Resonant (NASDAQ: RESN) shares gained almost 260% during the extended trading session on February 14, after Murata Electronics North America, Inc., a wholly-owned subsidiary of Murata Manufacturing Co., Ltd., agreed to acquire RESN for $4.50 per share in cash.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Resonant creates filter designs for radio frequency (RF) front ends for the mobile device industry. It is well-known for its proprietary XBAR technology, which is expected to achieve higher frequency and superior performance compared to other filter technologies.

Benefits of the Deal

Murata is a leading global provider of RF system solutions modules and filters. Resonant and Murata have been long-time partners closely working on the development of proprietary circuit designs using Resonant’s XBAR technology. Further, Resonant has licensed Murata rights for products on multiple specific radio frequencies.

The addition of Resonant’s leading-edge XBAR filter technologies to Murata’s existing portfolio will lead to expanded offerings of best-in-class products available to the RF front-end market. Together, Murata and Resonant will deliver a robust portfolio of intellectual property rights, covering the entire XBAR technology space.

Upon completion, Resonant will become a wholly-owned subsidiary of Murata and continue to deliver innovative solutions.

The acquisition is expected to close by the end of March 2022, subject to certain regulatory approvals.

Management Weighs In

Murata President, Norio Nakajima, commented, “This acquisition will combine Murata’s world-leading mobile RF product capabilities with Resonant’s best-in-class XBAR filter solutions and world-class team of talented engineers”.

He further added, “We are confident Resonant’s innovation is a key strategic differentiator for the mobile industry. This transaction will deepen our existing partnership and position us to better meet our customers’ needs and expand opportunities for Murata.”

Wall Street’s Take

Following the acquisition news, Stifel Nicolaus analyst Tore Svanberg downgraded Resonant to Hold from Buy.

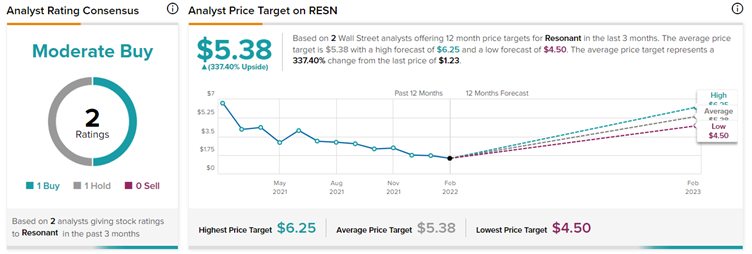

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 1 Buy and 1 Hold. At the time of writing, the average Resonant price target was $5.38, which implies 337.4% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Neurocrine Biosciences Up 7.5% Despite Q4 Miss

Mr. Cooper Group Gains 19% on Q4 Earnings Beat & New Partnership

Green Plains Tanks 9% on Wider-Than-Expected Q4 Loss