What’s better than receiving passive income once a quarter from your dividend stocks? How about getting paid dividends once a month?

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

That’s exactly what Realty Income (O) offers investors. Not only does the San-Diego based commercial REIT pay out a regular monthly dividend, but it features an above-average forward dividend yield of 5.2%.

I’m bullish on Realty Income based on its monthly payment cadence, its long history of being a consistent dividend payer, and its attractive dividend yield.

What is Realty Income?

Founded in 1969 and headquartered in San Diego, California, Realty Income is a REIT (real estate income trust) that “engages in generating dependable monthly cash dividends from a consistent and predictable level of cash flow from operations.” I’m optimistic for shareholders of the firm.

REITs are publicly-traded real estate companies that distribute most of their income to investors. With a market cap of over $50 billion, Realty Income is the eighth-largest REIT in the world. The company boasts a portfolio of 15,450 commercial real estate properties across all fifty states and six different countries in Europe.

Realty Income touts itself as “The Monthly Dividend Company,” and its cadence of monthly dividends makes it stand out as most dividend stocks typically pay out on a quarterly basis.

Yielding Over 5%

Realty Income’s yield of 5.2% is incredibly attractive — it is nearly four times higher than the yield of the S&P 500 (SPX), which currently stands at just 1.3%. It’s also significantly higher than the risk-free 3.7% yield currently offered by 10-year treasury bonds. With a jumbo rate cut earlier this week and further rate cuts expected going forward, Realty Income’s yield versus those of bonds should become even more attractive over time.

Consistent Track Record

Beyond the attractive yield and the frequent payouts, one thing I really like about Realty Income and its dividend is its steadfast commitment to rewarding its shareholders by consistently paying and growing its dividend.

The company states “Our goal is to deliver dependable monthly dividends that increase over time.” And it has certainly put their money where their mouth is — Realty Income has paid 651 consecutive dividend payments since its founding in 1969, and it has increased its dividend payment 127 times since its public listing on the New York Stock Exchange in 1994. The company is a Dividend Aristocrat and has increased its annual payout for 30 years in a row.

Diversified Income from 15,450 Properties

Realty Income has been a remarkably consistent dividend stock, and investors can take comfort in remembering that Realty Income’s dividend payments are backed by the tenants of these 15,450 commercial real estate properties from all across the United States and Europe. This gives the company, and its dividend, significant protection — if one tenant or a handful of tenants go bust, the company has many others to rely on. This diversification contributes to my optimism.

Not only is the company’s income diversified in terms of the large number of properties it owns, it’s also quite diversified in terms of the industries it has exposure to. Grocery stores are the largest type of property Realty Income has exposure to, but these account for just 10.2% of its portfolio. The degree of diversification here means that the company (and its shareholders) aren’t overly exposed to concentration in one specific industry, which could be a headwind if that industry were to turn south.

In addition to grocery stores, some of the major types of properties Realty Income has investments in include convenience stores, dollar stores, home improvement stores, drug stores, and quick-serve restaurants. Some of these may not sound like the most exciting types of investments, but they are stable businesses that aren’t going away any time soon. On the more exotic end, Realty Income even owns 12 vineyards in California’s Napa Valley that it leases to Treasury Wine Estates (TSRYF).

Is O Stock a Buy, According to Analysts?

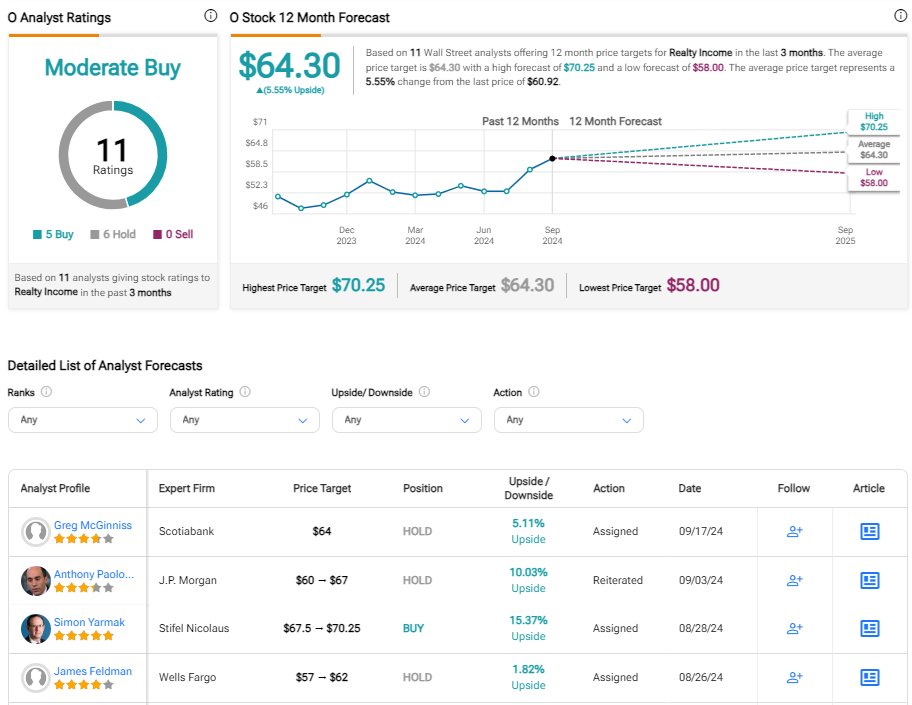

Turning to Wall Street, O earns a Moderate Buy consensus rating based on five Buys, six Holds, and no Sell ratings assigned in the past three months. The average O stock price target of $64.30 implies 5.8% upside potential from current levels.

A Time-Tested Dividend Stock

I’m bullish on Realty Income based on its attractive combination of a large 5.2% dividend yield and its monthly payout schedule, which gives shareholders a frequent, reliable stream of regular income.

Realty Income is also attractive based on its outstanding track record of paying out monthly dividends for over 50 years, and frequently increasing the size of this payout (with 127 dividend increases since its 1994 NYSE listing). Additionally, the REIT invests in many different types of commercial properties and has more than 15,000 properties mostly under long-term leases, giving it plenty of diversification in terms of where its income is coming from.

In a world where few things are certain, it’s nice to be able to rely on the consistency of a great dividend stock like Realty Income.