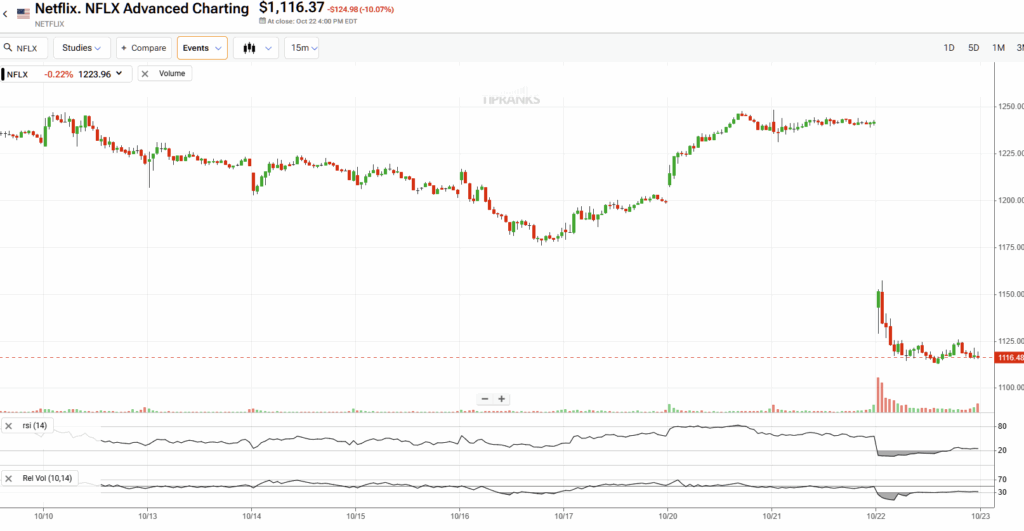

Netflix (NFLX) reported its Q3 earnings earlier this week and, almost predictably, the stock declined in the following sessions — now down nearly 8% for the week. The drop appears driven by an EPS miss that rattled a market expecting perfection. While some of the disappointment was justified, the results also included a few temporary soft spots and a curveball expense now added to the balance sheet.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, taking a step back, the report showcased meaningful progress in several key areas that will drive long-term growth over the next five years. Following the hasty selloff, shares now appear reasonably valued for what remains a powerful compounding business. Accordingly, I remain Bullish on NFLX stock.

Why The Stock Sank Post-Earnings

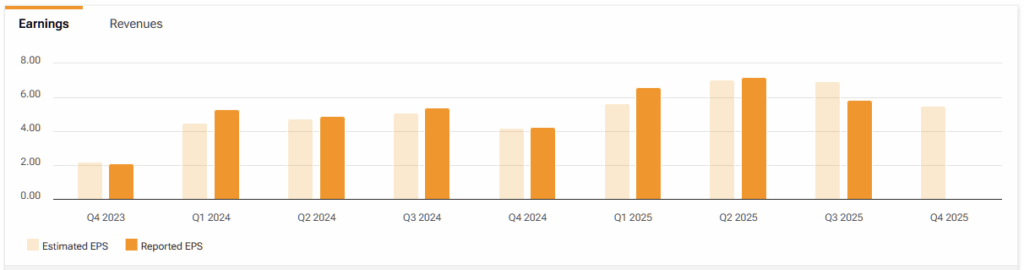

Let’s begin with the less impressive aspects of Netflix’s Q3 report. Earnings per share came in at $5.87, falling short of the roughly $6.97 consensus estimate, even as revenue was essentially on target at $11.51 billion. The sizable miss was primarily due to an unexpected ~$619 million expense related to a Brazilian non–income tax dispute, which was recorded under cost of revenue.

This one-time charge dragged the operating margin down to 28%, compared to guidance of 31.5%. Excluding this item, management noted that margins would have actually come in above expectations.

However, investors hate surprises, and they especially hate tax surprises. So it wasn’t a shock to see the stock take a beating. Moreover, two more factors seemed to have irked the market. First, Q4 margin guidance of ~23.9% implies a sequential step down.

Now, this is likely due to seasonality and content phasing, but it is still a visible dip. Second, free cash flow guidance was raised to about $9 billion, partly due to lower content spend. This might be great for cash today, but some see it as a touch of under-investment.

The Bullish Core Stayed Intact

Despite these missteps, I don’t believe they should overshadow Netflix’s otherwise great wins. Specifically, Netflix recorded its best ad sales quarter ever and remains on track to more than double ad revenue in 2025 (off a small base), with U.S. upfront commitments more than doubling. Crucially, the ad tech stack (Netflix Ads Suite) is now fully deployed across ad markets, and programmatic reach is expanding via integrations like Amazon’s (AMZN) DSP (global) and AJA (Japan) beginning in Q4. That’s a big deal for ease of buying and fill rates, and management says programmatic is growing even faster than upfronts.

In addition, view share hit all-time quarterly highs, up 8.6% in the U.S. and 9.4% in the U.K., with total view hours accelerating compared to the first half of the year. Big, mass-moment content is also doing exactly what it’s supposed to do, with the Canelo-Crawford fight drawing 41+ million Live+1 viewers and trending #1 in the U.S.

At the same time, KPop Demon Hunters became Netflix’s most popular film ever (325 million views) and spilled over into licensing with Mattel (MAT) and Hasbro (HAS), named co-master toy partners.

Last but not least, Q3 operating income reached $3.25 billion even after the tax hit, while free cash flow was $2.66 billion for the quarter. The full-year FCF outlook has now been stepped up to ~$9 billion.

