While large-cap stocks often steal the show, small-cap companies can offer compelling growth prospects for investors. The Russell 2000 Index (IWM) features several promising firms that have caught analysts’ attention. Among them, quantum computing specialist Rigetti Computing (RGTI) and digital banking platform Dave (DAVE) stand out for their bullish analyst ratings and growth potential. Both stocks hold a Strong Buy rating from analysts.

In context, the Russell 2000 Index is a stock market index that tracks 2,000 small-cap U.S. companies, serving as a key benchmark for the performance of smaller firms.

Now, let’s explore these two Russell 2000 stocks that analysts see as prime candidates for substantial growth.

What Is the Projection for RGTI?

Rigetti Computing focuses on developing hybrid quantum-classical systems to solve complex computational challenges across industries like finance, pharmaceuticals, and AI. Year-to-date, RGTI stock has declined by 46%.

While profitability remains distant for the company, RGTI stock is expected to react positively to upcoming product development and commercialization updates. Overall, analysts back this stock due to its advancements in quantum technology space, predicting more upside potential than downside risk for now.

On TipRanks, analysts have a Strong Buy consensus rating on RGTI stock based on six Buys assigned in the last three months. The average Rigetti Computing share price target of $14.80 implies an 80.7% upside potential.

Is Dave a Good Stock to Buy?

Dave is a fintech company that offers digital banking services, including cash advances, budgeting tools, and no-overdraft-fee banking, aimed at helping consumers manage their finances more effectively. DAVE stock has surged 116% over the past six months, driven by its innovative financial solutions and strategic partnerships.

Moving ahead, analysts see strong growth potential in Dave due to its expanding user base and revenue streams as digital banking adoption rises.

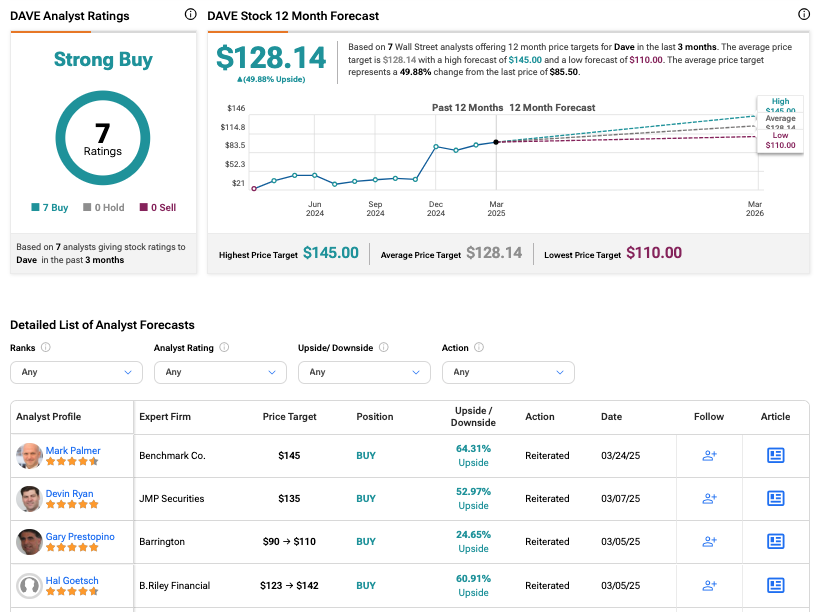

Turning to Wall Street, analysts have a Strong Buy consensus rating on DAVE stock based on seven Buys assigned in the last three months. The average Dave share price target of $128.14 implies a 49.8% upside potential.

Conclusion

Analysts see strong growth potential in these two Russell 2000 stocks, backed by strategic partnerships and sector momentum. Despite market uncertainties, their resilience and long-term prospects make them attractive to growth-oriented investors.