Quantum Computing (QUBT) reported its Q4 financials after the market close yesterday, revealing a drop in revenue and leading to an 11% decline in the stock price in aftermarket trading. This comes on the heels of Nvidia’s Quantum Day, which was intended to spotlight rising ventures in the quantum technology sector; however, it did not lead to positive momentum for the stocks involved. Despite expectations for significant updates, the event mainly resulted in an apology from Nvidia CEO Jensen Huang, who had previously downplayed the near-term potential of quantum technology. Huang’s remarks had earlier led to a sell-off of quantum stocks.

Quantum Competition Heating Up

Quantum Computing is a technology company that creates algorithms and solutions through quantum and quantum-inspired computing to address complex challenges across various sectors.

The company is progressing with its plans to launch the Quantum Photonic Chip Foundry by early 2025, evidenced by securing multiple purchase orders indicating strong market demand for TFLN-based photonic integrated circuits. Collaborations with NASA enhance the credibility and applicability of the company’s Dirac-3 quantum optimization machine, demonstrating its practical utility. Future priorities are set on implementing growth strategies, establishing further industry partnerships, and introducing advanced photonic and quantum technologies to the market.

However, Quantum Computing operates within a competitive and rapidly evolving industry as various companies strive to commercialize quantum computing technology. Key players include D-Wave (QBTS), IonQ (IONQ), and Rigetti (RGTI), all pursuing different technological approaches. The industry’s momentum intensified following Google’s (GOOG) significant move with the Willow chip, leading to further developments such as Microsoft’s (MSFT) introduction of Majorana, the first quantum processing unit powered by a Topological Core.

Adding to the competitive landscape, China is actively advancing its quantum computing capabilities, highlighted by establishing a substantial government-backed fund amounting to 1 trillion yuan ($138 billion) to foster emerging technologies, including quantum computing. Moreover, China has made notable advancements with the launch of Zuchongzhi-3, a 105-qubit superconducting quantum processor, which reportedly performs drastically faster than Google’s recent efforts. These developments underscore the fierce global race and substantial investments toward achieving quantum computing breakthroughs.

Earnings Miss

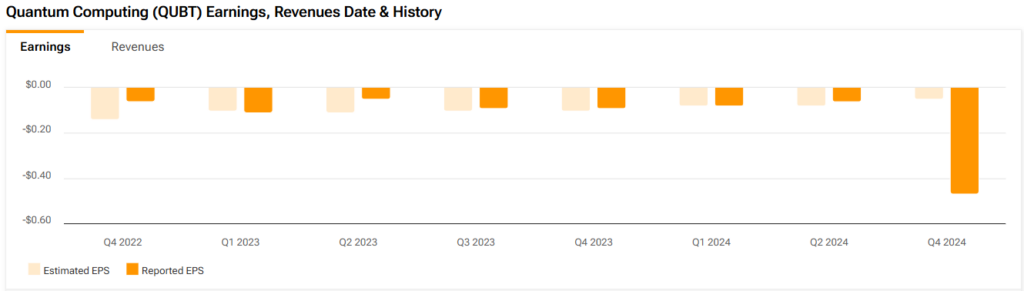

In the fourth quarter of 2024, the company reported revenues of approximately $62,000 with a gross margin of 55%, a notable increase from a 13% margin on $75,000 in revenue the previous year due to reduced costs of goods sold. Operating expenses rose to $8.9 million from $6.6 million a year earlier due to increased employee-related non-cash expenditures and depreciation at a new chip foundry. Despite a decrease in cash used in operations by $2.1 million for the entire year, the net loss swelled to $51.2 million partly because of non-cash charges related to warrant liabilities following a merger. Q4 GAAP EPS of -$0.47 missed analyst expectations by $0.42.

Total assets more than doubled to $153.6 million, spurred by a significant cash influx from stock offerings, reaching $78.9 million in cash and equivalents. However, liabilities also grew by approximately $41 million, mainly due to accounting changes associated with warrants.

Questions or Comments about the article? Write to editor@tipranks.com