We’ve got a full quarter of 2025 behind us, and the twin themes of the year so far are shaping up as increased uncertainty and consequent volatility. Thank President Trump for both; his policy of punitive or reciprocal tariffs, his stated intent to use them as negotiating leverage, and his on-again, off-again implementation of the import duties has investors worried about a long-lasting downturn.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

But even in a difficult market environment, there are still smart buys to find. The stock analysts at Raymond James are following that logic, and have picked out two undervalued stocks with solid growth potential.

Using the TipRanks platform, we’ve taken a closer look at these two names – both of which carry a Strong Buy consensus rating from Wall Street. It also doesn’t hurt that both offer investors double-digit upside potential and a small dividend as a bonus.

Apollo Global Management (APO)

The first Raymond James pick we’ll look at is Apollo Global Management, a major player in the global wealth management field. Even after the recent market declines, Apollo can still boast a market cap of ~$71 billion, and the company finished 2024 with $751 billion in total assets under management, including $569 billion in fee-generating AUM. The New York City-based financial firm has been in business since 1990 and has a global footprint serving both individual and institutional clients.

Apollo’s asset management business is conducted through two main segments, Equity and Credit. The first of these, Equity, is focused on creative structuring and sourcing to develop a strong portfolio that brings attractive outcomes for investors. The company’s Equity segment currently has $135 billion in AUM. The Credit segment is Apollo’s largest, and is connected to both private and public corporate credit and asset-backed markets. Through this segment, Apollo acts as a financing partner, providing flexible solutions for its clients’ capital growth. Apollo’s Credit segment currently manages $616 billion worth of assets.

Turning to results, we find that Apollo realized an adjusted net income, its key metric for non-GAAP earnings, of $1.4 billion in 4Q24, the last period reported. This figure, which is derived from the sum of the fee-related earnings (FRE), spread-related earnings (SRE), and principal investing income (PII), came to $2.22 per share, beating the forecasts by 33 cents per share and growing 16% year-over-year. For the full year 2024, the company’s adjusted net income of $4.6 billion translated to $7.43 per share, for a 10% year-over-year gain.

On top of that, Apollo announced a $0.462 dividend per common share in February, translating to an annualized yield of 1.7%.

Still, the stock tells a different story – APO shares are down 25% year-to-date, making the current pullback a potentially intriguing entry point for value-focused investors. At least, that’s the view of Raymond James analyst Wilma Burdis.

“We like its robust growth profile (~15% EPS CAGR target through 2029 boosted by good flows in wealth and retirement services, and potentially supplemented by inorganic), operational advantages supported by scale, and excellent risk management. The dislocation in the stock, off (22)% year-to-date, appears to be a unique opportunity… We think APO can achieve $20 billion of annual Global Wealth flows by 2025-2026, versus $12 billion in 2024, and is well on the way to a guided average annual $30 billion through 2029. We think newly launched asset backed credit (ABC) is poised to grow, as we see demand from wealth clients for collateralized products. We also think APO’s strong brand and robust distribution will help boost flows,” Burdis opined.

These comments back up the analyst’s Strong Buy rating, while her $173 price target shows her belief that the shares will grow by ~40% in the coming year. (To watch Burdis’ track record, click here)

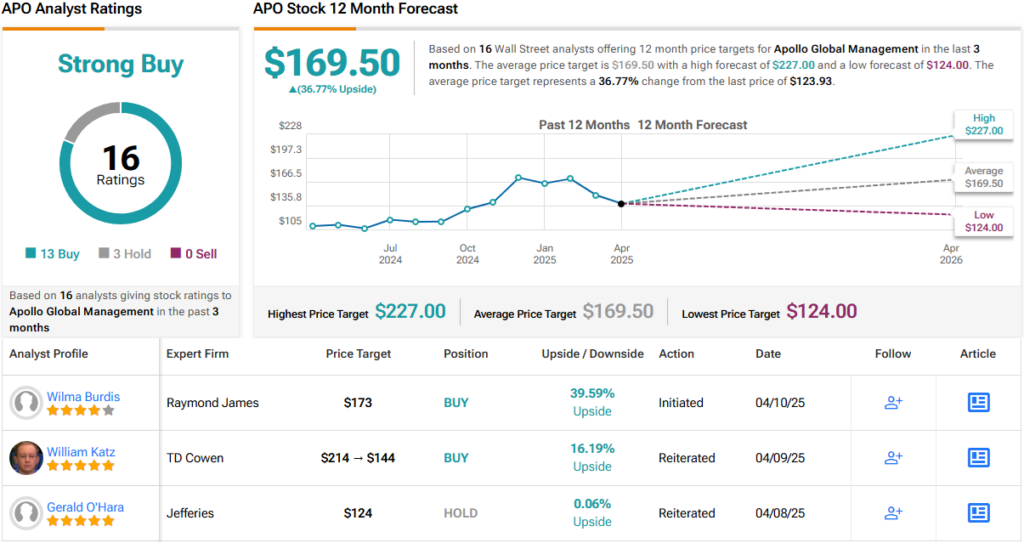

That view lines up with the broader Street consensus. Apollo holds a Strong Buy rating based on 16 recent analyst reviews, including 13 Buys and 3 Holds. Shares currently trade at $123.93, and the average price target of $169.50 suggests room for ~37% gains in the year ahead. (See APO stock forecast)

Orrstown Financial Services (ORRF)

Next on our list is a holding company, Orrstown Financial Services, that operates through its wholly-owned subsidiary, the Orrstown Bank. Based in the small town of Orrstown, Pennsylvania, Orrstown Financial Services, through its subsidiary, fills the role of a community bank in its local area of southern Pennsylvania and northern Maryland.

