The vapor trails of the AI rocket ship are still crisscrossing the skies as the sun sets on 2024. Tech companies who were able to capitalize on the revolutionary technology saw their valuations climb sharply upward, while the tech-heavy Nasdaq-100 grew by close to 30%.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

However, the story was quite different for Advanced Micro Devices (NASDAQ:AMD). Indeed, the AI chipmaker saw its share prices falter as it played second fiddle to the industry-dominating Nvidia. All told, the company is down close to 15% for the year.

Still, the company has some tailwinds driving it forward. AMD delivered revenues of $6.8 billion in its latest print—representing 18% year-over-year growth—along with a gross margin of 50%. These healthy numbers were helped along by data center revenues that grew by a whopping 122% year-over-year.

Could AMD be on the cusp of a break-out in 2025? Not according to one top investor known by the pseudonym Cavenagh Research, who does not believe that AMD’s fortunes will be on the rebound in the year to come.

“I see the company struggling against Nvidia’s dominance, as well as the growing adoption of custom chips by major cloud providers,” predicts the 5-star investor, who sits in the top 4% of TipRanks’ stock pros.

The investor explains that both Google and Amazon prefer either Nvidia’s products or their own internally developed ones. Looking forward, Cavenagh highlights the widening gap between the two AI chipmakers, with Nvidia expected to enjoy annual revenues of $260 billion in 2027 versus $48 billion for AMD.

AMD’s potential marketshare is squeezed even further by its reliance on general-purpose designs, notes the investor. “With custom solutions commanding 10–15% of the market and Nvidia taking 80%, AMD is left competing for a relatively small segment,” Cavenagh writes.

Moreover, Cavenagh expects AMD to struggle beyond the realm of AI datacenters. While PC sales are projected to increase by 11 million units in 2025, the investor notes that over three-quarters of this growth is expected to be from commercial demand—where AMD runs far behind Intel.

“Heading into 2025, investors should remain skeptical about AMD’s growth narrative because the company faces obvious challenges across its AI and PC segments,” concludes Cavenagh, who is reiterating a Sell rating. (To watch Cavenagh Research’s track record, click here)

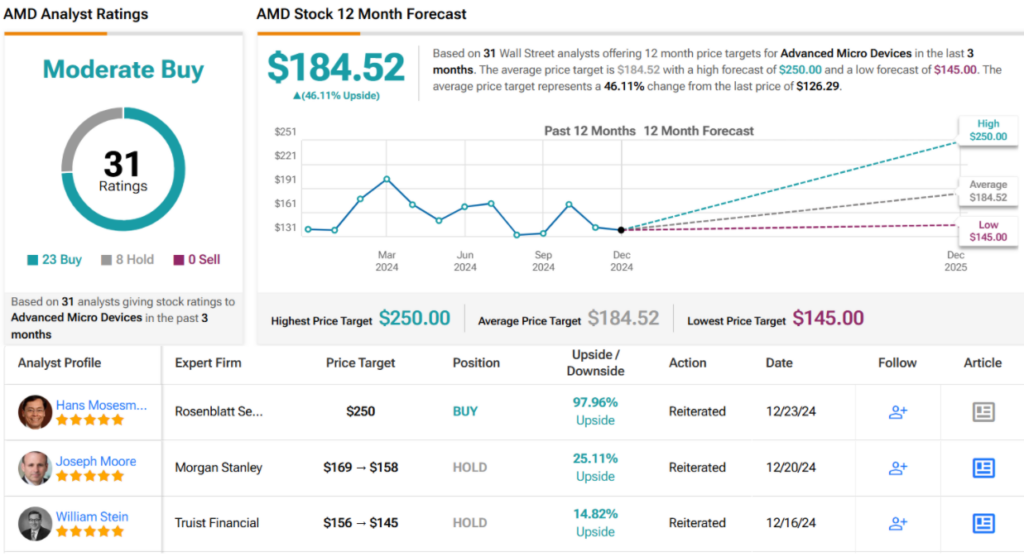

On the other hand, Wall Street remains fairly bullish regarding AMD’s prospects. With 23 Buy and 8 Hold ratings, AMD enjoys a consensus Moderate Buy rating. Its 12-month average price target of $184.52 would represent gains of some 46% in the year to come. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.