Few major enterprises are as hot as mobile technology specialist AppLovin (APP) right now. Last week, APP stock gained over 28% of equity value, a remarkable performance. Since the beginning of the year, the share price almost tripled. Still, such an impressive rally comes with risks for prospective investors — the understandable fear of holding the bag.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Nevertheless, when looking at the fundamentals, AppLovin appears to stand on solid ground. Last month, management disclosed solid results for the second quarter along with strong current-quarter sales guidance. Last week, three analysts issued Buy ratings on the security. Therefore, I am moderately bullish on APP stock. However, there’s a smart way to speculate on APP, which I’ll discuss below.

Evaluating the Pros and Cons of APP Stock

Primarily, the main upside catalyst for APP stock centers on the underlying Q2 earnings report. As someone moderately optimistic about APP’s prospects, I find the results promising. Based in Palo Alto, the tech specialist posted earnings per share of 89 cents on revenue of $1.08 billion. This bottom-line figure surpassed the Street’s consensus estimate of 74 cents, while the top line met analysts’ expectations. Furthermore, for Q3, management has guided projected sales to $1.125 billion, which is above the consensus forecast of $1.1 billion.

Another positive is that market experts are thrilled with AppLovin’s prospects. Most recently, BTIG’s Clark Lampen issued a Buy rating for APP stock. In particular, Lampen believes the tech company offers potential to scale up its business. Further, its data analytics capabilities could distinguish AppLovin and expand its market position. Two other analysts from Bank of America Securities and Jefferies also issued Buy ratings last week.

Of course, no investment idea is perfect, and all this enthusiasm for APP stock comes at a cost: it’s quite pricey. For example, the market prices shares at nearly 10x trailing-year sales. Still, when considering analysts’ realistic sales target of $4.43 billion for the year, the forward sales multiple slips to 7.55x. That’s not ideal, but it’s not terrible either, thus warranting a balanced approach to AppLovin.

Spinning the Wheel of Options on AppLovin

If we were to frame our approach to APP stock as a wheel of options — with three scales of bullishness and bearishness divided by a median category — I’d be hard-pressed to pick anything other than moderate bullishness. By process of elimination, in my opinion, there’s nothing out there that suggests AppLovin is fundamentally flawed. So, all three scales of pessimism can reasonably be eliminated.

Similarly, the business appears too strong for a neutral trading setup like an iron condor so that’s out. Further, going with a mildly bullish approach seems too conservative. On the other hand, I’m not entirely sold on the purely bullish methodology of buying a straight Call option. After all, APP stock is pricey — there’s no denying that.

That leaves the moderately bullish approach as arguably the most prudent. Subsequently, our framework points us to the Bull Call spread.

Setting Up a Bull Call Spread on APP Stock

Known as a vertical options strategy, the Bull Call spread involves buying a Call option and then selling a Call option of the same expiration date but at a higher strike price. I find this strategy particularly appealing because, although you pay a net debit for this directional wager, there’s a significant advantage: by selling a Call and receiving a premium, your bought Call ends up being cheaper.

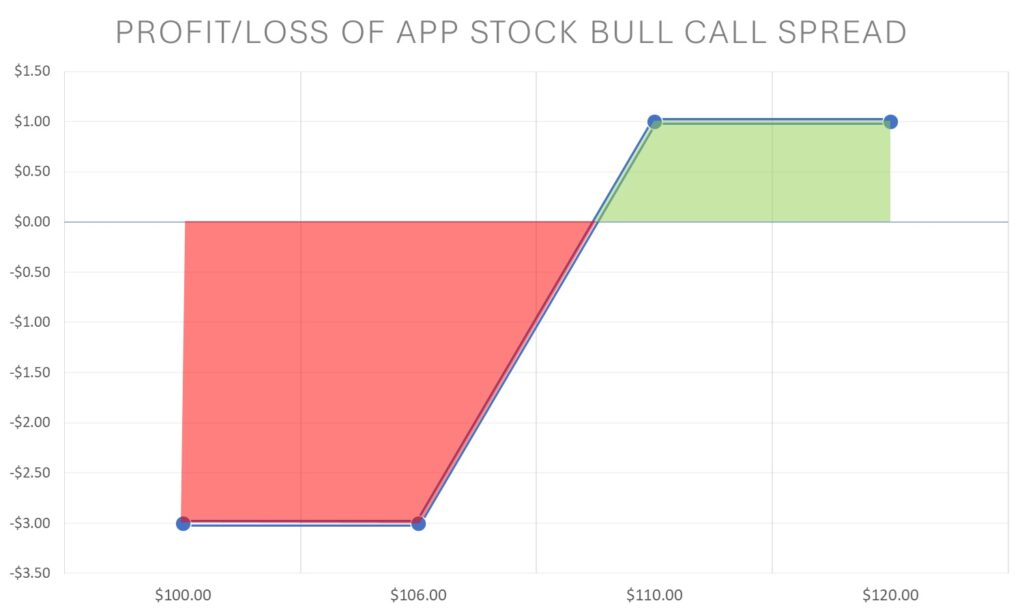

To be sure, multiple Bull Call spreads are available for your trading pleasure. However, if you happen to be conservative, you may consider the Calls expiring Sept. 27, 2024. Specifically, you may buy the $106 Call and sell the $110 Call. At time of writing, the ask and bid prices were $8.50 and $5.50, respectively.

Therefore, the maximum you can lose on this trade is the difference between the ask and bid prices per contract ($3 or $300 when multiplied by 100 shares). On the flipside, the maximum profit you may earn is $1 per contract (or $100). That comes out to the difference between the strike prices minus the price you paid to enter the Bull Call spread.

Dissecting the Call on APP Stock

Importantly, the breakeven price for the above trade comes out to $109. I find this setup intriguing because APP stock closed slightly higher than that on Friday, which increases the chances of success. If by the expiration date APP finishes above $109, you’ll at least gain something from this trade. Of course, it will be much better if APP moves beyond the $110 strike price, allowing you to secure the maximum profit.

At this point, a question may arise: why not just buy a straight Call? Obviously, if you truly believe the upside of APP stock has no immediate limit, a straight Call would be the best choice. A Bull Call spread limits your profit potential due to the sold Call. Here’s the thing — buying the $106 Call at time of writing would cost $8.50.

Instead, with a Bull Call spread, I can buy a directional Call that also has the margin to move sideways. With the spread, I’m only risking $3 per contract, a discount of almost 65%. It’s just a smarter way to play the optimist’s game.

Wall Street’s Take on AppLovin

Turning to Wall Street, APP stock has a Moderate Buy consensus rating based on nine Buys, two Holds, and one Sell rating. The average APP price target is $102.67, implying 11.68% downside potential.

The Takeaway: Stay Optimistic but Strategic with APP Stock

In conclusion, while no investment is without risks, I believe the bullish case for APP stock is compelling. The strong Q2 earnings report, with its earnings beat and encouraging guidance for Q3, demonstrates AppLovin’s ability to execute. Additionally, analysts’ optimism, reflected in multiple Buy ratings, reinforces my confidence in the company’s growth potential. Yes, the stock is pricey, but the forward sales multiple shows that valuation is not as extreme when considering future growth. Ultimately, while I acknowledge the need for caution, I remain optimistic that AppLovin has room to run, especially if it continues to outperform expectations.