William Blair analyst Sebastien Naji has maintained their bullish stance on NVDA stock, giving a Buy rating today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

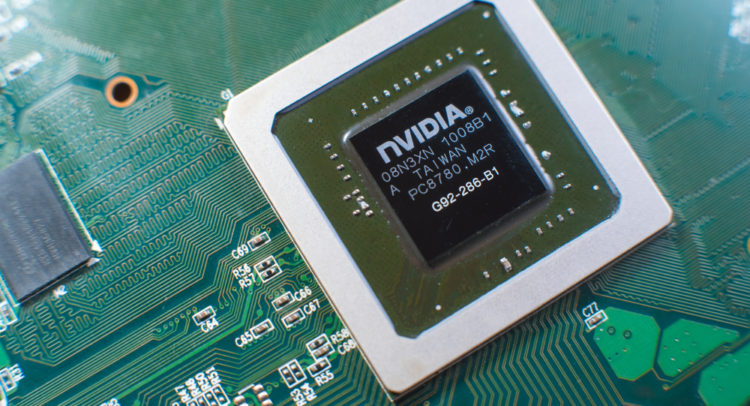

Sebastien Naji has given his Buy rating due to a combination of factors that highlight Nvidia’s strategic advancements and competitive positioning. Nvidia’s recent announcement of the Rubin NVL144 CPX rack, which is set to ship by the end of 2026, underscores the company’s ability to innovate with a new inference-focused architecture. This architecture leverages distinct GPUs designed for efficient data ingestion and response generation, showcasing Nvidia’s vertical integration advantage.

Naji emphasizes that the Rubin CPX chip, with its 30 petaFLOPs of compute power, demonstrates Nvidia’s commitment to building high-performance AI solutions. By focusing on creating comprehensive computing systems rather than just individual components, Nvidia is positioned to deliver competitive AI solutions. This strategic approach is a key factor in Naji’s positive outlook and Buy rating for Nvidia’s stock.

In another report released today, UBS also maintained a Buy rating on the stock with a $205.00 price target.

Based on the recent corporate insider activity of 115 insiders, corporate insider sentiment is negative on the stock. This means that over the past quarter there has been an increase of insiders selling their shares of NVDA in relation to earlier this year.