Investors are moving quickly into rare-earth and critical mineral stocks after new U.S. policies aimed at building supply chains outside China. The Trump administration is putting a strong focus on materials used in smartphones, electric cars, and defense systems. As a result, shares of U.S. and Australian miners have climbed sharply in recent weeks.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The White House plans to create a strategic reserve of key minerals and may set a price floor to steady the market. It is also cutting approval times for new mines and reducing environmental limits to speed up construction. In addition, the government has started taking equity stakes in some producers. It bought 15% of MP Materials (MP) for $400 million, 5% of Lithium Americas (LAC), and 10% of Trilogy Metals (TMQ).

Stocks React to U.S. Spending and Chinese Controls

Since these steps began, shares of MP Materials, USA Rare Earth (USAR), and Lynas Rare Earths (AU:LYC) have more than doubled in 2025. The rally has spread to companies producing other vital metals such as lithium, cobalt, and germanium. In Canada, Lithium Americas and Trilogy Metals both surged after the U.S. government took ownership stakes. Standard Lithium (SLI) also raised $130 million in a public share sale, while Critical Metals (CRML) secured $50 million from an institutional investor to fund its Greenland project.

At the same time, China introduced new export rules that limit sales of magnets containing even small amounts of its rare earth materials. It also added five more rare earths to its export list. The move tightened supply expectations and added to the price momentum for Western producers.

Analysts See Promise but Warn of Hype

Market analysts say some price gains reflect real demand and policy backing, while others may be fueled by hype. Experts note that a few smaller mining firms have issued vague updates that lifted share prices without clear results. Others believe government stockpiling could help set a stable reference price for these materials.

Still, investors are showing growing interest in rare earth mining as a long-term theme. The mix of government support, supply concerns, and clean energy demand is creating a rare mix of growth and risk. However, analysts advise that not all companies will benefit equally, and investors should study each case before taking a position.

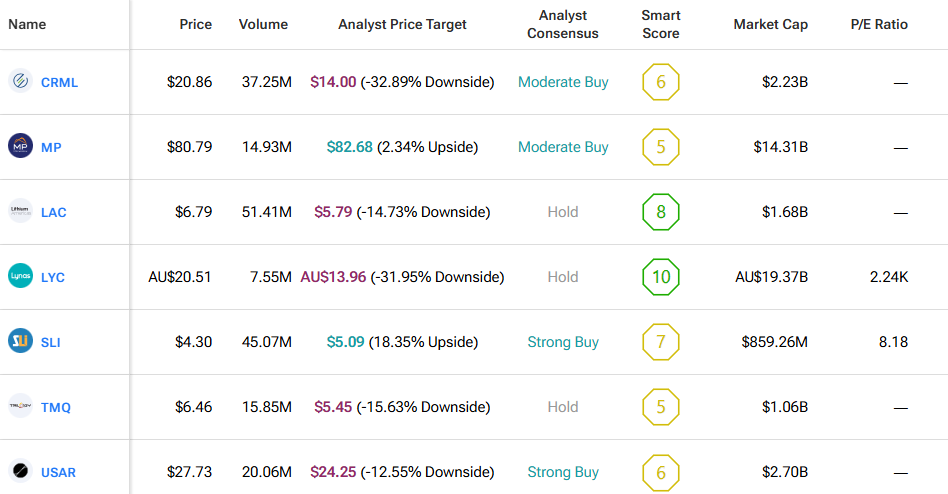

By using TipRanks’ Comparison Tool, we’ve lined up all the companies mentioned in this piece to make it easy for investors to review each stock and see how they stack up across the mineral sector.