File this under “things that should have been a thing three years ago;” but exercise equipment maker Peloton (PTON) is rolling out a marketplace for used hardware. The tool is known as “Repowered” right now, and will help people sell off the Peloton hardware they no longer want or need since gyms have finally been reopened all over the United States for the last few years now. Still, the news was better late than never for shareholders, who sent shares up fractionally in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Basically, Repowered looks to do what a lot of people have wanted for some time: provide an easy way to sell off that old Peloton gear. Repowered opens up the opportunity to sell, and also offers up a “generative AI tool” that helps users set prices on the hardware in question. Naturally, sellers will have the ultimate say over what their products are priced at—Repowered will apparently not refuse any outrageous offer—but the tool will make suggestions according to several factors, form condition to age.

Peloton will take 30% of the sale price for itself, splitting it with Archive, who is providing the platform to run Repowered on in the first place. The remaining 70% goes to the seller. For those wondering why they simply do not just sell on eBay (EBAY), Peloton is sweetening the pot by offering a discount for new equipment. Plus, buyers will get a hefty discount on activation fees, which means more motivated buyers.

Cutting Costs

One fact that Peloton likely realized far too late way back when was that keeping costs down is not a bad idea. That was likely a lesson they would have rather learned before they ramped up their production just ahead of all the gyms re-opening post-COVID. But learn they did regardless, and the CEO is looking to pare back costs and keep Peloton on track.

With sales on the decline for the third year running, reports note, Peloton is paring back on costs to match its own customers’ paring back on purchases. Peloton has also seen a decline in subscriptions on its streaming workout programs, which makes cost-cutting less of a smart idea and more of an outright necessity. In fact, Peloton is out to cut $200 million out of its budget before the end of this fiscal year, going after “run-rate cost savings.” More specifics, however, were not available.

What is the Prediction for Peloton Stock?

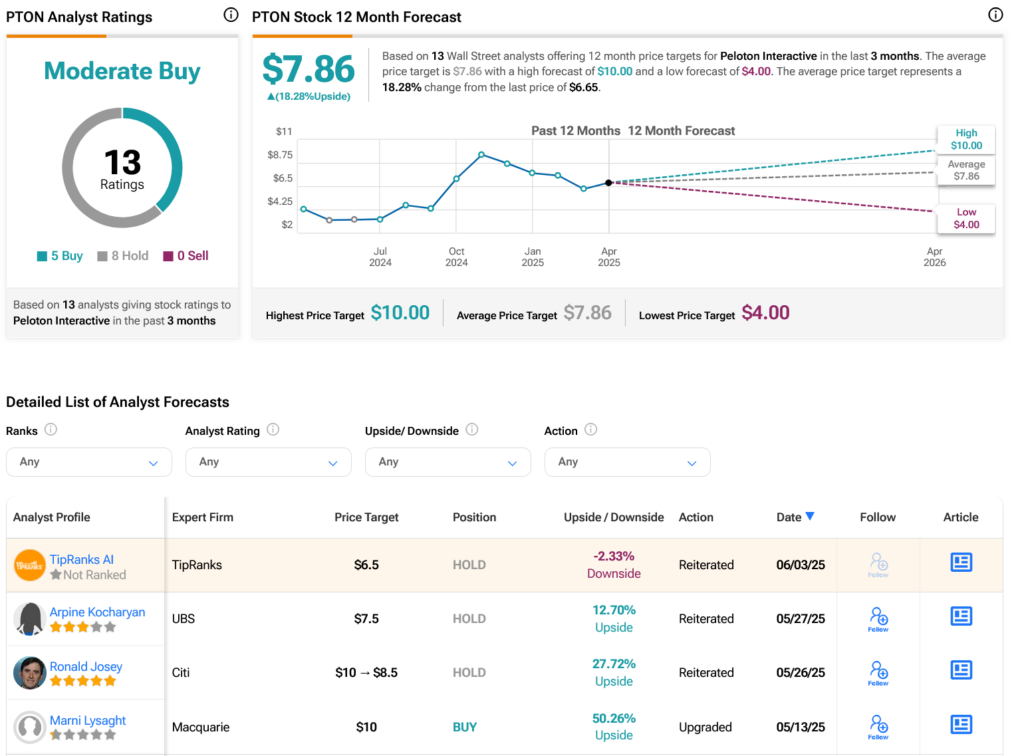

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PTON stock based on five Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 83.32% rally in its share price over the past year, the average PTON price target of $7.86 per share implies 18.28% upside potential.