Rigetti was founded in 2013 and is well-known as a designer and builder of superconducting quantum integrated circuits and processor chips, as well as the dilution cooling systems needed for quantum circuits to function properly.

The basic unit of measurement in quantum computing is the qubit, a superposition-capable analogue to the classical binary bits we are already familiar with. Rigetti’s flagship product is the Ankaa-3 quantum computer system, which is capable of handling 84 qubits of total processing power with 99.91% fidelity in its single-qubit gates. The company has already released a more advanced system, the Cepheus-1-36Q. Cepheus was made available in August of this year, and while it is a 36-qubit system, it is based on a modular design and optimized for a higher two-qubit gate fidelity and boasts a lower two-qubit gate error rate.

Those are the big systems. Rigetti has also developed the Novera quantum computer, a 9-qubit system based on the company’s Ankaa-class architecture, as a smaller system designed to bring high-end quantum computing technology within reach of new customers. The company announced at the end of September that it had secured two purchase orders for Novera, one with an Asian tech manufacturer and the other with a California-based AI startup. The two purchase orders together are worth $5.7 million, and delivery is expected during 1H26.

More recently, at the end of October, Rigetti announced that it is collaborating with Nvidia on the superconductor chip maker’s NVQLink, an open platform built to integrate AI systems with quantum computers. Rigetti has designed its quantum computers with hybrid classical-quantum system compatibility in mind.

Now, the stock price has been on a roller coaster. After topping $56 in October, RGTI has pulled back sharply, falling 58% from those highs, as the entire quantum-computing space has cooled off. A softer-than-expected revenue print in the latest quarter, combined with growing skepticism about lofty sector valuations and the long commercialization timeline for quantum hardware, triggered a broad reset across the group.

Yet, Israel Englander is clearly thinking long term. During the third quarter, the billionaire initiated a brand-new position in RGTI, scooping up 522,112 shares. At today’s prices, his stake is valued at $12.5 million.

Benchmark analyst David Williams also sees far more potential than turbulence in Rigetti’s story. In his view, the company offers compelling reasons for investors to take notice.

“While we remain constructive on RGTI’s progress, particularly its chiplet-based architecture and continued roadmap execution, the recent volatility across emerging tech and AI sectors has tempered near-term investor enthusiasm for quantum-related shares. The long-term investment case remains intact, supported by ongoing technical milestones, expanding strategic partnerships, and sustained public and private funding. However, after a period of significant appreciation through mid-October, shares have entered a consolidation phase. Although we think the recent pullback is healthy, volatility looks to be subsiding, and we encourage investors to be opportunistic buyers on further weakness as the next catalysts develop,” Williams opined.

These comments support the 5-star analyst’s Buy rating on the shares, while his $40 price target points toward a one-year upside potential of 67%. (To watch Williams’ track record, click here)

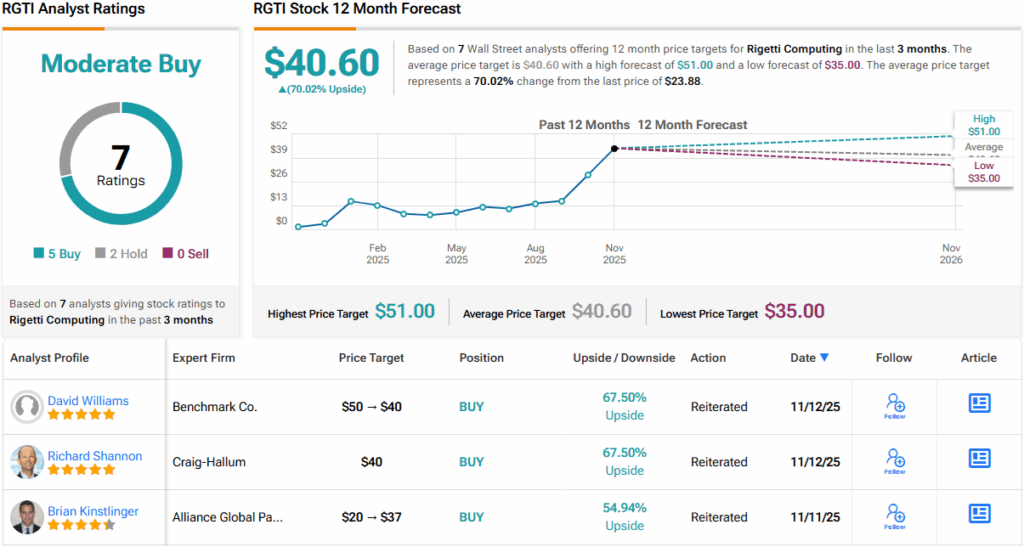

Benchmark’s outlook lines up with the broader Wall Street view. Rigetti carries a Moderate Buy consensus based on 7 recent reviews – 5 Buys and 2 Holds – and with shares trading at $23.88, the Street’s $40.60 average target suggests there’s 70% upside on the table over the next 12 months. (See RGTI stock forecast)

IonQ

The second quantum computing name on Israel Englander’s radar is IonQ, a company taking a different path from its superconducting-based peers. Instead of chilled circuits, IonQ builds its machines around trapped-ion technology, using electrically charged atoms whose naturally stable states make them excellent carriers of qubit information. These ions sit suspended in meticulously controlled electromagnetic fields and are steered with laser pulses, allowing the system to tap directly into their inherent quantum behavior. IonQ’s hardware is based on ytterbium, a rare-earth element prized in this context for its exceptionally clean, high-fidelity quantum transitions.