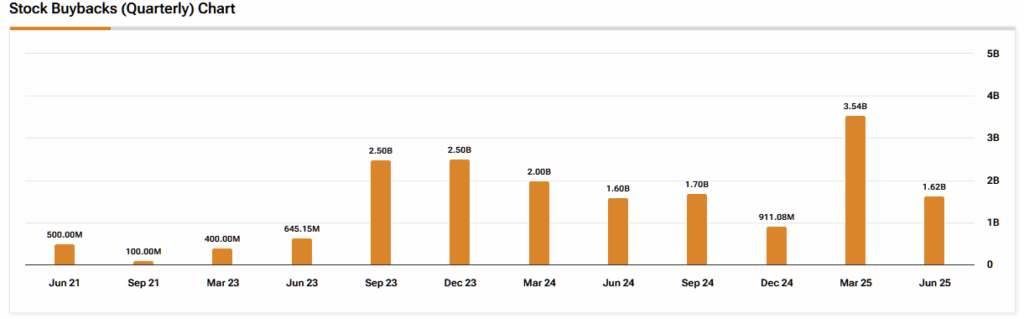

Netflix also stepped up capital returns, repurchasing $1.9 billion of stock in Q3 and still ended with $9.3 billion. Its scale across technology, distribution, and content operations in 190+ countries, along with a massive cash position to fund projects, is the moat that lets margins expand over time while its peers seem to struggle.

Content Slate Powers Long-Term EPS Expansion

Management guided Q4 EPS to approximately $5.45. Year to date, EPS stands at $19.67, implying a reasonable full-year run rate of around $25–26. Street consensus for 2025 is also near $26. Based on this morning’s post-earnings pre-market price of roughly $1,162, Netflix trades at about 44.7x forward earnings.

That’s not exactly cheap — but for a business compounding at scale, expanding its distribution footprint, enhancing ad monetization, and benefiting from global content and technology synergies, the valuation looks more compelling than it might initially appear.

Could the multiple compress if growth slows? Certainly. However, with a blockbuster Q4 lineup — featuring the Stranger Things finale and the NFL holiday showcase — and a clearer 2026 roadmap packed with returning franchises and new live-event tentpoles, Netflix’s earnings outlook remains well supported. Combined with continued share buybacks and rising operating leverage as the ad business scales, a medium-term EPS CAGR above 20% looks entirely achievable.

Is Netflix a Buy, Sell, or Hold?

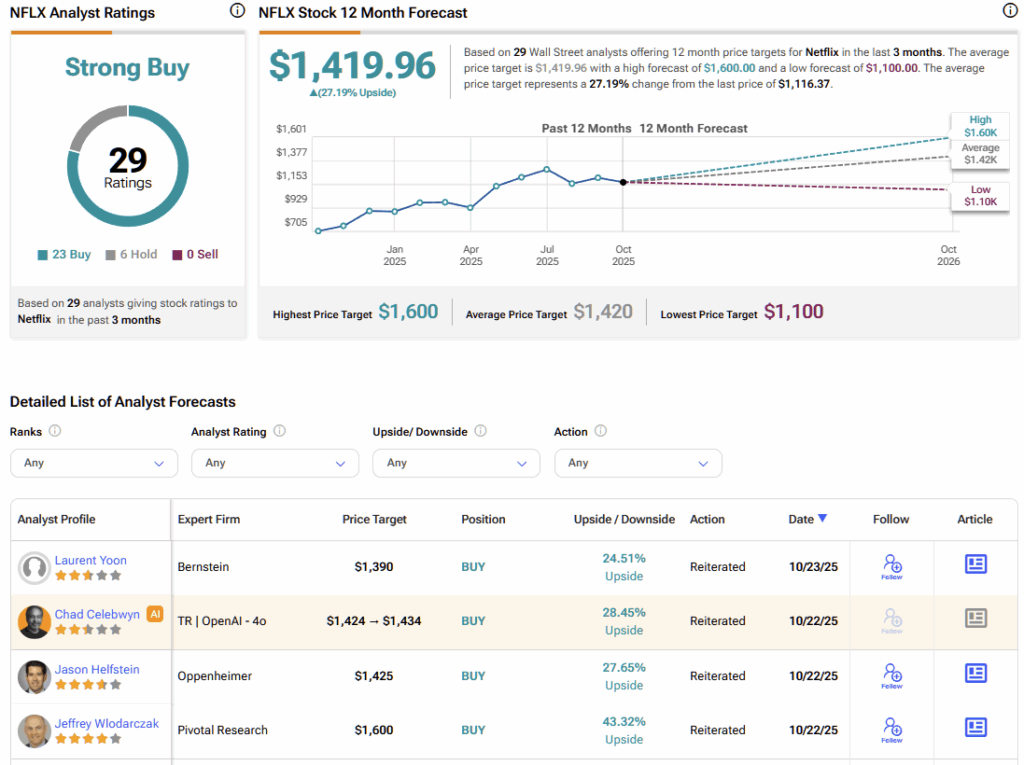

Wall Street remains quite bullish on Netflix, with the stock carrying a Strong Buy consensus rating based on 23 Buy and six Hold ratings over the past three months. Notably, not a single analyst is bearish on the stock. Moreover, NFLX’s average stock price target of $1,419.96 suggests ~27% upside over the next year.

Netflix’s Brazil Blip Creates a Buying Opportunity

Earnings nights can be unpredictable, and this one was messier than usual — largely due to the Brazil-related charge. Still, when you weigh the facts — accelerating ad growth, industry-leading engagement, and strong cash generation — against a one-time tax headwind, the long-term story clearly prevails. Following the market’s overreaction, NFLX now looks like a high-quality compounder trading at a fair price. I’m buying the dip.