Pure-play quantum stocks moved lower last week after enduring a rough November, and the trend continued into early December. Most names in the group went down between 3% and 7% on Friday’s session. However, this recent trend could be seen as a correction following a long rally that pushed share prices far ahead of near-term sales.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

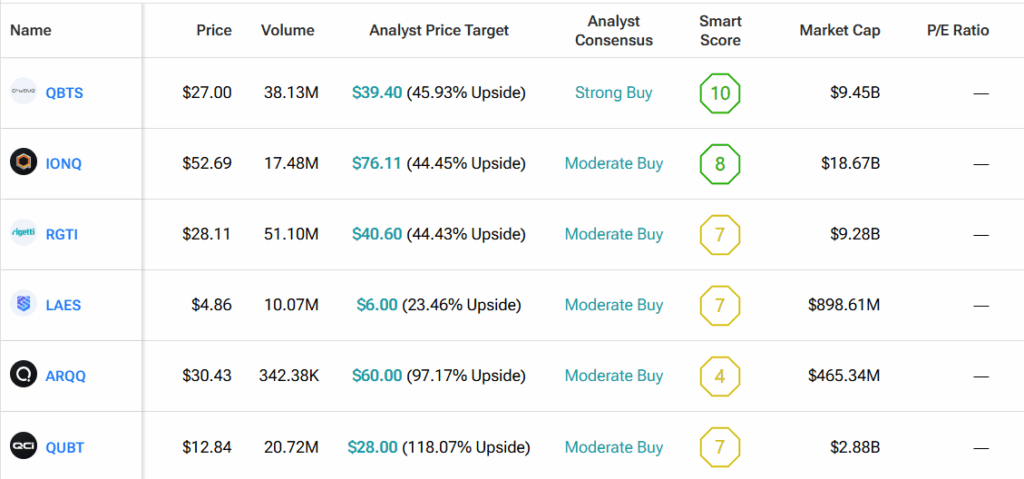

Rigetti Computing (RGTI), D-Wave Quantum (QBTS), Quantum Computing (QUBT), IonQ (IONQ), Arqit Quantum (ARQQ), and SEALSQ (LAES) fell in the same range, and the drop fit the tone in the wider high-risk tech space. There was no clear firm-specific news for any of the names. Instead, the group moved as one, as many traders pulled back from high-beta stocks with thin sales and firm cash needs.

Thin Trade Added Pressure

The slide also lined up with a key issue for the sector. These stocks trade on low volume, and each has a small float. As a result, even a light sell flow can move prices quickly. This effect grew in early December, as trade volume slowed ahead of the year-end. In this case, small sell orders had a larger impact on prices. At the same time, share sales by some firms in recent weeks added a new layer of strain to the group. This shift raised fear of more dilution at a time when risk levels in tech stocks have eased.

There was also a clear spillover from the sharp drop across the group in November. As prices broke through key lines in the past weeks, many traders set tight stop levels to guard gains from the long rally that took hold in early 2025. When prices turned lower on Dec 5, those stops began to hit. This added more sell flow, which then fed into the next round of trades.

In addition, some holders appeared to lock in tax plans for the year. These stocks posted steep gains in the first half of 2025, only to see deep cuts in November. This mix made the names likely picks for year-end plans on gains and losses, and that trend added one more push to the down move.

Overall, the slip on Friday looked like part of a wider risk reset, as traders stayed cautious with low-float tech stocks. The move did not link to new news. Instead, it stemmed from thin trade, stops from the past month, and slower risk demand across the high-growth space.

We used TipRanks’ Comparison Tool to line up all the quantum stocks mentioned in the piece. It’s a quick way to see how they stack up and where the field could be heading.