That approach has already yielded a commercial lineup. IonQ’s Forte and Forte Enterprise systems both deliver 36 algorithmic qubits, with the Enterprise model engineered specifically for data-center integration. It slots into standard server racks and conforms to existing installation requirements – a practical step that puts quantum acceleration directly into environments where computing demands never stop climbing.

The company has also begun to roll out its next leap forward. Tempo, IonQ’s newest machine, arrives with a 64-algorithmic-qubit rating and, according to the company, far outpaces other publicly accessible quantum systems in raw computational capability.

November brought a flurry of updates that highlight just how quickly IonQ is broadening the reach of its technology. Early in the month, the company secured a spot in Stage B of DARPA’s Quantum Benchmarking Initiative – a meaningful advancement that positions IonQ among the firms helping define what “utility-scale” performance should look like in quantum computing.

Just weeks later, on November 17, IonQ announced an agreement to acquire Skyloom Global, a high-performance optical-communications specialist. It’s a move that underscores IonQ’s push into quantum-enhanced secure communications.

And to round out the month, IonQ unveiled a new strategic partnership with drone maker Heven AeroTech on November 24. Heven, known for its ties to the U.S. defense ecosystem, plans to integrate IonQ’s quantum capabilities into its hydrogen-powered aerial drones.

IonQ’s last earnings report, for 3Q25, was impressive. The company reported a top line of $39.9 million, a figure that came in above the high end of guidance, while beating expectations by almost $13 million, and grew 221% year-over-year. On earnings, IonQ’s EPS loss, of 17 cents per share by non-GAAP measures, was 2 cents per share better than the forecast. We should note that the stock is down 40% from mid-October, a share price loss that reflects, in part, dilution of the stock after a $2 billion equity raise held in October.

It’s this mix of technological differentiation and rapid execution that appears to have caught Englander’s eye. He has been holding IonQ since 3Q24, and in 3Q25, he purchased an additional 204,028 shares. That move represented a 97% increase in his position and brought his total stake to $19.5 million.

For Rosenblatt analyst John McPeake, a key point here is IonQ’s strong revenue in its last reported period, and its potential to continue expanding.

“We view this as a pivotal quarter as 3Q revenue came in 48% above our and Street estimates and grew 222% Y/Y. Street estimates for revenue growth over the period from 2025 to 2030 show almost 8,000bp of deceleration–the Q&A on the call suggested the reverse. We think investors should own IONQ during this period of acceleration, and looking further out to a more mature business model in 2035,” McPeake noted.

To this end, McPeake rates IONQ shares as a Buy and backs that view with a $100 price target, suggesting a one-year upside potential of 113%. (To watch McPeake’s track record, click here)

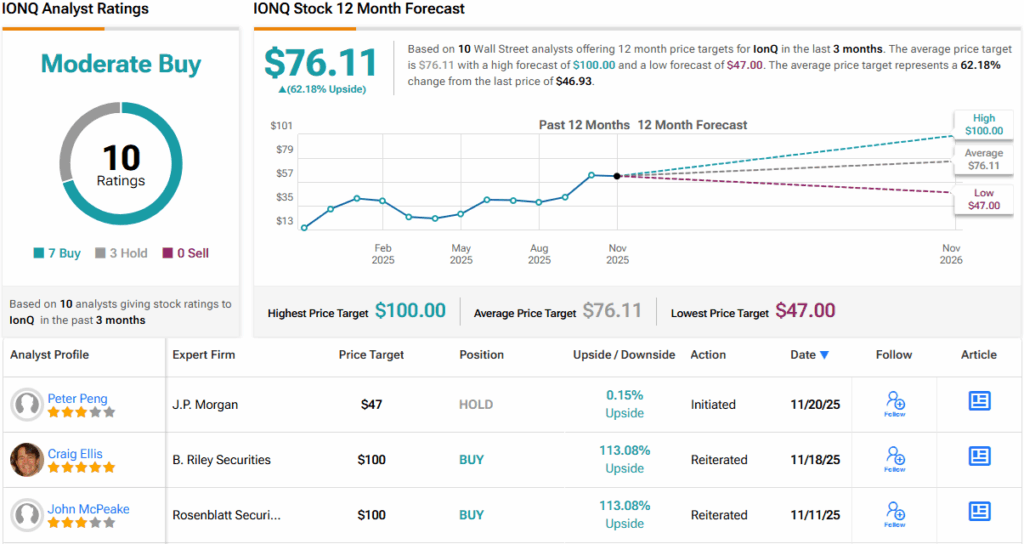

The overall rating here is a Moderate Buy, based on 10 reviews from the Street’s analysts that break down 7 to 3 in favor of Buys over Holds. The shares currently trade at $46.93, and the average target price of $76.11 implies a one-year gain of 62%. (See IONQ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.