Broadcom, the Technology sector company, was revisited by a Wall Street analyst yesterday. Analyst Aaron Rakers from Wells Fargo maintained a Hold rating on the stock and has a $345.00 price target.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Aaron Rakers has given his Hold rating due to a combination of factors surrounding Broadcom’s current market position and future growth prospects. While Broadcom has shown impressive growth in its AI semiconductor segment, with a significant $10 billion order from a new customer and expectations of accelerated revenue growth in the coming years, there are still uncertainties that temper a more bullish outlook.

Despite the positive momentum, Rakers maintains a cautious stance, noting that while the company has exceeded revenue and earnings estimates, the market has already priced in much of this optimism. Additionally, the infrastructure software segment, although showing strong year-over-year growth, may not be enough to offset potential risks. As a result, the Hold rating reflects a balanced view of Broadcom’s potential for future gains against the backdrop of existing market conditions.

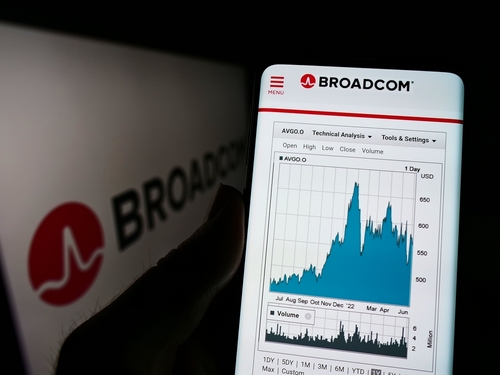

AVGO’s price has also changed dramatically for the past six months – from $187.480 to $306.100, which is a 63.27% increase.