According to RBC’s (TSE: RY) Post-Holiday Spending & Saving Insights Poll, one-third (33%) of Canadians went over budget by succumbing to a gift-giving spree, up eight percentage points from the previous year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The good news is that these shoppers spent an average of C$414 more than expected, well below the previous year’s all-time high of C$588.

Across the country, in Quebec and British Columbia, consumers went over budget the most (C$476 and C$454 respectively); those in Saskatchewan/Manitoba and Atlantic Canada overspent the least (C$320 each).

The use of credit cards increased by six percentage points, from 37% to 43%.

This year, the most popular gift categories, based on the average amount spent, also changed. Across all gifts given to loved ones, experiences moved to the top of the list (C$160 vs. C$91 in 2020), relegating gift cards to second place (C$115 vs. C$121), and electronics in third place (C$90 vs. C$104).

Canadians More Pessimistic About Financial Health

The RBC poll also found that Canadians are less likely to paint an optimistic picture of their financial health in 2022 after their year-end spending.

Over the past year, NOMI Find & Save has helped customers set aside an average of $429 per month, which can add up to nearly $5,150 in additional savings by the end of the year.

Management Commentary

“It’s easy to see why giving experiences has grown in importance during the pandemic, as many are placing more significance on the gift of time together with family and friends. We also saw an increase in the amount Canadians gifted to charities on behalf of themselves or others over the holiday season, to help those in need,” said Flora Do, Vice-President, Term Investments & Savings and RBC InvestEase.

“When each new year begins, the challenge for some becomes how to pay for their generosity over the holiday season and get savings back on track.”

Wall Street’s Take

On January 19, Barclays analyst John Aiken kept a Buy rating on RY, with a price target of C$157.

This implies 7% upside potential.

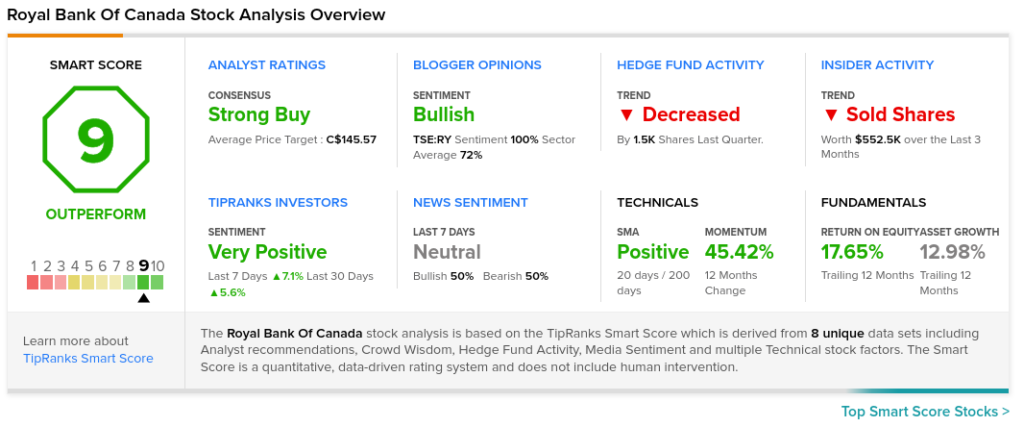

The rest of the Street is bullish on RY with a Strong Buy consensus rating based on six Buys and two Holds.

The average Royal Bank of Canada price target of C$145.57 implies 0.7% downside potential from current levels.

TipRanks’ Smart Score

RY scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that its stock has a good chance of beating the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

RBC: More Canadians View Mental Illness as a Disability

RBC: Canadian DB Pension Plans Performed Well in 2021

RBC Launches RBC Global Choices Portfolios