Luxury lifestyle retailer Ralph Lauren (NYSE:RL) gained in trading after strong third-quarter earnings results. The retailer reported Q3 adjusted earnings of $4.17 per share, a growth of 24% year-over-year, exceeding consensus estimates of $3.57 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

RL posted revenues of $1.9 billion, an increase of 6% year-over-year, which surpassed Street estimates of $1.87 billion. In Q3, the company’s direct-to-consumer comparable store sales accelerated by 9%, as retail comparables improved across all channels.

In FY24, RL expects revenues to increase year-over-year by low-single digits on a constant currency basis. In the fourth quarter, the retailer has estimated revenues to grow by the same percentage. At the same time, the operating margin is expected to expand by around 350 to 400 basis points on a constant currency basis.

Is Ralph Lauren Stock a Buy or Sell?

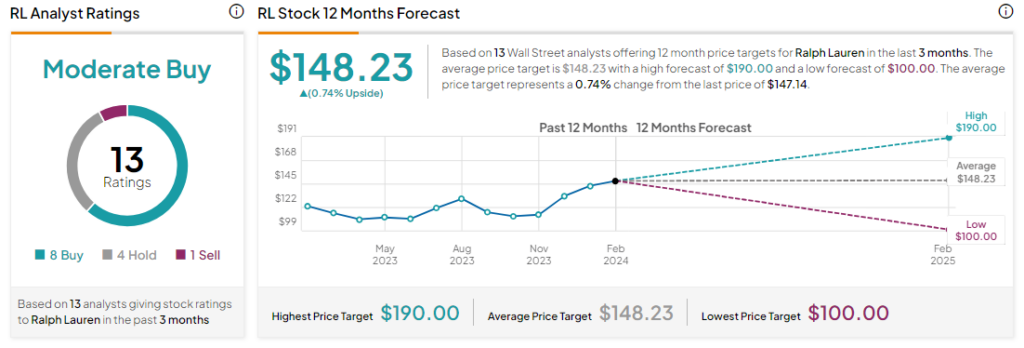

Analysts remain cautiously optimistic about RL with a Moderate Buy consensus rating based on eight Buys, four Holds, and one Sell. Over the past year, RL has gained by more than 20%, and the average RL price target of $148.23 implies an upside potential of 0.74% at current levels.