The company offers a full range of banking services, including personal checking and savings accounts, and retirement planning, along with personal loans, auto loans, credit cards, and home equity loans. On the business side, the company offers similar services – checking and savings accounts as well as loans –that are tailored to the needs of small businesses. Orrstown Bank can be accessed through its network of branches or online, through its website or mobile apps. The company’s online services include alerts on banking activity, online bill paying, e-statements, and transaction history records.

In short, while Orrstown is a small banking company – the market cap here is just $513 million – it holds a sound niche. The company finished 2024 with $5.4 billion in total assets, up from $3.1 billion at the end of 2023. Orrstown Financial had revenues in Q424 totaling $61.82 million, up 90% year-over-year, and realized a non-GAAP EPS in that period of 87 cents.

The bank saw fit, in its Q4 report, to declare a common share dividend of 26 cents. This represented a 13% increase in the payment from the previous quarter. The dividend was paid out in February, and the annualized rate of $1.04 per common share gives an annualized yield of 4%. Orrstown has a dividend history going back to the 1990s.

Yet, the market hasn’t been kind lately. ORRF shares are down 27% year-to-date, retreating from a November 2024 high. Even so, Raymond James analyst David Long remains optimistic. He believes the recent pullback doesn’t reflect the bank’s underlying strength – and sees long-term value in this undervalued name.

“We are bullish on Orrstown’s long-term prospects, as we believe the bank will produce better than peer balance sheet growth and generate superior profitability, while maintaining its improved risk profile. Orrstown is currently operating from a position of strength that should help the bank execute on its offensive strategy that combines organic and inorganic growth. With the stock trading at a discount to peers, we believe ORRF shares offer an attractive investment opportunity… Orrstown has an impressive growth engine within the franchise, producing organic loan growth with 25-, 10-, and 5-year CAGRs of 10.5%, 12.1%, and 11.6%, respectively. While we believe its growth profile remains intact, we conservatively model 6.5% loan growth in both 2025 and 2026,” the analyst stated.

Long goes on to rate ORRF as Outperform (i.e., Buy), with a $35 price target that points toward an upside of 33%. (To watch Long’s track record, click here)

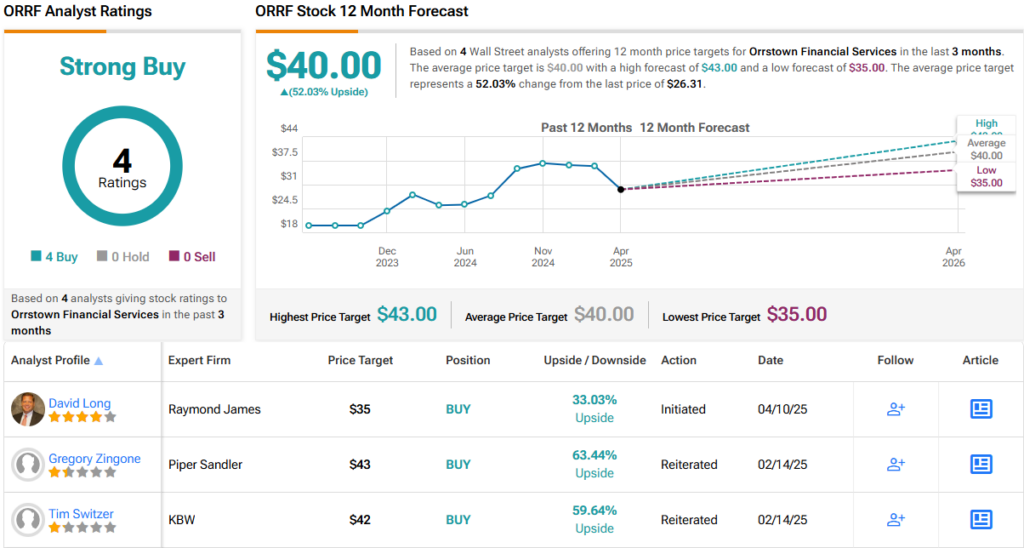

Overall, there are 4 recent analyst reviews here, and they are all positive – for a unanimous Strong Buy consensus rating on ORRF. The stock’s trading price of $26.31 and its average price target of $40 combine to suggest a potential one-year upside of 52%. (See ORRF stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.